America has deliberately chosen to be a low-wage society since the 1970s. This status was not thrust upon it inevitably by technological change or globalization, but instead was the result of deliberate policy choices made over the years. America likewise has the ability to reverse course, pursuing a policy agenda that would put it back on the path toward a high-wage economy.

A policy agenda for a high-wage America is long overdue, and the negative impacts of the political economic status quo will continue without decisive policy intervention. Most important, a sensible high-wage economy will not, contrary to unsupported theory, inevitably undermine business investment, profits and growth, nor will it stimulate inflation. Rather, through strong demand, it will stimulate business investment, economic growth, and gains in productivity and employment.1

While action at the federal level has been circumscribed by politics and ideological overreactions to federal budget deficits, there are myriad opportunities to develop a high-wage society in collaboration with state and local stakeholders to improve the opportunities, wages, and living standards of middle-income, working class, and poor Americans.

This report provides an overview of the current state of the U.S. economy, characterized by a sluggish recovery, stagnant living standards, inequality, increasingly volatile and uncertain incomes, especially for low-income Americans, persistent poverty, and declining benefits. Our review below of the economic data and literature will demonstrate the persistence of reduced opportunity and a low-wage America for millions since the 1970s.

The report also explores the deliberate policy choices that led to the low-wage economy that developed in the late 1970s and was solidified by the 1980s and 1990s. There was only a brief reprieve during the full-employment economy of the late 1990s, when wage growth lifted wages for all income levels; even during this time, anti-inflationary monetary policy reduced the bargaining power of workers relative to capital.

After reviewing the political and academic influences that created a low-wage America, the report proposes alternative policy choices to build a high-wage America that extends prosperity to a broader range of workers. The three main pillars of a high-wage economy identified in this report—public investment and industrial policy, education and training, and labor standards and social supports—will guide the Rediscovering Government Initiative’s research and event agendas in the coming months, as it seeks to build an agenda that can return American workers to prosperity.

The State of Low-Wage America

The growth of inequality, the increase in the volatility of incomes, and the stagnation of living standards since the late 1970s is well known. But less recognized is that America has indeed become a low-wage society in the process. Low-wage America is marked by a number of trends, which bring with them social fragmentation, political uncertainty2, and lost economic potential.3

Stagnating Wages and Rising Income Inequality

In the postwar United States, wages rose steadily for a wide range of workers.4 As mainstream theory suggested, workers came to earn—and to expect—regular earnings increases proportional to their labor. Moreover, those wages rose rapidly, roughly doubling over twenty years. But since the late 1970s, wage growth has stopped for the eightieth percentile of earners on down, and for much of the wage distribution, earnings have actually fallen.5 In the latest recovery, beginning in 2009 after the Great Recession, wages have again risen slowly, but those with jobs are often not earning enough to support a family or to rise above the official level of poverty, and too few working-age people are employed.

Material inadequacy defines today’s economy for many.6 In fact, job growth has been subpar in the three recoveries since the 1990s. In addition, employer-provided health insurance7 coverage either has been reduced or its cost to workers increased,8 and pensions appear to be almost a relic of a bygone era.9

Our own analysis of Current Population Survey data10 found that from 2010 to 2016, between 46 percent and 50 percent of hourly workers between the ages of 25 and 54 earned less than $15 an hour (the wage that many now propose should be that national minimum), and were less likely to have full-time work than counterparts who earned more than $15 an hour.

Figure 1

Figure 1 shows just one example of the impact of a low-wage America on society: an increased number of households in the United States earn less than 60 percent of the median disposable income, adjusted for household size. The rate spiked in the late 1970s, and has been around 24 percent ever since.

Working Families Facing Financial Stress and Insecurity

While real wages have stagnated for most workers and even declined for some, the costs of child care, education, housing, and health care—today’s basic needs for working families—have increased significantly relative to the overall rate of inflation (see Figure 2). In combination with low real-wage growth, this means that middle-class living standards are increasingly out of reach for many Americans.11 The Economic Policy Institute estimates that a two-parent, two-child household today would need to make $63,741 a year to have an adequate standard of living;12 but the median household income is only $56,516, according to the Census Bureau in 2015.13

Figure 2

With wages low, many more workers must rely on public assistance to get by. In 2014, 31.8 percent of people on supplemental nutrition assistance program (SNAP, or food stamps) lived in a household where at least one person was working, up from 19.6 percent in 1989.14 A full 71.6 percent of individuals in households on some form of public assistance also work or are in a working family.15 The working poor—workers that spent twenty-seven weeks in the labor force during the year but were still in poverty—stood at 6.7 percent of labor force in 2014 (9.5 million people), and has hovered around 6 percent since the early 1980s, with a significant increase during the Great Recession. By other measures of poverty, the working poor rate is much higher.16

