Community Colleges are pivotal institutions in American society—crucial to our economic competiveness and our efforts to revive the American Dream. As open-access institutions located close to where students live and work, community colleges are uniquely situated to jumpstart social mobility for those who aspire to the middle class. That is why President Obama has called for making community college free and the first two years of college universal, just as primary and secondary education have been for decades.

Yet, the outcomes today at community colleges are often dismal. While 81 percent of first-time community college students say they wish to earn a bachelor’s degree or more, after six years,1 only 12 percent do so; two-thirds fail to get even an associate’s degree or certificate after six years. With 86 percent of high school graduates going on to college,2 the central challenge in higher education has shifted from access to college to something different: access to high-quality programs that have the support to ensure graduation.

Given these low completion rates, new accountability measures are coming to higher education—as they should. States are adopting performance-based funding, the Obama administration is proposing a college rating system, and a Brookings Institution scholar recently recommended a No Child Left Behind Act for higher education.3 But as we apply accountability to colleges and universities, we need to make sure institutions have sufficient resources to succeed. We often hear the mantra that community colleges need to do more with less; but if we really care about invigorating the promise of two-year schools, why should we accept that artificial limitation? As we will see below, research suggests that targeted investments can produce substantially better educational results than we see today—which will pay crucial dividends for society at large.

This issue brief looks at three key issues surrounding the funding of higher education: (1) What are the overall variations in spending between community colleges and four-year institutions, and do the justifications advanced for those differences hold up? (2) Are the current (relatively low) levels of funding at community colleges efficient, or inefficient? (3) Does it make sense to move toward a K–12 style system of “adequacy” funding in higher education, where public funding would be weighted toward institutions such as community colleges, which educate large numbers of low-income students? How would such a system work?

A program of funding weighted toward low-income students in higher education would be a far cry from what we have today. Community colleges educate students with the greatest needs, on average, yet spend far less per pupil than four-year institutions. As The Century Foundation’s 2013 task force report on community colleges documented, this inequality persists even when one separates out the research function of universities and focuses exclusively on educational instruction.4 And it remains true even when one accounts for the fact that the first two years of college are generally less costly than the third and fourth. The current approach—trying to educate low-income and working-class students on the cheap—ends up being highly inefficient, because while the costs of community college are relatively low, low completion rates at these schools mean the costs per degree or certificate are high.

Current Inequality in Spending

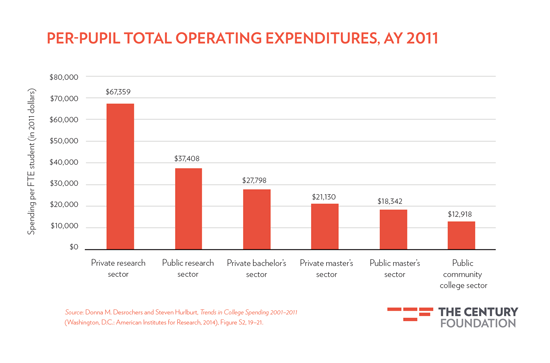

Per-pupil operating expenditures vary dramatically, as Figure 1 shows. In raw numbers, private research universities spend five times as much per student as community colleges, and public research universities almost three times as much.

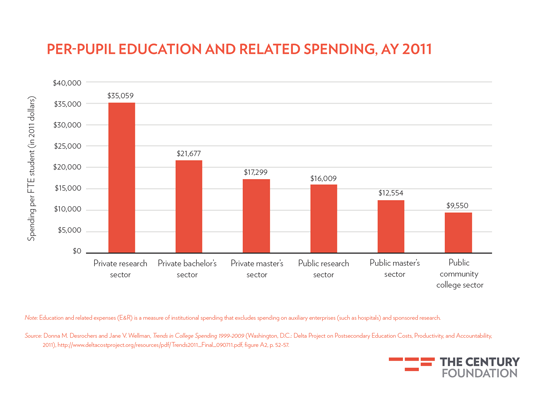

Three major justifications are offered for this differential, but each fails to fully justify the disparities. First, research universities are charged not only with educating students, but also with conducting basic research that advances human understanding of the world. This valid point takes us only so far, though, because when scholars separate out research and include only education and related expenses, large gaps in expenditures remain between institutions, as Figure 2 shows.

