When the federal government stopped guaranteeing new bank-based student loans on June 30, 2010, it left behind a dozen or so nonprofit intermediaries, known as guaranty agencies, that had played administrative roles approving bank loans, reviewing colleges’ eligibility, and rehabilitating defaulted loans. Legally structured as nonprofits, these agencies are, at least in theory, committed to the public interest. But keeping them aligned with the needs of students and taxpayers has always been a challenge, and now that the Guaranteed Student Loan (GSL) program that they were designed to serve is in the rear-view mirror, what should happen with the endowments of more than $5 billion they have amassed?

If the $5 billion these agencies control had come from private donations, then we could perhaps leave it to the donors to actively press the agencies to put the money to good use. There are no donors, though. Most of the money came from federal coffers, or from fees charged to former students who defaulted on their student loans. Many of those defaults, it turns out, were the result of predatory colleges convincing students to enroll in programs that were of poor quality, failing to meet students’ needs and leading to debts rather than a degree or a job. Given the source of the money, an appropriate way to use it would be to repair the damage done by some participants in the federal student loan program and to prevent further hardship. For example, support is sorely needed, now, to provide counseling and legal aid to distressed borrowers. It is troubling that in the case of at least two of the largest agencies—ECMC and USA Funds—their direction seems to be almost the polar opposite.

This report looks at the rise and current limbo status of the legacy student loan guaranty agencies. It presents a brief history that covers the original role intended for them, as authorized in the Higher Education Act of 1965, as well as their tendency, from the earliest years, to abandon their public missions. It examines the current activities of two guaranty agencies that appear to be severely diverging from their missions, ECMC and USA Funds, and makes recommendations for putting their resources to better use.

The Birth and Troubled Life of the Guaranty Agencies

Banks have always been reluctant to loan money to students, especially those from low-income families, because of the risk that they will not be able to repay a loan. When an applicant has no collateral and no work history, banks charge high interest rates, if they are willing to make a loan at all. In the early 1960s, Congress was considering the idea of making loans available to students by promising to compensate the banks if the students fail to repay. Rather than take on all of that risk at the federal level, Congress, in the Higher Education Act of 1965, established a creative approach in which nonprofit organizations and state government agencies would partner with the federal government to co-sign the bank loans, with the partner agencies serving as ambassadors at the local level, educating high school students about college opportunity and the availability of loans. For example, if ten cents on every dollar of loan value needed to be set aside to pay for the future loan defaults, the federal government would pay, say, seven cents, while the guaranty agency would pay three cents, and handle any paperwork.

The idea was that by putting their own donated resources on the table, guaranty agencies would have a stake in a humane and successful loan program, helping low-income students attend quality colleges. Further, they would operate as charities do, with an approach that hinged on more than just the bottom line: when borrowers did default, rather than immediately engaging in aggressive collection tactics, the agencies could assess the situation and provide assistance and advice as appropriate.

Few states, however, volunteered for the guaranty agency role, so to encourage them, Congress kept sweetening the deal to the point that the risk-sharing disappeared completely. By 1976, according to the Government Accountability Office, the federal government took on “100 percent of program costs, while still requiring a network of guaranty agencies to help administer the program.”1 In essence, the federal government was issuing a blank check to cover the cost of operational expansion by any guaranty agency that decided to take advantage of that opportunity. The system boomed, but rather than having risk-sharing partners, the federal government instead had a set of guaranty agencies that, like a sole-source contractor, earned more money with every loan they guaranteed rather than contributing anything at all. By the end of the 1980s, the agencies had attached federal insurance to $48 million bank loans totaling $102 billion.2

Eliminating the agencies’ need for private donors or state tax dollars left the agencies unmoored from the underlying purposes of the Higher Education Act: quality outcomes for low-income students. Nonetheless, many of the forty-odd guaranty agencies took an appropriate public-interest-minded approach to their responsibilities. The agencies that were part of a state government (such as the Vermont Student Assistance Commission), in particular, performed their federal duties and used the money they earned beyond their expenses to boost state funding for scholarships, to conduct outreach to low-income high schools, and to educate borrowers on their options and responsibilities.

At the other end of the spectrum, however, were agencies that saw revenue and expansion as their raison d’etre. It was easy for agencies to mistake their role as that of a money-making business, partnering with for-profit banks and colleges. While born nonprofit, the agencies took on a business venture mentality, which in some cases led to disastrous results.