Where wages and public assistance fall short, debt fills the gap, with many workers increasingly reliant on forms credit—credit cards, auto loans, predatory payday loans, and auto title loans—just to get by.17 This is not a story of profligate spending, but rather the need for credit to meet basic needs. This reliance on credit is increasing the amount of financial stress and insecurity that working families face, as interest payments and late fees eat away at already meager earnings. According to an analysis of the Federal Reserve’s Survey of Consumer Finances, working-class households18 were nearly twice as likely to be financially stressed than non-working class (wealthier) households over the period of 1992 to 2016 (see Figure 3).19 This financial stress includes such factors as filing for bankruptcy in the past five years, being turned down for credit, fear of being turned down for credit, and late payments on debt such as student loans or mortgages.

Figure 3

While low-wage workers have seen their incomes shrink, top earners have seen their incomes rise rapidly. Figure 4 compares wage growth of those in the ninetieth percentile (top) to those in the fiftieth percentile (middle) and the tenth percentile (bottom) of the wage distribution. The rate of wage growth for the ninetieth percentile was steady from 1990 to 2016, while, after substantial wage gains were generated in the late 1990s, real wages in the fiftieth and tenth percentiles stagnated from 2008 to 2016. Meanwhile, neither the tenth percentile nor the fiftieth percentile the wage distribution has yet recovered the level of wages reached prior to the recession. Has high income at the top led to lower income in the middle and near the bottom? The answer is not as straightforward as many assume. But many of the practices that contributed to keeping wages low—anti-inflationary policies that favor business over workers, the increased importance of financial markets in the operation of the economy, low taxes on the well-off—were a direct consequence of soaring incomes at the top.

Figure 4

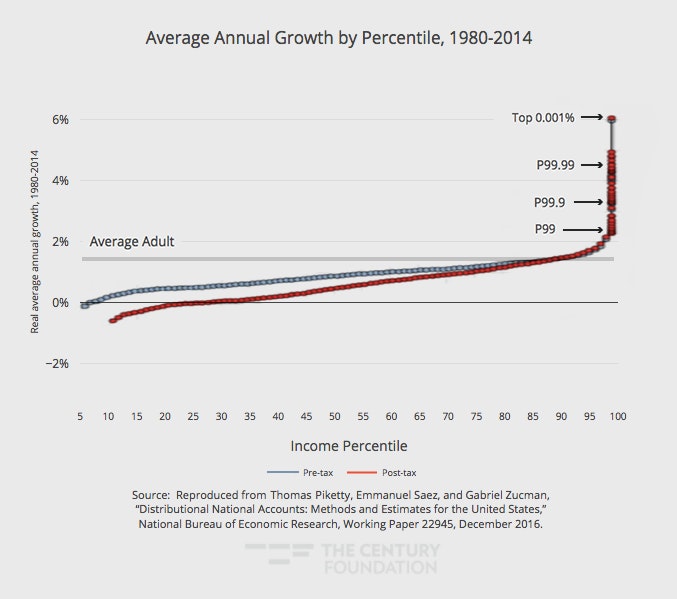

Highly detailed recent research by economists Thomas Piketty, Emmanuel Saez, and Gabriel Zucman20 demonstrates how the 1 percent at the top of the income distribution has had 6 percent annual wage growth, while the rest of America is on average experienced stagnant wage growth from 1980 to 2014 (Figure 5). They find that post-tax transfers did little to shift the curve in favor of those in the lower percentiles. And steep cuts to the top marginal tax rates beginning in the 1980s helped to exacerbate inequality.

Figure 5

Skyrocketing income at the top has recently slowed. The labor market has tightened over the past two years, and there are indications in the Census’s “Report for Income and Poverty in the United States: 2015” that the rest of America is seeing their prospects improve.21 From 2014 to 2015, real median household income increased by 5.1 percent, the official poverty rate decreased by 1.2 percent, and the number of people in official poverty fell by 3.5 million.

But these upticks for working families do not make up for the losses incurred during the recession: household income is still down 4.6 percent since 2007.22 And incomes could have improved even earlier, had austerity policies and the budget sequester been avoided in the early post-recessionary period.23

Wealthy Whites Are Leaving the White Working Class Behind

As with the overall trends in the wage distribution, the white upper-middle class has pulled away from poorer whites. Working-class whites without a college degree in particular were left behind, partly because middle class jobs became scarcer for them. Whites without a college degree earned $696 in median usual weekly earnings in 2014, compared to $1,132 for those with a bachelor’s degree.24 The gap has been growing since the 1970s.25 Wage gaps by education also persist for black and Hispanic workers, suggesting that a dearth of middle-skill, middle-wage jobs is hurting all groups.