Second, community colleges educate students in the first two years of college, whereas four-year institutions also educate upper-division students, whose education is often estimated to cost 1.5 times as much as the education of first-and second-year students.5 But as George Washington University professor Sandy Baum and education researcher Charles Kurose have noted, differences in the cost of educating lower- and upper-division students explain only a modest portion of the education and related spending gaps between public and private research universities and community colleges, and a large residual remains.6

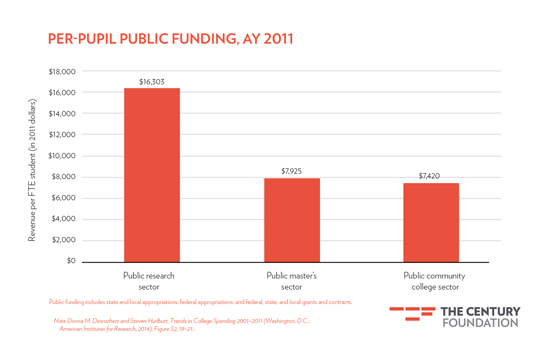

Finally, supporters of the status quo note that community college students generally contribute less in tuition than four-year students and cite this as justification for lower spending levels. If students and parents are paying more for tuition in the private marketplace, the argument runs, they deserve to enjoy greater resources. Set aside for the moment that low tuition is basic to the mission of community colleges as open-access institutions—and that low-income students should not be denied a full education just because their parents cannot pay, given the large benefits to society from educating all students.7 Looking just at the numbers, tuition differentials do not fully explain spending differences. In fact, as Figure 3 shows, direct public funding is more than twice as high at public sector research universities than at community colleges; that is, more-affluent students who can afford to attend a more prestigious program are then rewarded with their school receiving an outsized portion of public support. Sometimes, the inequity in public spending is even part of an explicit policy. In Maryland, for example, the state legislature decreed that full-time equivalent community college students should be funded at 25 percent the level of students at four-year colleges.8

Moreover, this public support is only the tip of the iceberg, since wealthy private colleges receive enormous tax subsidies that are largely hidden from the public. Based on the theory that nonprofit private colleges serve the public interest, they are exempt from property, sales, and income taxes, and donations made to nonprofit universities are tax deductible to the donor.9