The earliest and most blatant example was when a small, Minnesota-based nonprofit—the Higher Education Assistance Fund, or HEAF—rapidly expanded in the 1980s by teaming up with banks and for-profit trade schools also eager for growth. Within just a few years, HEAF had become a behemoth, guaranteeing more than a quarter of all of the federal student loans nationally; loans to students attending for-profit trade schools made up more than half of the agency’s portfolio. Growing loan defaults led to a bipartisan Senate investigation, which found that for-profit schools, lenders, accreditors and guaranty agencies had conspired to offer poor-quality education to students who ultimately could not repay the loans. The committee labeled as “a farce” the guaranty agencies’ claims that they operate as risk-sharing partners.3 The high default rates ultimately resulted in HEAF being shut down.

In the 1990s, it was the Indianapolis-based USA Funds that aggressively and unapologetically built a student loan business empire off of its federal charter. While it carried out its guaranty role monitoring bank collections in one subsidiary, it created another subsidiary that worked as a bank contractor servicing the same loans, putting the agency in the conflicting role of policing itself. USA Funds branched out into capital financing and technology, and purchased a management consulting firm to add to its portfolio of companies. USA Funds’ 1994 annual report crowed that the “company” had successfully morphed into a provider of “loan, financial, and information management systems and services for education.” Executive salaries skyrocketed. In 1996, the Department of Education’s Inspector General found that conflicts of interest had led the agency to overspend $40 million in federal money, a cost borne by taxpayers.4

To be considered a nonprofit by the IRS, an organization must be committed to a charitable, educational, or government purpose. By 2000, because leadership at USA Funds was worried that the IRS might accuse it of extending beyond the legal boundaries of a valid nonprofit,5 its executives cut a deal to transfer most of the organization’s operations to the for-profit student loan company, Sallie Mae. The money that Sallie Mae paid to acquire the business operations of USA Funds was used to endow the Lumina Foundation.6 The sale (which at the time was described as a merger between the for-profit Sallie Mae and portions of nonprofit USA Funds operations) included an agreement that Sallie Mae would carry out, through a contract, many of the guaranty agency responsibilities of USA Funds, which continued as a nonprofit shell corporation. That pact established a close business relationship—which continues today—between USA Funds and an arm of Sallie Mae now known as Navient.

The troubles at HEAF led some guaranty agencies—especially those that were offices of state government—to quit their guarantor roles entirely. Those nonprofit agencies not tied to state government often took on the abandoned responsibilities. In the 1990s, for example, the nonprofit serving Wisconsin, Great Lakes Higher Education Corporation, absorbed a portion of the HEAF portfolio and also became the designated guarantor for Ohio, Minnesota, Georgia, and Puerto Rico.7

In 1994, the Department of Education chartered a new nonprofit guaranty agency, originally named the Transitional Guaranty Agency. It was supposed to be a flexible but tightly controlled operating arm of the department, with an initial job of handling borrowers filing for bankruptcy, and serving as a backstop for the HEAF debacle and other problems or gaps that might emerge in the guaranty program.8 Having an agency that would faithfully carry out the Department of Education’s orders was particularly important as President Bill Clinton attempted to implement his campaign promise to eliminate the bank-based GSL system in favor of direct loans.9

By 2000, however, the GSL system had not only survived, but was roaring back, with $317 billion of loans guaranteed. As detailed in the next section of this report, the Transitional Guaranty Agency, with a new CEO and a new name—the Educational Credit Management Corporation (ECMC)—started to follow the empire-building script, much like HEAF had in the 1980s, and USA Funds had in the 1990s. When President Obama finally put an end to the program in 2010, there were half a trillion dollars in guaranteed loans outstanding10—and a set of guaranty agencies with money they had amassed from their role in the federal program.