The fortieth percentile of white households saw their real incomes grow by a total of 29 percent over nearly forty years from 1967 to 2015—0.6 percent per year—while richer white households in the eightieth percentile saw their incomes grow by 67 percent (an average of a much faster 1.4 percent per year) over the same period.26

For some, low-wage jobs with little security replaced the middle-class occupations—often manufacturing work—that they had built into their expectations. For others, chronic and long-term unemployment became the new normal.

In addition, and most startling, mortality rates for middle-aged whites (white males particularly) with less than a college education have risen, the only demographic group to see rising mortality since the late 1990s. Deaths from alcohol, drugs, and suicide account for these higher rates.27

Racial Inequality Persists, and Worsens in Low-wage Jobs

While middle- to low-income whites have lagged behind their high income counterparts, income inequality between whites and blacks has remained much the same since the 1967, with black households in the sixtieth percentile earning 61 percent of a white household in the sixtieth percentile.28 The gap has increased slightly for poorer black households: the bottom 20 percent of black households earned 55 percent of their white counterparts in 1967, but in 2015 these households earned only 53 percent of their white counterparts.29 Latino households also continue to lag behind their white counterparts, with the median Hispanic household earning 61 percent of the median white household in 2014.30 In sum, no substantial relative progress has been made by minorities.

Meanwhile, the median white household’s wealth is thirteen times greater than the median black household.31 With yawning racial wealth gaps in cities like Washington, D.C.—where the average white household has a net worth eighty-one times greater than the average black household—it is apparent that historical factors dating back to the nation’s history of slavery and discrimination have been difficult to correct, including unequal treatment under New Deal programs during the Depression and the failure to enforce the Fair Housing Act.32 People of color were deliberately excluded from the policies that built the American middle class in the mid-twentieth century.33

Newer areas of economic research, including stratification economics,34 have identified how inter-group inequalities continue through transfers of wealth (or lack of wealth) from one generation to another. Without major policy interventions, these inequities will persist, especially in a political environment where social spending is curtailed.

Women Face a Wage Gap, Particularly Women of Color

Even as the gender wage gap has closed since the early 1970s, women are paid 80 percent of their male counterparts,35 and are 35 percent more likely to be in poverty than men.36 For women of color, the gap is larger. In 2015, black women working full time year-round are paid 63 cents to the dollar of a white, non-Hispanic man. The devaluation of care work37 and occupations typically filled by women undermine women’s earnings and occupational mobility.38

According to the economists Randy Albelda and Michael Carr, some antipoverty programs designed to assist those with little to no income are predicated upon an antiquated male-breadwinner model39 that assumes women provide the bulk of care work in the home of a nuclear family.40 This makes it difficult for working single mothers in low-wage occupations to maintain eligibility for certain programs with strict income requirements, like Temporary Assistance for Needy Families (TANF), housing assistance, and Food Stamps.41

Women faced setbacks from the recession and the austerity that followed. Women of color and single mothers suffered disproportionately, especially as TANF benefits were cut. Spending cuts for state and local government budgets have limited a robust employment recovery for women who work in good public service jobs.42 The lack of robust paid leave programs and universal childcare programs continue to place female workers at a disadvantage.43

Labor’s Shrinking Share of Nationwide Income

Another indication of a low-wage economy is the nation’s falling wage share compared to its GDP. Generally, economists assume that labor composes two-thirds of the income share of an economy (with the remaining third allocated to profits).44 However, the United States has had a decline in the labor share of income as a percent of GDP since the 2000s (see Figure 6).

Figure 6

Wages have also not kept up with the growth of productivity, breaking the implicit promise of regulation-free economics. The growth of productivity and hourly compensation began to diverge from 1973 onward.45 The long-held assumption has been that productivity—the output per hour of work—and compensation would grow at similar rates. In other words, workers would share equally in the growing productive potential of the economy. But between 1973 and 2015, productivity increased by 73.4 percent, while hourly compensation increased by only 11.1 percent.46 Had the minimum wage grown along with productivity as it had in the immediate postwar years, the hourly minimum wage would be greater than $20 an hour compared to $7.25 today.47 Even as workers produced more output per hour of work, the productivity gains were captured by capital, not labor, reducing the labor share of income.