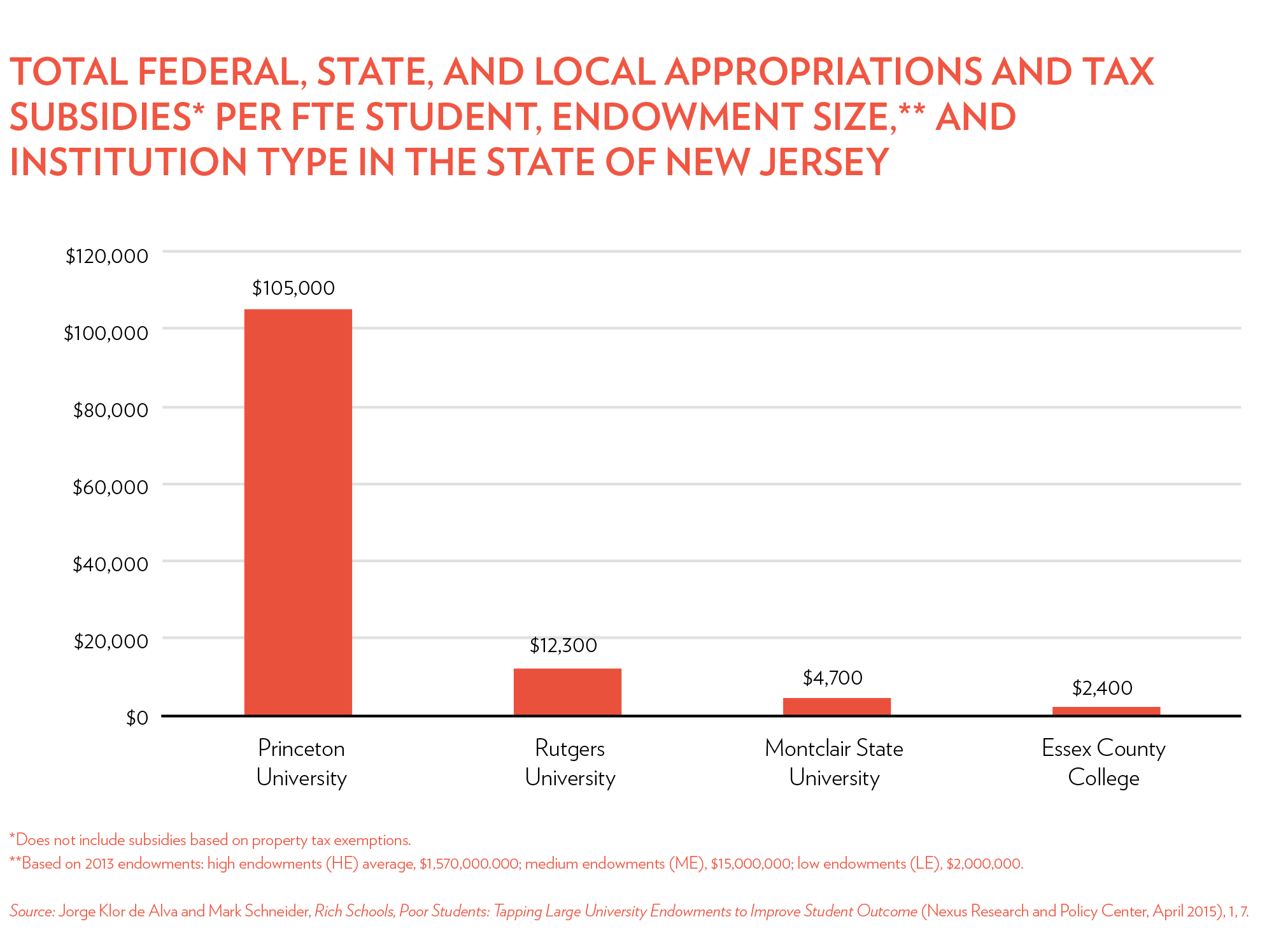

How much are these tax breaks worth? A new study by Jorge Klor de Alva of the Nexus Research and Policy Center and Mark Schneider of the American Institutes for Research notes that “many of the richest universities in the country—sitting on hundreds of millions, if not billions, of dollars in tax exempt endowments, and garnering tens of millions of dollars of tax deductible gifts every year—receive government subsidies through current tax laws that dwarf anything received by public colleges and universities, institutions that educate the majority of the nation’s low- and middle-class students.”10 The researchers estimate that in 2013, the taxpayers subsidized Princeton University students to the tune of $105,000 per full-time equivalent student, compared to $12,300 per student at the New Jersey state flagship, Rutgers; $4,700 per pupil at the regional Montclair State University; and just $2,400 per student at Essex County College (see Figure 4).11 The $105,000 figure actually understates the full amount of Princeton’s subsidy, the authors note, because they did not include property tax exemptions in the calculations.12 Public community colleges take very little advantage of tax breaks because they receive few donations—an average of $149 per full-time equivalent student, compared with $39,323 at private research universities.13

Overall, the report by de Alva and Schneider concludes that total federal, state, and local appropriations and tax subsidies per full-time equivalent student is $41,100 at private high-endowment institutions, $15,300 at public flagship institutions, $6,700 at public regional institutions, and $5,100 at community colleges. The institutions that get the very lowest subsidies include private mid-level endowment institutions ($1,500) and private low-endowment institutions ($400 per pupil).14

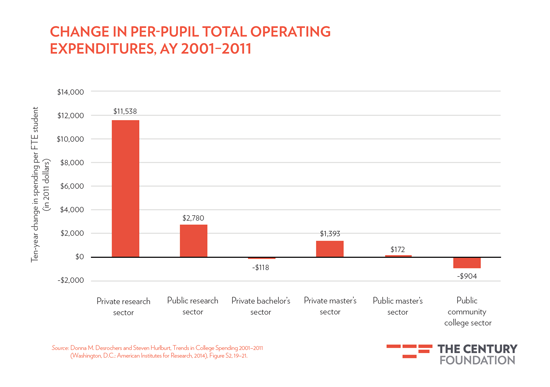

Even if one thinks the gross inequalities in spending and subsidies are perfectly justified, the growing gap in spending over time seems hard to defend. In the period from 2001 to 2011, as Figure 5 shows, funding increased substantially at public and private research universities, while public community colleges actually saw a $904 decline in real funding. These inequalities are particularly difficult to swallow, given the evidence (which we present below) to suggest that community college students on average have greater—not fewer—needs than four-year college students.

It is important also to note that there is substantial inequality in funding within the two-year sector, in part because community colleges typically receive some local funding, which tends to reflect the wealth of neighborhoods. In a 2006 paper, scholars Alicia C. Dowd and John L. Grant found that the intrastate variation in state and local community college appropriations (between institutions at the ninetieth and tenth percentiles of funding in each state) in half the states studied ranged from 2.0 to 2.8 times as much. These levels “are considered high in comparison to K–12 finance inequities,” the authors concluded.15

Inefficiencies Built into the Current System

Some may argue that the current system—which allocates many more resources to four-year institutions—is efficient because the most funds are spent developing the talents of those students (of whatever race and class) who succeeded at the K–12 level, won slots at four-year colleges, and are likely to contribute the most to society in the future. Students who have been less successful in society’s meritocratic race, the argument runs, should be educated more cheaply in the community college system.