The Money that Remains, Held (and Spent) in Trust

Today, the remaining legacy student loan guaranty agencies have more than $5 billion sitting in their bank accounts.11 Where did the money come from? A 2009 analysis, just before the bank-based GSL program was ended, showed that the bulk of the agencies’ funds came from collecting defaulted federal student loans—authority they are granted by the federal government—with most of the remainder coming from the federal government directly.12 And in just the four years after the bank-based program was ended, the total amount grew by more than 70 percent, in part from continued payments from federal government.13

| Table 1. Student Loan Guaranty Agency Funds | ||

| Funds | Unrestricted Net Assets, 2014 | GSL Loan Principal Balance Outstanding, 2014 |

| Lumina Foundation (Lumina was created from USA Funds assets; it never operated as guarantor) | $1,234,159,244 | $0 |

| Great Lakes Higher Education Corporation | $1,151,689,292 | $33,177,864,808 |

| USA Funds | $1,031,492,151 | $64,768,751,307 |

| ECMC | $1,024,412,735 | $32,457,045,935 |

| American Student Assistance | $388,000,136 | $28,544,241,108 |

| Texas Guaranteed Student Loan Corporation | $375,010,597 | $15,499,742,797 |

| Nebraska Student Loan Program | $146,557,056 | $6,416,516,041 |

| Other Nonprofit (New Hampshire, Connecticut, Arkansas, New Mexico, Northwest) | $87,133,467 | $5,885,092,259 |

| 20 State Agencies (PHEAA, New Jersey, Tennessee, Utah, etc.) | N/A | $93,166,534,309 |

| Total | $5,438,454,678 | $279,915,788,564 |

| Source: Authors’ analysis of unrestricted net assets and on federal loans guaranteed, based on Forms 990 filed with the IRS and available and data from the U.S. Department of Education,”Report to Congress: Assessment for Fiscal Soundness of the Guaranty Agencies Participating in the Federal Family Education Loan Program for FY 2014.” | ||

The U.S. Department of Education, meanwhile, has asked Congress to increase payments to the guaranty agencies out of a concern that they “will no longer have sufficient funds to perform their required operational activities.”14 Given the large growth in these agencies’ assets, however, that risk seems much exaggerated. While the funds belong to the agencies, much of it is governed by department regulations that allow funds earned as guarantors to be used for:

- application processing;

- loan disbursement;

- enrollment and repayment status management;

- default aversion activities;

- default collection activities;

- school and lender training;

- financial aid awareness and related outreach activities;

- compliance monitoring; and

- other student financial aid-related activities for the benefit of students, as selected by the guaranty agency.15

That final category is pretty broad, allowing an agency a lot of discretion to decide what activities are “related” to financial aid. But the agencies cannot use the funds for anything they want. Even without the department’s rules, the assets are public in the sense that they are restricted to charitable and educational purposes under section 501(c)3 of the Internal Revenue Code. The money does not belong to the employees or board members of the organization. And in the case of one agency, ECMC, its charter appears to require an okay from the U.S. Department of Education to spend funds from its work for the department.16

Are the legacy guaranty agencies behaving as nonprofits should? Judging whether a nonprofit is adequately committed to the public interest is not always a simple matter, especially when an organization is involved in activity that can be perceived as either charitable or self-interested, such as delivering health care, education, or having little girls sell cookies.17 The guaranty agencies, in particular, have the responsibility of collecting from borrowers who have defaulted on their loans, so they inevitably will garner a negative image from some quarters. But what would a more charitable loan collector look like? Lacking the profit motive, a guaranty agency might be more humane in its treatment of borrowers, even if it resulted in less revenue from collections. For example, one agency, American Student Assistance, many years ago adopted a financial-education approach to its student loan responsibilities. The agencies might, in addition, make donations with the money they’ve earned. For example, $114 million in grants were given to a wide variety of recipients in 2014, nearly half of it from the Lumina Foundation, which has no ongoing role in the federal student loan program (Table 2).

| Table 2. Where $114 Million in Grants from Legacy Guaranty Agencies Went in 2014 | |

| Policy Organizations | 25% |

| Four-Year Colleges | 20% |

| Foundations | 10% |

| Government agencies (not schools) | 10% |

| Community Organizations | 6% |

| Two-Year Colleges | 5% |

| Business Associations | 5% |

| Workforce Development | 5% |

| College Access Organizations | 5% |

| Scholarship Providers | 4% |

| Media | 1% |

| K-12 Schools | 1% |

| Culturally Based Organizations | 1% |

| Professional Associations | 1% |

| Other | 1% |

| Source: Compiled by author from information filed with the IRS, available through Guidestar. | |