In times when the labor share was larger and wages were high, economic growth and investment were robust, and productivity grew more rapidly. Now that labor costs are cheaper and economic demand is subdued, we argue there is less incentive for firms to improve productivity via investments in labor-saving technology, which in turn limits economic growth. Productivity lags, and an increased profit share eats into labor’s share of income.48

There is substantial debate around the meaning of this decline in the labor share.49 But the decline can be at least partially attributed to changes in the economy that began in the late 1970s and accelerated in the 2000s. Literature suggests that financialization—the increased importance of financial markets in the operation of the economy—has contributed to the shift of income from wages to profits,50 along with increased capital international flows,51 globalization, and the decreased bargaining power of workers.52

American Wages Are Falling Behind the Rest of the Developed World

Workers’ wages in the United States are also falling measurably behind their counterparts in the developed world. While the average annual earnings in the United States for 2015 were among the top three among OECD countries ($59,700),53 a large share of American workers are defined as low-paid. Comparing the United States to the OECD nations, a quarter of full-time American employees earn less than two-thirds of median earnings, the largest share of countries with available data in the OECD (see Figure 7).

Figure 7

In general, inequality of incomes in the United States has grown more rapidly than in almost all other advanced nations. One way to measure this is to compare average earnings—which skew upward when there is a high proportion of highly paid workers—to median earnings, those in the middle of the pack. This mean-median income gap has grown substantially in the United States compared to other nations (see Figure 8).

Figure 8

U.S. Manufacturing Work Is Particularly Underpaid

Evaluating the differences in the hourly labor costs of manufacturing workers between countries also indicates that U.S. manufacturing wages lag behind several advanced countries. According to data from the International Labour Organization from 2015, there is a divergence in manufacturing wages between the United States and its counterparts in the developed world. Hourly labor cost per employee includes direct pay along with employer social insurance expenditures and labor-related taxes.54 According to Figure 9, hourly compensation of manufacturing workers ranked eighteenth out of twenty-seven OECD nations with available data.

Figure 9

Thus, despite manufacturing workers earning more than nonmanufacturing workers in the United States, they are still in the middle of the pack internationally. Even Germany, whose economic policies in the early 2000s included wage moderation55 via the famed Hartz56 reforms,57 ranks well ahead of U.S. hourly compensation in manufacturing.

The fact remains that America is the low-wage model of a modern economy when compared to other advanced economies. While most populations of advanced economies did not experience prolonged income stagnation or declines until the mid-2000s, American workers have been experiencing wage stagnation since the late 1970s.58

Taken together, these data point to a political-economic model that in many ways deliberately creates low-wage conditions for millions of Americans. The policies that constructed this low-wage model are reviewed below.

How Did We Get Here? The Origins of Low-Wage America

The adoption of low-wage policies in America was based on a renewed laissez-faire economic ideology, and a loss of faith in government. This ideology grew out of the stagflationary period of the 1970s, as both high unemployment and high inflation deeply affected the nation’s people. The search for answers during this confusing time led to a set of policies that, ultimately, over the period of four decades, penalized workers and resulted in relatively poor levels of business investment. Productivity growth was slow, except for a few years in the late 1990s, and public investment was tragically neglected.

In this environment of free-market idealism, government industrial policies to aid industries were eschewed and even ridiculed. Restraining wage growth was considered a central way to subdue inflation. The regulation of the labor and financial markets was essentially eviscerated. Anti-trust efforts were, for all practical purposes, abandoned, and unions were attacked and weakened by government. Free trade, a subset of laissez-faire fundamentalism, was blindly followed to the detriment of manufacturing and other jobs. And Keynesian fiscal policies to mitigate recessions and restore rapid growth were insufficiently adopted. To the contrary, government austerity in order to reduce budget deficits was the reigning philosophy. Under Bill Clinton, devoting temporary budget surpluses, for example, to pay down federal debt was given a priority over public investment in infrastructure and education. Over this period wages by and large stagnated or fell in America, and lagged behind wages paid in other nations.

By contrast, following World War II, American workers’ wages rose in tandem with productivity growth, as unions and social protections were strong. Learning from the Great Depression, government had a role in levelling the economic playing field via a safety net and strong regulation of business as well as Keynesian stimulus. Subsidized housing, social programs such as Medicare and Medicaid, anti-poverty programs, and civil rights legislation helped to protect vulnerable groups while a middle class grew. At every income level, inflation-adjusted wages doubled during this period.59

By the 1970s, runaway inflation in combination with high unemployment (stagflation) bred skepticism of government’s part in the economy,60 and served as an impetus to move away from the established postwar norms of political economy in the United States.61 No doubt adjustments and reforms of government policies were necessary, but the pendulum swung much too far. Originating among conservative and libertarian thinkers, the aversion to “Big Government” entered the mainstream by the late 1970s.62