In fact, educational opportunities in primary and secondary schooling are vastly unequal, so we can have little confidence that the “meritocratic” winners by the end of high school are indeed society’s most able. Moreover, many highly able low-income students “undermatch,” attending community college even though they have the academic credentials to attend a selective four-year college.16 The current system then compounds this inequality and inefficiency by educating low-income students on the cheap in community college. In so doing, we often waste the talents of those students who could contribute a great deal to our society, but who are failed by our grossly unequal two-tiered system of primary, secondary, and tertiary education.

The raw completion rates at two- and four-year institutions begin to tell this story. According to the 2004/2009 Beginning Postsecondary Student Longitudinal Study (BPS), only 34.5 percent of students who started in a two-year college earned a degree or certificate (from their starting institution or another school) within six years (8.5 percent earned certificates, 14.4 percent earned associate’s degrees, and 11.6 percent earned bachelor’s degrees.) By contrast, 57 percent of first-time students enrolled in bachelor’s programs or equivalents at four-year institutions earned a bachelor’s degree within six years.17

Part of the differential is surely related to lower levels of academic preparation found, on average, among community college students. But studies that carefully control for academic and demographic factors find a substantial “community college penalty”—a reduced chance of earning a bachelor’s degree—if a student begins at a two-year rather than a four-year institution.18

As a result of low completion rates, the Delta Cost Project estimates that the spending per degree at public community colleges was $73,940 in 2009, compared with $65,632 at public research institutions and $55,358 at public master’s institutions.19 Likewise, Mark Schneider of the American Institutes of Research concluded that over a five-year period, from 2004–05 to 2008–09, “almost $4 billion in federal, state and local taxpayer monies in appropriations and student grants went to first-year, full-time community college students who dropped out.”20 This might be tolerable if community college students saw clear benefits from attending some college without receiving a certificate or degree, but the strongest evidence suggests there is “no earnings payoff” from having “some college,” absent a credential.21

The underfunding of the community college sector is also inefficient to the extent that it pushes students toward for-profit colleges and online learning—neither of which has a particularly good track record for students. After a two-year investigation of thirty for-profit companies, the U.S. Senate Committee on Health, Education, Labor, and Pensions reported in 2012 that while community colleges and for-profit two-year programs have similar retention rates, “the cost of the for-profit programs makes those programs more risky for students and Federal taxpayers.” The committee noted: “While 96 percent of those attending a for-profit college borrow to attend, just 13 percent of community college students do so.”22 Likewise, one recent study found that community college students are increasing enrolling in online classes, which are relatively inexpensive for institutions to provide, even as retention rates are lower in those classes.23

By contrast, a growing body of research suggests smart investments in traditional community college classes can produce substantial gains. To take one prominent example, under the City University of New York’s Accelerated Study in Associate Programs (ASAP), full-time students are provided with a highly structured learning environment that provides extra financial, academic, and career support. According to a rigorous analysis by MDRC, which employed a randomized trial, the program nearly doubled the three-year graduation rate of students, from 22 percent to 40 percent. The program cost 60 percent more per student—about $16,300 more per pupil over three years—yet by boosting results, it actually reduced the amount spent for each college degree by more than 10 percent.24 Research also finds that investments in smaller class sizes in community colleges, more counselors, and more full-time faculty can improve outcomes for students.25

More funds do not guarantee success, but they are likely to prove critical, especially for “high touch” interventions than are often effective. As Baum and Kurose observe: “supporting the success of community college students requires much more than adequate funding for the students and their institutions. But without adequate funding, significant progress is unlikely.”26

Toward a System of Higher Education Adequacy Funding, Weighted Based on Student Needs

What would a more equitable and efficient system of higher education funding look like? The K–12 system—which has greater experience educating disadvantaged students and has lower dropout rates than higher education—may be informative.27 Considerable K–12 research has been conducted at the state level to estimate the cost of an “adequate” education, and a key finding of that research is that a funding premium needs to be provided for low-income elementary and secondary students to be successful.

Some studies estimate the costs of building a successful school—by extrapolating from proven examples—and vary the costs based on the demographics of students in those schools. Other studies use statistical models to estimate the “cost function” of schools, examining the observed relationship generally between inputs and outputs. These analyses can also predict different costs depending on the demographics of the student body.28

A 2008 review of thirteen studies found that the extra cost of educating disadvantaged students ranged from 22.5 percent to 167.5 percent more than other students.29 In a 2015 analysis, the Education Trust said a 40 percent premium should be considered “conservative,” given some research finding that it costs twice as much to educate low-income students to the same standards as more-affluent students.30

At the K–12 level, two-thirds of state funding formulas recognize that students with greater needs deserve greater resources.31 And the federal Title I program within the Elementary and Secondary Education Act is based on the premise that schools with concentrations of student poverty deserve extra funding.