The U.S. Department of Education has not had much public discussion about the ways that a guaranty agency uses the non-federal funds that it holds. If it was a for-profit company it could simply give the money to the shareholders as profit. But with a nonprofit, the department, like the IRS and state charity officials, appears to put its faith in the boards of directors—the trustees—of the organizations, relying on them to ensure that the assets are used in the public interest. But can these trustees be trusted to do that? If there is any question about their deeds or their motivations, one test is to see whether the trustees have a conflict of interest—a sign that they are there for the money not for the cause, steering the organization in the wrong direction. To prevent any such problem or the appearance of impropriety, trustees of nonprofit organizations generally forgo any pay whatsoever, so that their motivations cannot be influenced by personal financial gain. That’s why nationally fewer than 3 percent of public charities pay any of their non-CEO board members.18 Guidelines developed by a leading advocate of nonprofits hold that board members be “generally expected to serve without compensation, other than reimbursement for expenses incurred to fulfill their board-related duties.”19

Despite the reputational taint and the hazards of the conflict of interest, many of the trustees governing legacy student loan guaranty agencies are taking money for themselves (see Figure 1). In some cases, the amounts are relatively small. But in the case of two agencies, ECMC and USA Funds, the trustees are being paid, for part-time board service, more than most Americans are paid in a full time job. In 2014, the USA Funds trustees took between $43,000 and $95,000 annually (not including reimbursement of expenses) for their occasional governance responsibilities. The trustees at ECMC have been paying themselves even more, between $76,000 and $142,000 for what they report as generally no more than ten hours of work a week.20

The justification proffered for paid board members is that experienced businesspeople are needed to oversee the complex operations of the agencies, and that knowledgeable people will not work for nothing. However, another large agency, Texas Guaranteed Student Loan Corporation (TG) has never paid its trustees at all. Sue McMillin, TG’s long-time president (now working elsewhere) told me that her board members never asked for compensation, and she thought doing so was neither necessary nor appropriate. “I honestly have never been on any nonprofit board where they did anything other than reimburse expenses,” she explained when interviewed.21 Another agency, Great Lakes, also has substantial ongoing business operations that must be overseen by the board, yet their board member compensation in 2014 was modest, from $7,750 to $15,500.22

Perhaps it is no surprise that TG and Great Lakes, which pay their boards less (or nothing), have a fairly positive reputation among legal aid attorneys and consumer protection associations we informally surveyed. In contrast, ECMC and USA Funds are viewed as being less sensitive to the needs of borrowers, engaging in activities that seem different from what would normally be expected as public-minded, charitable decisions.

ECMC

Two years ago, with the support of the Department of Education, ECMC purchased fifty-six of the campuses owned by the for-profit Corinthian Colleges chain, which was under investigation for lying about its job placement rates, and was heading toward bankruptcy.23 Legal aid and consumer protection organizations roundly criticized having ECMC, which had no experience running schools and had a reputation for rough treatment of borrowers, take on the task.24 Certainly if a nonprofit entity is going to attempt to turn around a poor quality vocational training program, the utmost care should be taken to ensure that that motivation is not complicated by the same conflicts of interest that have led so many for-profit colleges down a predatory path.