This anti-government attitude intensified in the 1980s with Ronald Reagan’s election.63 As we suggested, curtailing social programs, deregulating business, cutting taxes for the wealthy and corporations, “disciplining” labor, and rejecting the role of government in setting rules all gained political legitimacy. Lax enforcement of labor regulations, short-term stock price objectives for business, and wide-ranging deregulation were implemented, not just theorized about.64

There were some social policy successes, however. Along the way, as social spending was cut, new tax-credit-oriented social policies were adopted, emphasizing work incentives. The Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC) have been successfully expanded and have redistributed income to those who need it. Food stamps were made more generous, if hardly by enough. But to a large degree, anti-government attitudes persisted, even in the 1990s with the adoption of “work-first” welfare reform in 1996, the repeal of Glass-Steagall in 1999, the deregulation of financial futures in 2000, and general deficit wariness that still lingers today.65

The ideological views that emphasize free markets,66 unrestrained international competition, and the reduced role of the state are still powerful. In our view, the heart of this ideology was a conclusion that restoring growth and profitability required restraining wage growth through tight monetary and fiscal policy; tolerance of new forms of corporate behavior, such as increased industrial concentration, stock buybacks, CEO compensation based on options;67 and the decreasing unionization of industries.

The trends that characterize this shift to a low-wage society over these periods are reviewed briefly below.

Federal Industrial Policy Was Dropped from the Tool Kit

Government intervention to subsidize industries was neglected and ridiculed in this low-wage era. While every major trading partner of the United States was busy subsidizing their manufacturing sector, both Republican and Democratic regimes minimized aid to struggling U.S. industries and to new companies. And rather than focusing on the times when productive U.S. government investment saved and created American jobs, such as through the American Recovery and Reinvestment Act of 2009,68 public policy discussion fixated on the few times the government made an obvious error, such as with the Solyndra solar energy company.69 The effort, stymied by congressional dissension, should on balance have been more robust. Local organizations filled in the gap to some degree, but could not prevent the hemorrhaging of manufacturing employment.

Similarly, serious education programs to improve the skills and opportunities for high school graduates were not undertaken. In particular, apprenticeships remained unpopular in the United States compared to thriving apprenticeship programs in many of America’s competitors.

Most conspicuously, America’s inadequate spending on infrastructure investment has been a virtual scandal. Again, the source of this neglect is laissez-faire economics that emphasize government restraint over robust public investment.

Anti-trust policies, weakened under President Reagan, also continued to be neglected. As a report from the Council of Economic Advisers concluded, monopolistic power has grown rapidly in America.70 Two economists recently completed a research study to suggest low levels of capital investment were the result of monopolistic industries that didn’t require further innovation and commitment to maintain profits.71 Another study by a group of economists found that industries with high levels of concentration had a low wage share compared to revenues.72 These are but a few examples of the failures of stern laissez-faire principles over the past generation.

Deregulation of Labor Markets

The deregulation of labor markets in the United States began in earnest following the election of Ronald Reagan in 1980.73 The free-market ideology that Reagan brought into popularity demonized labor and labor organizing, blaming it for many of the problems plaguing American companies. Rather than guiding industrial investment through thoughtful policy, Reagan believed the answers lay in weakening labor’s voice, keeping wages low, and removing worker protections.

The Attack on Unions

In 1981, President Reagan’s firing of air traffic controllers during a strike and his dissolution of the Professional Air Traffic Controllers Organization (PATCO) indicated his administration’s willingness to discipline organized labor.74 It served as a signal to businesses that the administration would allow union-busting and side with management. Union density continued its precipitous decline—from 21 percent of the workforce in 1983, to 10.7 percent in 201675—and family-supporting wages eroded as worker bargaining power eroded.76 The decline in unionization contributed to an increase in income inequality.77 Similarly, the outgrowth of right-to-work legislation, which permits workers to not pay union dues even if they are represented by a union at work, has undermined wage growth and worker bargaining power in many states, making it more difficult for workers to organize.78

Meanwhile, management efforts to undermine labor organizing have continued unabated. Employers are allowed to hold closed-door meetings designed to discourage worker organization. A cottage industry of consultants and law firms exist to block union drives. Threats of relocation or dismissal are common responses to worker organizing.79 As labor law retreated in the 1980s from protecting workers’ right to organize, union-busting became commonplace, with varying degrees of intensity. Tougher regulations of these efforts are required, and workers’ right to free association and free speech should not be infringed.80

As an outgrowth of this attack on labor, the nature of work has changed, with a rapid growth in the use of contingent workers and independent contracts. Recently, there has been some policy pushback, protecting the rights of this contingent workforce. A law introduced to the California State Assembly in 2016, for example, would allow such workers to organize. Groups like the App-Based Drivers Association in Seattle, affiliated with the Teamsters, successfully pushed for the right for Uber and Lyft drivers to organize and collectively bargain in 2015.81