Although many inequities remain in our K–12 system of funding given reliance on property taxes for the local contributions to school resources, on net, a 2015 Education Trust analysis found that state and local funding was higher in high-poverty than low-poverty districts in 17 states, about the same in 24 states, and lower in 6 states.32 When federal funds are included, data show that, in 2012, in 45 states, high-poverty districts spent an equal or greater amount on students than wealthier districts.33

In higher education, by contrast, we generally spend the most on four-year institutions that educate the wealthiest students, while community colleges, which educate a disproportionate number of needy students, get the least. In 2008, 62 percent of community college students came from bottom half of income distribution, compared with 43 percent at public four-year schools and 38 percent at private, nonprofit four-year schools.34 In 2012–13, a study looking at ten large states concluded that the median proportion of Pell Grant recipients ranged from 14 percent at private, high-endowment institutions to 23 percent at public flagship universities, to 41 percent at community colleges.35 While students from socioeconomically disadvantaged families outnumber wealthy students at community colleges by two to one, at the most selective four-year colleges, rich students outnumber poor ones by fourteen to one.36

There is, of course, progressivity in funding built into federal financial aid programs such as the Pell Grant, which is means tested. But many other programs—particularly tax breaks for students and parents—pull in the direction of supporting the wealthy. And federal, state, and local aid in higher education involves a complex mix not only of aid to individual students (such as the Pell Grant program) but also direct aid to public colleges (most notably in the form of state subsidies) and tax subsidies to institutions (the deductibility of donations and non-taxation of income and property of nonprofit colleges). Although original legislation back in 1972 envisioned federal institutional aid for colleges and universities that educate low-income students, along the lines of K–12’s Title I program, the system soon morphed into our current program that funds individual students through grants, loans, and tax subsidies, along with various forms of institutional aid.37

While the Pell Grant is the most high-profile form of federal aid to students, the New America Foundation’s Federal Education Budget Project estimates that federal tax credits, deductions, and exemptions total $37 billion, an amount greater than the $30 billion spent on direct student grants.38 Unlike the Pell Grant, which is directly targeted to low-income students, higher-education tax breaks can benefit students from families making up to $180,000 per year. Likewise, private scholarships skew toward wealthy students. A 2015 report found that a higher proportion of high-income families receive private scholarships than low-income families.39

Federal aid that goes directly to institutions also tilts toward the wealthy. According to a May 2009 Brookings Institute report, four-year institutions received nearly three times as much aid ($2,600 per student, including financial aid) as community colleges ($790).40 Meanwhile, as outlined above, state aid to institutions often tilts toward flagship universities, which educate a disproportionate number of wealthy students, and away from community colleges, which educate large numbers of disadvantaged students. And some of the largest federal and state subsidies—up to $105,000 per student—come in the form of tax breaks for four-year colleges with large endowments.

The first step, then, is to provide more equality in funding to students and institutions across the spectrum. But education research at the K–12 level has long suggested that equality is not enough: low-income students deserve more in order to reach their potential. Very little comparable research has been done at the higher education level to determine the right premium for low-income students, in part because there has not been litigation in the area like there has at the K–12 level and in part because postsecondary institutions have not had the same uniform standards and assessments as those employed at the primary and secondary levels.41

But broadly shared outcome measures are beginning to emerge in higher education. Today, more than half of states employ performance-based funding for higher education, meaning they provide some portion of funding based on student outcomes, according to a 2015 report of the National Conference on State Legislators.42 As states have adopted outcomes-based funding, they have necessarily devised standards of success that offer benchmarks to which higher education “adequacy” funding can be tied.

Moreover, researchers have begun to quantify the real costs of educating low-income students in community colleges to high levels, using a variety of methods, from reliance on professional judgement to examining the amount spent at successful institutions.43 In September 2003, a working group put together by the California Community College Chancellor’s Office released a report called “The Real Cost Project.”44 Recognizing the student body makeup of California community colleges—such as income level and academic preparation of students—the working group sought to price out the cost of an adequate education. The group assembled a number of quality indicators (such as class size, high-quality faculty and staff, need for counseling and health services, equipment, and technology) and derived a cost estimate of $9,200 per full-time equivalent student considerably higher than the actual amount spent, which was less than $5,000.45

Likewise, as outcomes-based funding becomes more popular, states are experimenting with financial incentives to ensure that institutions continue to serve low-income populations.46 This weighted funding for low-income graduates implicitly recognizes that it may be more difficult—and expensive—to successful educate at-risk students.