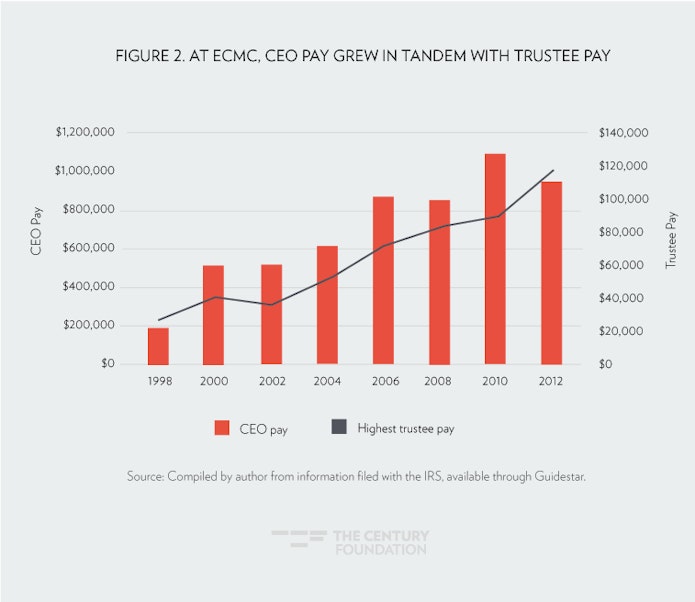

ECMC is a guaranty agency created by the Department of Education in 1994. After the arrival of a new CEO in 2000, the relatively young organization began creating for-profit and nonprofit subsidiary corporations that became involved in the private loan business, management and technology services, and default management. Over that same time period, ECMC—still, as now, operating as a tax-exempt charity—increased the CEO’s compensation fivefold, from less than $200,000 in 1998 to more than $1 million a dozen years later, with trustees taking the opportunity to boost their own compensation as well (see Figure 2). Why would a CEO advise trustees to pay themselves, given that it is a controversial practice? A CEO who takes a stand against the trustees could lose his or her job. But another dynamic at play may be what in the for-profit world is called “mutual back-scratching.”25 Board members who are paid are more inclined to pay CEOs more, and the more that the executives are paid, the justifiable pay of trustees also rises, a dynamic that can keep ratcheting pay upward.

The CEO and the chairman of the board of ECMC, in an e-mailed statement in response to an inquiry from The Century Foundation (TCF), insist that the board members are “corporate directors (that is the official title, not ‘trustees,’)” and that their pay is justified because they “oversee the management of complex and diverse activities, including a guarantor/servicing business, a for-profit accounts receivable management firm, a substantial philanthropic foundation, and nonprofit career education institutions.” They said that the amount of compensation is endorsed as not unreasonable by an independent compensation firm. But just because the trustees hire a firm that declares their behavior not illegal does not mean it is ethical or advisable. The fact that other guaranty agency trustees, and trustees of other large nonprofit operations, pay themselves little or nothing indicates the pay is unnecessary. Why not eliminate any doubt about trustees’ commitment to the public interest?

A major part of the argument for ECMC taking over the Corinthian campuses was that they would benefit from public-minded, nonprofit governance. But paying trustees undermines that claim, especially at nonprofit schools and colleges where the practice is almost unheard of. Indeed, trustees at nonprofit colleges are usually donating money in addition to their time, not taking the college’s money. (Trustees are basically vouching for a school by serving as trustees and donating, an endorsement that means something because it is not from a paid spokesperson. The paid board members of guaranty agencies, instead, are like paid spokespeople who set their own salaries.)26

Given the issues with board member compensation, how did ECMC get the IRS to approve its new subsidiary, Zenith Education Group, as a nonprofit college? The documents ECMC submitted reveal that ECMC hid the trustee pay from view. The application for IRS tax-exempt status, filed by the CEO of ECMC, accurately declared that the board members—the same people who are on the ECMC board—were not receiving any compensation directly from Zenith.27 Oddly, however, when the form asked about whether Zenith board members were receiving any compensation from any related entity, the “No” box was checked, even though ECMC is related and pays the board members handsomely. In an e-mailed statement in response to an inquiry from The Century Foundation, ECMC denied that this was a fraudulent answer, saying that the organization “worked closely with an expert outside counsel to ensure that the Form 1023 was completely accurate and in accordance with IRS procedures and instructions.”28

If there were ever a right moment to disclose board member pay, it would have been in response to the direct question (Form 1023, Part V, Question 3b): Do any of your officers, directors, trustees . . . receive compensation from any other organization, whether exempt or taxable, that are related to you through common control? ECMC did not explain, in its response to The Century Foundation, how an answer of “No” fit the question, given the common-control relationship between ECMC and Zenith. A “Yes” answer to that important question about trustee compensation very easily could have slowed down or sunk IRS approval of the application, an approval that was necessary for ECMC to go forward with its purchase of the Corinthian campuses.

The IRS appears to have done no more than a cursory review of the Zenith application. Normally, IRS review of a Form 1023 takes six months.29 Zenith got its tax-exempt status from the IRS with jaw-dropping speed: only six weeks, during the holidays (the application was submitted during Thanksgiving week of 2015 and approved on January 7, 2015). The application was accompanied by a letter from the U.S. Department of Education, asking for expedited treatment.30

Is this the case of a charity that, in purchasing the Corinthian campuses, made a noble if misguided attempt to transform a corrupt enterprise? Or is this just a corporate board seeing if they can make a buck? Unfortunately, the compensation of the board makes it impossible to rule out the latter explanation. We cannot know whether trustees who were serving without pay—involved because of the charitable aspects of the enterprise, not because they were getting paid— would consider buying the Corinthian campuses to be in the public interest.