Meager Increases in the Minimum Wage

Over the past several decades, there has been constant congressional resistance to increases in the minimum wage. Today, the federal minimum wage remains at $7.25 an hour; adjusting for inflation, it is well below its 1968 high.82 But substantial minimum wage increases have been undertaken in recent years at a more local level, illustrated by the adoption of $15-an-hour minimums by cities such as Seattle and Washington, D.C., and the states of New York and California.83

Lack of Enforcement of Labor Standards

Resources devoted to the enforcement of basic labor standards84 did not nearly keep up with the growth of the economy.85 To make matters worse, President Trump’s budget proposal from May would cut the Department of Labor’s funding by 20 percent.86 Only the budgets of the Reagan administration saw consistently deeper cuts to the Department of Labor.87 Enforcement of the minimum wage, overtime, and health and safety standards has been undermined by this lack of resources. New beneficial overtime rules under President Obama were stayed by the courts and are being rewritten by Trump’s Department of Labor.88

This lack of enforcement has placed a heavy burden on today’s workers. Wage theft resulting from the avoidance of minimum wage and overtime rules, for example, reached enormous heights: in the ten largest states in the United States, wage theft cost 2.4 million workers $8 billion a year.89

Anti-inflationary Monetary Policy

While the Federal Reserve has a mandate of striving for full employment and stable prices, monetary policy since Paul Volcker’s era as president of the Federal Reserve Bank has been excessively concerned with high inflation and stable prices at the expense of full employment and wage growth. Spurred on by Milton Friedman’s non-accelerating inflation rate of unemployment (the natural rate of unemployment in common jargon), which dictated that unemployment rates below the “natural rate” would automatically result in accelerating inflation, Alan Greenspan and other inflation hawks made too much of a crusade of fighting inflation.90

Excessive fear of inflation led to tight policies to restrain wage growth, and the unemployment rate was kept unnecessarily high throughout much of this period. Economist John Schmitt found that the unemployment rate was above the natural rate computed by the Congressional Budget Office for more than two-thirds of the years from 1979 to 2014.91 Despite the success in reducing inflation and the volatility of GDP under Volcker, Greenspan, and Bernanke, the economy’s vitality was not restored.92 Productivity growth today is particularly low and wage improvements have only begun to occur for lower income workers recently, despite the low technical unemployment rate.93

The Rise of Short-termism and the Influence of Finance

Under the influence of speculative financial markets, corporate governance has shifted to short-term profit making, equity buyouts, and flexible production processes where labor costs are sharply reduced. Mergers and acquisitions accelerated some decades ago, and share price maximization now guides corporate behavior.94 CEOs are typically compensated by stock options that rise in value as stock prices do. These strategies often result in harsh cuts in labor costs to produce short-term profits, often involving the outsourcing of labor.95 The outsourcing of nonessential labor to contractors and the offshoring of production stimulated by financial strategies generated on Wall Street resulted in lost incomes and insecurity for millions.96

Instead of investing in employees or in productivity-enhancing capital,97 corporations also often bought up their own stocks and other instruments in financial markets to raise the earnings per share of the company. CEOs often benefited as stock prices were driven up.98

The speculative excesses that rewarded such corporate strategies and financial excesses were mostly ignored by federal regulators. The boom in subprime mortgages was the most extreme example, and the financial crisis of 2008 followed. Wages fell sharply in the Great Recession of 2009 and have been slow to rise since.

Tax Cuts and Inequality

Over the forty-year period we are addressing, progressive income taxes were cut sharply, but did not deliver what was promised. Under Ronald Reagan, the top income tax rate was cut from 70 percent to 28 percent, and only increased to 31 percent at the end of the George H. W. Bush administration. During this period of low taxation, the well-off benefited far more than the poor, and outside the dot-com boom, little happened to spur the economic growth that was promised.99

In free market ideology, such tax cuts are expected to induce economic growth, and if labor markets are functioning as theorized, wages will go up. Tax cuts are said to increase incentives to work and invest. If taxes are very high, the theory goes, such a growth scenario is plausible for a short period of time.

But the more cogent view of the benefits of tax cuts is that they increase aggregate demand, and therefore economic growth and wages in the Keynesian sense. This again is possible when resources are not fully utilized in the economy. The tax cuts generally harmed workers over this period, however, even as some middle income tax rates were cut. In the Reagan era, economic stimulus was generated by the sharp cuts in interest rates under Paul Volcker. Lower tax rates under Reagan led to unmanageable budget deficits, contrary to what was promised by supply-side advocates. Reagan soon raised these rates, but more so on the middle class than on the rich. It was under Reagan that income inequality began to rise rapidly and the rate of productivity growth slowed, partly for lack of strong investment.