A February 2015 report by Martha Snyder of HCM Strategies finds that thirty-five states are either developing or using some form of performance-based funding.47 According to the report, fourteen of twenty-six states currently employing performance-based funding provide priority funding to institutions that have success with underrepresented students, including those from low-income backgrounds.48 Among the states providing extra funding for success with underrepresented students are Arkansas, Hawaii, Illinois, Indiana, Minnesota, Mississippi, Nevada, New Mexico, Ohio, Oregon, Pennsylvania, Tennessee, Texas, and Wisconsin.49 Of ten other states in the process of developing performance-based funding, eight plan to prioritize funding for underrepresented student outcomes, and two are in the process of deciding whether or not to do so.50 The weights in these plans can go as high as a 100 percent premium for graduating at-risk students.51

Tennessee is considered to be at the vanguard of outcomes-based funding, and it provides a substantial financial premium for success with low-income students. In 2010, at the urging of Governor Phil Bredesen (a moderate Democrat), the legislature passed the Complete College Tennessee Act, to replace college funding based on student enrollment with a program funding success as measured by various outcomes such as retention rates and completion. The act called for a “fair and equitable distribution and use of public funds” to guide the outcomes-based model.

In response to the legislation, the Tennessee Higher Education Commission convened a Formula Review Committee that devised a number of benchmarks for success that would vary based on an institution’s mission as a community college or a research university. The group also concluded that a 40 percent funding premium should be provided to institutions that have success with students who are low-income (defined as eligible for federal Pell Grants) or adult learners (age 25 or over.)53 These students often struggle, so Tennessee officials wanted to provide a generous enough level of funding to ensure colleges did not exclude them. In addition, the premium also covers the extra costs associated with having a reasonable chance of success with low-income and adult students.54

Although the program is relatively new, preliminary evidence from a couple of reports is encouraging.55 An official at the Tennessee Commission of Higher Education notes “increases in the success of older and low income students in terms of numbers and completions,” although it cautions that this trend cannot be definitively tied to the performance funding.56 The long-term success of the program with low-income students in particular will help determine whether the 40 percent funding premium is sufficient to provide an incentive for colleges to educate low-income students and the resources necessary to provide a strong educational environment for success.57 Another Tennessee official says the state is considering increasing the premium to as high as 100 percent.58

Looking abroad, countries such as Ireland and England are employing weighted funding formulas for low-income college students. The Irish Higher Education Authority allocates extra public funds—called “access weighting”—for institutions that succeed in educating larger proportions of low-income students.59 The funding has been part of a plan to increase the proportion of economically disadvantaged students who attend college from 20 percent in 2007 to 54 percent by 2020.60 England has had a similar plan in place for some time. Higher education researcher Arthur Hauptman noted in 2003: “The English funding council for a number of years has paid institutions a premium of 5 percent for students who come from postal codes with the lowest income profiles.”61

Policy Recommendations for Next Steps

It is long past time for the United States to modernize its haphazard, inequitable, and inefficient system of higher education funding. Federal and state governments have roles to play in promoting reform, as does the philanthropic community. At the federal level, progressive congressional action is unlikely in the short term, but the executive branch could take action in the near term that would lay the groundwork for critical reform over time. What should be done?

- First, the U.S. Department of Education—or a group of foundations—should support rigorous research to better identify the full level of funding each higher education institution currently receives. When you cobble together the federal, state, and local subsidies—both direct expenditures and tax breaks (for institutions and individuals)—what does the total allocation of public support look like? Once we have a clear and systematic accounting—from Princeton’s $105,000 per student subsidy to Essex County College’s $2,400—we will be able to accurately evaluate whether the current distribution between community colleges and four-year institutions, and between low-income and affluent students, is equitable and efficient.

- Second, we need a better understanding of what it takes to educate the more-disadvantaged students to high levels. State performance funding formulas—which provide 40 percent (or even 100 percent) more for success with low-income students—could provide a model for increasing needs-based funding for Community College students. The Century Foundation’s Community College Task Force was right to call for a rigorous federal study of how much weighting low-income college students deserve.62 Failing that, foundations could fund this important research so that we will have a stronger basis for making policy decisions about the allocation of public dollars.

- Third, in the longer term, once we have a firm sense of who currently gets what, and how much spending students with different needs deserve, we need to fundamentally rethink how we allocate public funds to better match student needs and public resources. As a part of that thinking, federal and state policymakers should carefully watch programs like the one in Tennessee to better calculate what premium is necessary to tap into the talents of students from all backgrounds. In addition, the federal government should consider taxing the endowments of very wealthy institutions, and dedicating the proceeds to community colleges serving low-income students. Policymakers should seriously consider the recommendations of the Nexus Research and Policy Center to apply an excise tax of between 0.5 percent and 2.0 percent on endowments of more than $500 million, a tax that institutions could offset by devoting greater funds to financial aid for needy students.63

As the nation becomes more racially, ethnically, and economically diverse, we can no longer afford to write off large chunks of our population. Providing adequate levels of funding to educate students of all backgrounds is a critical step in helping community colleges fulfill their original promise of serving as engines for social mobility.