USA Funds

In all of their activities, guaranty agencies are supposed to be operating in the public interest as nonprofit organizations. In their ongoing work managing old loans from the GSL program, the agencies are operating as partners with the federal government, in the interests of borrowers and taxpayers. Thus it has been eye-opening and quite distressing to watch USA Funds fight aggressively in court and in Congress to be able to charge delinquent borrowers more than the Department of Education considers reasonable.31 The explanation may be that USA Funds is not really operating as a nonprofit organization, but instead as a way to enrich its trustees, its executives, and especially the for-profit Navient Solutions. Of every dollar that comes into USA Funds, nearly 80 percent goes to Navient—formerly part of Sallie Mae—which runs the bulk of the charity’s debt collection operations.32

A nonprofit organization is allowed to work with a for-profit: take the Girl Scouts and the cookie companies, for example. But the actions of USA Funds trustees suggest that their overriding priority is not public interest but instead the interests of Navient and of for-profit colleges. As CEO they recently hired William Hansen, who was responsible for opening the floodgates to predatory recruiting by colleges when he was deputy secretary of education in the early 2000s, and later became a lobbyist for the University of Phoenix, a fact that USA Funds expunged from his online bio.33 Further, USA Funds donated nearly $100,000 to the lobbying organization that represents for-profit colleges, and $2 million to its lobbying partner, the U.S. Chamber of Commerce.34 Meanwhile, according to the Chronicle of Higher Education, the person that Hansen sends “out hunting” for new businesses to buy is Mark Pelesh, who previously served for ten years as the lobbyist for none other than the Corinthian Colleges chain of for-profit trade schools.35

Over the past fifteen years, college students have been misled by predatory colleges, have taken out loans, have failed to get jobs, have defaulted, and were not told of their repayment options; when they defaulted, they were charged penalties and fees by Navient, and had their paychecks docked. And now that money is comprising handsome payments for the executives at USA Funds, who—in their prior roles at the Department of Education and at Corinthian Colleges—helped create the dangerous predatory college landscape in the first place.

USA Funds officials did not respond to multiple inquiries from The Century Foundation regarding these matters.

What Can Be Done?

With $1.3 trillion of outstanding student loans in the United States, the nation has never been more anxious about student debt and its impacts. Nearly 3 million borrowers are more than thirty days delinquent on their federal student loans, and more than one million have not paid in more than six months.

As TCF’s president Mark Zuckerman recently pointed out, for borrowers with federal loans, there are options available to reduce the burden of student loan debt, but many eligible borrowers are failing to access. Instead, many students fall prey to online companies that promise to help gain loan forgiveness, but really are trolling the Internet for a quick buck. And hundreds of thousands of struggling borrowers who were treated poorly by their colleges have little or no access to neutral, expert assistance that could help them to navigate through their options.

These are all problems that a large infusion of charitable resources—not tied to any school or lender—could help to address, right now. A major investment could, for example, underwrite counseling and legal assistance for borrowers, help that would be useful immediately given the closure of the ITT Tech chain earlier this month. The resources could be used to sponsor advertising campaigns to warn of and shut down bogus debt assistance sites. The effort could go in the direction of preventing abuse by tracking college advertising and recruitment to check for questionable claims and manipulative sales tactics. The most appropriate pots of money to tap for these efforts would be the funds that actually came primarily from struggling borrowers themselves: the $5 billion held in trust by the legacy guaranty agencies.

The secretary of education’s first step should be to ask the trustees to stop paying themselves, and instead commit the funds of these organizations to aiding struggling borrowers and to investigating and preventing predatory behavior by schools and lenders. If the legacy guarantors protest “But this money is ours!” the secretary has tools he can use. Many of the organizations still do work for the government, and that ongoing business relationship can be conditioned on the agencies demonstrating their commitment to the public interest as nonprofit organizations. With ECMC, the secretary should invoke his authority in the group’s charter, which requires the department’s okay for much of its spending.36 To replace the current trustees, the secretary of education should offer recommendations of people who would guide the organizations with greater sensitivity to work that needs to be done to compensate for the abuses of the federal student aid system; for example, people with expertise on poverty, college counseling, consumer protection, and teaching disadvantaged students.