George H. W. Bush’s income tax cut led to the slowest job growth in any economic recovery in the post–World War II era. Additionally, businesses enjoyed large tax loopholes, which reduced the share of income tax paid by business, from 3 percent of GDP to just 1 percent of GDP.

Reduced federal tax revenues led to an era of austerity, with political pressure to reduce the deficit by cutting social and anti-poverty programs. The reduced revenues also made serious public investment in infrastructure politically difficult to achieve, a development with serious implications for wages nationwide.

The economists Emmanuel Saez and Peter Diamond also argue that lower taxes on high income individuals encouraged speculation and what is known as rent-seeking: investments with little value except to improve the fortunes of the well-off.100 Private equity, leveraged buyouts, stock buybacks—these in excess were arguably a function of low taxes rates at the top. All put downward pressure on wages rates.

Excessive Faith in Free Trade

International trade agreements, partly influenced by the shift in economic ideology, contributed to low wages as well by putting American workers increasingly in direct competition with low-wage countries. In the construction of these trade agreements, concern about protecting intellectual property and copyrights trumped protection of the well-being of American workers and workers in the Global South.101 While trade has value in stimulating growth, little to no effort was made in these agreements to open up markets for exports of American manufacturing goods or to protect strategic industries in the United States. And while this trade regime delivered some advantages to U.S. workers, such as lower consumer prices, job losses in manufacturing within America’s Heartland devastated local communities102 dependent on these industries.103

The Resistance to Fiscal Policy

All the while, a near obsession with managing the federal deficit, as well as the ideological turn against government social policies alluded to above, contributed to a failure to improve the social safety net beyond tax-credit-oriented policies. It also restrained the use of Keynesian fiscal policies to minimize recessions and stimulate rapid growth and more employment. Less public spending on education, early childhood care, green investment, and transportation infrastructure in general was the result. New social policies to subsidize wages or create universal minimum incomes were rarely discussed.

Austerity and fiscal belt-tightening have limited the government workforce in particular, with state and local budget cuts soon after the Great Recession resulting in government jobs in the United States dipping below their 2006 levels. Between October 2010—after the temporary employment boost from the decennial Census survey—and January 2014, around 492,000 government jobs were lost.104 Spending cuts to schools, first responders, day care, and other public sector fields also undermine a major source of good jobs, particularly for communities of color.105 While trade policy hollowed out middle-class manufacturing jobs in the Heartland, cuts to the public sector have hollowed out middle-class jobs at town halls, fire stations, and public schools around the nation.106 The pullback in President Obama’s stimulus plan attributed to the sequester made the recovery less robust, and suppressed wages.107

High-Wage America: The Alternative to a Low Wage Economic Policy Regime

If America has chosen this current low-wage course (and it is not an economic destiny), the direction can be changed—but only through different policy choices. And as with any new bold agenda, implementing policies to build a road to a high-wage America will require the nation to answer tough political questions.

The High-Wage America project proposes an agenda that is three pronged: (1) a full commitment to public investment and industrial policy, (2) more aggressive and practical education and training programs, (3) and raised labor standards and social supports that have been purposefully neglected in recent decades.

These three components of a high-wage society complement one another. Public investment in burgeoning fields such as smart manufacturing and alternative energy, as well as major infrastructure investment, can provide the impetus for output and productivity growth, spurring high-wage employment.108 Meanwhile, training can “upskill” people into the new jobs created by such investment, equalizing opportunity and reducing inequality as well as creating more human capital to enable more bold investment. Finally, job supports and policies, including adequate minimum wages, set a floor for living standards, encouraging high-wage and high-benefit employment, and enable workers to bargain for their compensation on a more level playing field. The high-wage agenda requires new approaches to directly confront underemployment and unemployment that may include government acting as an employer of last resort109 and support for labor organizing, which is now actively thwarted.

As the last election demonstrated, anxiety about the decline of high wage America has been acute in the Industrial Heartland. Manufacturing stands out as a sector that provides high-paying jobs to Americans at varying levels of education (including for African-American, Hispanic, and Asian-American workers), and contributes to higher levels of productivity through research and development.110 Manufacturing has always depended on government support, as it does everywhere in the rich world, and the fate of a manufacturing recovery that has brought back 1 million jobs since the depth of the recession will hinge on effectiveness of public policies.111 Investments in infrastructure112 and the conversion of the economy from fossil fuels to renewable energy have a similar effect;113 as do targeted investments in rural communities struggling to grow.114