Notes

- 1.

Bridging the Higher Education Divide: Strengthening Community Colleges and Restoring the American Dream: The Report of The Century Foundation Task Force on Preventing Community Colleges from Becoming Separate and Unequal

- , (New York: The Century Foundation Press, 2013), 12.

2. James Rosenbaum, Caitlin Ahearn, Kelly Becker, and Janet Rosenbaum, The New Forgotten Half and Research Directions to Support Them (New York: William T. Grant Foundation, 2015).

3. Harry Holzer, “Should There Be a No Child Left Behind Act for U.S. Universities?” Brookings Institution, April 13, 2015.

4. Bridging the Higher Education Divide, 24.

5. Sandy Baum and Charles Kurose, “Community Colleges in Context: Exploring Financing of Two and Four-Year Institutions,” in Bridging the Higher Education Divide, 82.

6. Ibid., 97 and 102. The authors calculate that private research universities spend 5.63 times more, and public research universities spend 2.014 times more for education and related expenses than community colleges. This is a larger differential than the upper division/lower division distinction would explain.

7. Ibid., 99.

8. Christopher M. Mullin and David S. Honeyman, “The Funding of Community Colleges: A Typology of State Funding Fomulas,” Community College Review 35, no. 2 (October 2007): 113–27, at 117. See also Christopher M. Mullin, Doing More with Less: The Inequitable Funding of Community Colleges (Washington, D.C.: American Association of Community Colleges, September 2010), 6.

9. Baum and Kurose, “Community Colleges in Context,” 91.

10. Jorge Klor de Alva and Mark Schneider, Rich Schools, Poor Students: Tapping Large University Endowments to Improve Student Outcomes (Chandler, Ariz.: Nexus Research and Policy Center, April 2015), 1.

11. Ibid., 1.

12. Ibid., 5.

13. Donna Desrochers and Steven Hurlburt, Trends in College Spending: 2001–2011 (Washington, D.C.: American Institutes for Research, 2014), 17–18.

14. De Alva and Schneider, Rich Schools, Poor Students, 7, Table 1.

15. Alicia C. Dowd and John L. Grant, Equity and Efficiency of Community College Appropriations: The Role of Local Financing (Ithaca, N.Y.: Cornell Higher Education Research Institute, January 2006), 2, 15.

16. Caroline Hoxby and Christopher Avery, “The Missing ‘One-Offs’: The Hidden Supply of High-Achieving, Low-Income Students,” Brookings Papers on Economic Activity (Washington, D.C.: Brookings Institution, Spring 2013), 1–50, http://www.brookings.edu/~/media/projects/bpea/spring-2013/2013a_hoxby.pdf .

17. Bridging the Higher Education Divide, 30.

18. Ibid., 31–32.

19. Ibid., 36.

20. Mark Schneider, and Lu Yin, The Hidden Costs of Community Colleges (Washington, D.C.: American Institutes of Research, October 2011), 2.

21. Rosenbaum, Ahearn, Becker, and Rosenbaum, The New Forgotten Half and Research Directions to Support Them, 5.

22. Bridging the Higher Education Divide, 38.

23. Ashley A. Smith, “Survey shows participation in online courses growing,” Inside Higher Ed, April 21, 2015.

24. Susan Dynarski, “How to Improve Graduation Rates at Community Colleges,” New York Times, March 11, 2015; and Katherine Mangan, “Program’s Extra Support for Community-College Students Is Paying Off,” Chronicle of Higher Education, February 26, 2015.

25. Bridging the Higher Education Divide, 35–40.

26. Baum and Kurose, “Community Colleges in Context,” 74.

27. Bridging the Higher Education Divide, 11.

28. Bruce Baker, Lori Taylor, and Arnold Vedlitz, Adequacy Estimates and the Implications of Common Standards for the Cost of Instruction, Report to the National Research Council, May 30, 2008, 4–5.

29. Bridging the Higher Education Divide, 17

30. Natasha Ushomirsky and David Williams, Funding Gaps 2015: Too Many States Still Spend Less on Education Students Who Need the Most (Washington, D.C.: The Education Trust, March 2015), 5.

31. Bridging the Higher Education Divide, 17.

32. Ushominsky and Williams, Funding Gaps 2015, 4, Figure 1.

33. Emma Brown, “In 23 states, richer school districts get more state and local funding than poorer districts,” Washington Post, March 13, 2015, A18.