The money held in trust by legacy student loan guaranty agencies belongs to the public, and the U.S. Department of Education should make sure that it is used productively and appropriately, taking into consideration its source: the blood, sweat, and tears of struggling student loan borrowers.

Notes

- U.S. Government Accountability Office, “Financial Audit: Guaranteed Student Loan Program’s Internal Controls and Structure Need Improvement,” March 1993.

- U.S. Department of Education, Federal Student Loan Programs Data Book: FY 1997-FY 2000, https://www2.ed.gov/finaid/prof/resources/data/fslpdata97-01/edlite-intro.html.

- Permanent Subcommittee on Investigations, Committee on Governmental Affairs, U.S. Senate, “Abuses in Federal Student Aid Programs,” May 17, 1991, http://files.eric.ed.gov/fulltext/ED332631.pdf.

- U.S. Senator Paul Simon, Letter of Complaint to the IRS Commissioner Regarding USA Group and Affiliates, July 18, 1996.

- According to the then-general counsel, “Our concern was that the government might eventually come in and challenge the continuation of our tax-exempt status.” From the Ground Up: An Early History of the Lumina Foundation, Lumina Foundation, https://www.luminafoundation.org/files/resources/from-the-ground-up.pdf.

- When a charity becomes for-profit its former owners—the public—are frequently compensated by creating a freestanding foundation. See Robert Shireman, “Conversion of Nonprofit Student Loan Companies,” The Institute for College Access and Success, May 25, 2005, http://ticas.org/content/pub/conversion-non-profit-student-loan-companies.

- History provided by Great Lakes CEO, Richard George, in response to our request.

- Affidavit of Larry Oxendine, director of the Department of Education’s Guarantor and Lender Oversight Staff, cited in Pelfrey v. Educational Credit Management Corporation, United States District Court, N.D. Alabama, Eastern Division, February 10, 1999, http://law.justia.com/cases/federal/district-courts/FSupp2/71/1161/2515468/.

- Steven Waldman, The Bill: How the Adventures of Clinton’s National Service Bill Reveal What Is Corrupt, Comic, Cynical—and Noble—About Washington (New York: Penguin Group, 1995).

- More precisely, $497 billion. U.S. Department of Education, “Student Loans Overview,” Fiscal Year 2011 Budget Request, https://www2.ed.gov/about/overview/budget/budget11/justifications/t-loansoverview.pdf.

- The $5 billion are the organizations’ accumulated revenue in excess of expenses. The amount is in addition to a designated federal reserve fund that is, by law, a proportion of the declining balance of guaranteed federal student loans.

- Benjamin Miller, “Rethinking the Middleman: Federal Student Loan Guaranty Agencies,” New America, July 2009, https://static.newamerica.org/attachments/2733-rethinking-the-middleman/Rethinking_the_Middleman_24pp_PDF.dd6316015e6a415aadd9fa1ae08e80a.pdf.

- As explained at note 6, the Lumina Foundation, while never a GSL player itself, was created from sale of USA Funds assets to Sallie Mae.

- Federal Student Aid, “FFELP Wind-Down Report to Congress,” June 2016.

- 34 CFR 682.423

- ECMC’s charter documents, which we received in response to a FOIA request, declare that ECMC operates as “a fiduciary for the Department” and that revenue associated with duties performed for the department “are Federal Funds and shall be available to ECMC solely for the purpose of supporting other such duties as may be assigned by the Department.”

- The Girl Scouts have a massive network of more than a million underage girls selling hundreds of millions of dollars of cookies that are in turn made by to two large for-profit corporations. The reason no one has been arrested is that the trustees are not taking a cut of the proceeds, so the public has no reason to doubt that the trustees are making decisions they believe are in the best interests of the girls. (The Girl Scouts of America and its regional councils contract with two bakers, ABC Bakers and Little Brownie Bakers. http://mentalfloss.com/article/75103/alert-girl-scout-cookies-differ-depending-where-you-live.)