34. Bridging the Higher Education Divide, 76–77.

35. De Alva and Schneider, Rich Schools, Poor Students, 11 and 21.

36. Bridging the Higher Education Divide, 18–19.

37. Charles B. Reed and F. King Alexander, “We Need a New Kind of Institutional Aid,” Inside Higher Ed, March 30, 2009.

38. New America Foundation, Federal Education Project (2014), cited in De Alva and Schneider, Rich Schools, Poor Students, 5.

39. Jon Marcus, “Wealthier students more likely than poor to get private scholarships,” Hechinger Report, April 17, 2015.

40. Sara Goldrick-Rab, Douglas N. Harris, Christopher Mazzeo and Gregory Kienzl, “Transforming America’s Community Colleges: A Federal Policy Proposal to Expand Opportunity and Promote Economic Prosperity,” Brookings Policy Brief, May 2009, 1 and 3.

41. In 2003, a California working group reported, “No state has seriously attempted an adequacy-oriented Quality Education approach to postsecondary funding.” Chancellor’s Office, California Community Colleges, The Real Cost Project: Preliminary Report (September 2003), 9–10, http://californiacommunitycolleges.cccco.edu/Portals/0/Reports/realcost.pdf.

42. National Conference of State Legislators, “Performance-Based Funding for Higher Education,” January 13, 2015.

43. Chancellor’s Office, California Community Colleges, The Real Cost Project, 5

44. Ibid.

45. Ibid., 1–2, 15–19.

46. National Conference of State Legislatures, “Performance-based Funding.”

47. Martha Snyder, Driving Better Outcomes: Typology and Principles to Inform Outcomes-Based Funding Models (HCM Strategies, April 2105), 9. See also Paul Fain, “Report seeks to add specificity to debate over states’ performance-based funding models,” Inside Higher Ed, February 12, 2015.

48. Snyder, Driving Better Outcomes, 22–23.

49. Ibid., 29.

50. Ibid., 30.

51. See Dennis P. Jones, Outcomes-Based Funding: The Wave of Implementation (National Center for Higher Education Management Systems, October 2013), 4. (citing Texas).

52. Postsecondary Analytics, “What’s Working? Outcomes-Based Funding in Tennessee,” October 2013, 1.

53. Russ Deaton, Tennessee Higher Education Commission, “Tennessee’s Outcomes-Based Funding Formula,” http://www.tn.gov/thec/Divisions/Fiscal/outcomes_resources.shtml.

54. Ibid., 2 (“A 40 percent premium is applied to these outcomes as a way to recognize the added assistance provided to these populations and the importance of success for these populations to state goals”).

55. See Postsecondary Analytics, “What’s Working?”; and Frank Woodward, “Do Performance Funding Policies Impact Higher Education Outcomes,” American Society for Public Administration, March 24, 2015.

56. Richard Rhoda, Tennessee Higher Education Commission, e-mail to author, May 8, 2015.

57. In 2013, the Ford Foundation approved a $500,000 grant to the Tennessee Higher Education Commission to “evaluate the effects on campus of the state’s new outcomes-based funding formula for public higher education and develop Web-based reporting and analysis tools.” See Ford Foundation website, http://www.fordfoundation.org/grants/grantdetails?grantid=119506.

58. Russ Deaton, Tennessee Higher Education Commission, e-mail to author, May 11, 2015. See also Kevin J. Dougherty, Sosanya M. Jones, Hana Lahr, Rebecca S. Natow, Lara Pheatt, and Vikash Ready, Implementing Performance Funding in Three Leading States: Instruments, Outcomes, Obstacles, and Unintended Impacts, Working Paper no. 74 (New York: Teachers College, Columbia University Community College Research Center, November 2014), 32 and 37 (citing interviews with Tennessee college officials and concluding that “the premium for graduating at-risk students might have to be even bigger.”)

59. Irish Higher Education Authority, National Plan for Equity of Access to Higher Education, 2008–2013, July 2008, 48. See also Irish Department of Education and Skills, National Strategy for Higher Education to 2030, January 2011, 114–15, 122.

60. Irish Higher Education Authority, External Audit of Equal Access Survey, June 2010, pp. 7–8, 16.

61. Arthur M. Hauptman, “Using Institutional Incentives to Improve Student Performance,” in Double the Numbers: Increasing Postsecondary Credentials for Underrepresented Youth, ed. Richard Kazis, Joel Vargas, and Nancy Hoffman (Cambridge, Mass.: Harvard Education Press, 2004).

62. Bridging the Higher Education Divide, 39.

63. De Alva and Schneider, Rich Schools, Poor Students, 2 and 14–16.