- Citing the IRS and other sources, the National Council of Nonprofits says “Charities should generally not compensate persons for service on the board of directors” (see “Can Board Members Be Paid?” National Council of Nonprofits, https://www.councilofnonprofits.org/tools-resources/can-board-members-be-paid).

While paying board members has become more common among nonprofit hospitals, the practice is controversial and unusual enough that it prompted an effort by the Massachusetts attorney general to outlaw the practice (See Emily Friedman, “Compensatory Justice: A Cautionary Tale,” Hospitals and Health Networks, August 2, 2011, http://www.hhnmag.com/articles/4746-compensatory-justice-a-cautionary-tale.

- Independent Sector, “Principles for Good Governance and Ethical Practice,” 2015, https://www.independentsector.org/principles.

- Based on Forms 990 filed by the organizations with the IRS and acquired through Guidestar.

- The director of the Vermont agency said something similar. It and other organs of state government are not included in this report because their finances are entangled with the state. The Pennsylvania Higher Education Assistance Agency continues to be a large operation, and has branched out into loan servicing.

- Based on Forms 990 filed by the organizations with the IRS and acquired through Guidestar.

- According to a history written by ECMC, “institutions like Corinthian Colleges, Inc. defrauded students through falsified job placement claims and predatory lending.” Lead the Way, ECMC Group, May 2015.

- Disclosure from the author, Robert Shireman: Before the proposed Corinthian purchase was public information, I introduced ECMC to College Abacus, which runs a tuition comparison site, with the idea that ECMC might be interested in purchasing it, which it did. In addition, I introduced ECMC’s grant-making foundation to uAspire, a nonprofit college affordability advising organization, for which I serve as an unpaid/donor trustee. Last year the foundation made a grant to uAspire).

- Dan Lin and Lu Lin, “The Interplay Between Director Compensation and CEO Compensation,” The International Journal of Business and Finance Research, 8:2, 2014.

- At a lunch meeting with the author, the chairman of the ECMC board said he has no qualms about his leadership of the agency, because he would never let the money he is taking from ECMC, which came from struggling borrowers, affect his judgment. That claim alone is a pretty good reason to question his judgment.

- IRS Form 1023 filed by Zenith Education Group, Inc., by David Hawn (CEO of ECMC Group and President of Zenith), November 25, 2014, https://production-tcf.imgix.net/app/uploads/2016/09/29135353/Zenith-1023-from-IRS.pdff

- The lawyers were with the major Washington, D.C., law firm of Arnold & Porter. The response to our inquiry about the failure to disclose the board member pay went on to explain that “the close relationship between Zenith and ECMC, including the overlap between directors and officers, was fully and plainly disclosed.” The response was from the CEO, David Hawn.

- “Where’s My Exemption Application?” IRS, Page last updated on April 19, 2016, https://www.irs.gov/charities-non-profits/charitable-organizations/wheres-my-application.

- See pages 25-27 of the IRS Form 1023.

- Michael Stratford, “Political Muscle to Protect Fees,” Politico, July 21, 2016.

- Payments to Navient represent nearly 80 percent of the organization’s functional expenses. (On its IRS Form 990 for fiscal year 2014, USA Funds reported functional expenses of $428,978,343, and payments to Navient totaling $337,604,644.)

- Pelesh’s previous employer has vanished from his online bio on the USA Funds site, according to the Republic Report’s David Halperin. http://www.huffingtonpost.com/davidhalperin/debt-collection-agency-ru_b_7820326.html

- The organization’s IRS Form 990 for fiscal year 2013 shows an “operating grant” of $50,000 to the Association of Private Sector Colleges and Universities. The filing for 2014 shows another grant to APSCU for $48,600, and a grant to the U.S. Chamber of Commerce Foundation for $2,000,000.

- Goldie Blumenstyk, “Backer of Student Loans Pivots in Push to Reshape Higher Education,” Chronicle of Higher Education, May 11, 2016, http://chronicle.com/article/Backer-of-Student-Loans-Pivots/236429.

- See footnote 16. On June 29, we asked ECMC’s CEO, Dave Hawn, whether three documents, from 1994 and 2000, provided to us by the U.S. Department of Education, constituted the complete charter for ECMC. He said he believed so but would check. Two weeks later we inquired again and he did not reply. One month later he announced that he was leaving ECMC to take a new job.