Regarding our commitment to higher skills and education, our particular concern is the nation’s woeful approach to training workers who don’t go on to a four-year college degree, for whom both private and public investment have waned, even as employer complaints about shortages of skilled workers have grown.115 Policy imperatives include continued momentum to rebuild the nation’s apprenticeship system that still only reaches less than half a million workers, and translating promising high school career academies into respected vocational and career education system that, among other things, creates inclusive access to well-paid skilled blue collar jobs.116 And, America will never return to a high-wage economy unless it rectifies the unequal and often deliberately overlooked access to a sound, basic K–12 education. This requires solving the shortage of high-quality preschools,117 chronic insufficient funding, and racially segregated schools.118

While public investment and innovation in combination with robust education and training policies can create jobs with skill sets that are in demand, an economy with adequate government interventions will not guarantee a high-wage economy. The nation’s floor of labor standards needs to be modernized, starting with a higher minimum wage, new protections for workers subject to increasingly erratic schedules,119 and policies that close loopholes that exclude gig economy workers from critical protections. A prime target is government subsidies of low-quality jobs in vast, publicly supported caregiving industries such as health care, child care, and social services.120 But a return to high-wage jobs requires more than a floor—it necessitates restoring the ability of workers to collectively agitate and bargain for better-than-average wages. Getting there will require new state and local policies to support strengthened worker voice, and a reimagined twenty-first-century Labor Bill of Rights.121 More thought needs to be put into ways government can provide good-paying jobs as an employer of last resort, or directly making up for the lack of high wages through a strengthened earned income tax credit or a universal basic income.122

While the areas of emphasis are clear, getting the policies right is not easy. The needed policy direction is politically ambitious, and may require more taxes to fund them. Some progress had been made under President Obama, but the shift in political power in Washington may reverse and certainly won’t fortify the policy direction needed. Underlying all will be a call for aggressive fiscal and monetary policies, in contrast to what has been practiced in recent decades. Further research, especially evaluation of state and local practices (and international examples) that can be scaled nationally, is required.

The Benefits of a Return to High Wages

We realize we present a bold and ambitious agenda. But if Americans want and expect a return to a secure and equal society that ensures dignity for its workers, we believe it will require robust new government directives and policies.123 The low-wage consequences of policy choices made in the United States in the past three decades are not acceptable economically, socially, or politically.

Without fundamental changes, secular stagnation may remain the nation’s fate, meaning workers will face ongoing inadequate wage growth, and the reduction of poverty—essentially the highest in the rich world—will not make headway.124

Our ultimate task is to build a broad-based coalition of organizations and stakeholders dedicated in practical ways to building a high-wage America agenda on a state, regional, and federal level. The Bernard L. Schwartz Rediscovering Government Initiative is building this agenda now and into the future.

Notes

- Verdoorn’s Law, developed by the Dutch economist Petrus Johannes Verdoorn, states that long run productivity grows proportionally to the square root of output. Current output is estimated to be around 15 percent below the pre-recession trend, contributing to unusually slow productivity growth and business investment years after the recession. See J. W. Mason, “What Recovery: The Case for Continued Expansionary Policy at the Fed,” Roosevelt Institute, July 25, 2017, http://rooseveltinstitute.org/wp-content/uploads/2017/07/Monetary-Policy-Report-070617-2.pdf.

- “Life Satisfaction,” Pew Research Center, http://www.pewresearch.org/topics/life-satisfaction/.

- Ibid.

- The Golden Age of Capitalism: Reinterpreting the Postwar Experience, ed. Stephen A. Marglin and Juliet Schor (New York: Oxford University Press, 1992).

- Elise Gould, “Wages Have Fallen for Most Americans in 2014,” Economic Policy Institute, August 27, 2014, http://www.epi.org/blog/wages-fallen-americans-2014/.

- Jeff Madrick, “The Deliberate Low-Wage, High-Insecurity Economic Model,” Work and Occupations 39, no. 4 (2012): 321–30.

- Michelle Long, Matthew Rae, Gary Claxton and Anthony Damico, “Trends in Employer-sponsored Insurance Offer and Coverage Rates, 1999–2014, Kaiser Family Foundation, March 21, 2016, http://www.kff.org/private-insurance/issue-brief/trends-in-employer-sponsored-insurance-offer-and-coverage-rates-1999-2014/.

- Elise Gould, “A Decade of Decline in Employer-sponsored Health Insurance Coverage,” Economic Policy Institute, February 23, 2012, http://www.epi.org/publication/bp337-employer-sponsored-health-insurance/.

- Employee Benefits Security Administration, “Private Pension Plan Bulletin Historical Tables and Graphs 1975-2014,” September 2016, https://www.dol.gov/sites/default/files/ebsa/researchers/statistics/retirement-bulletins/private-pension-plan-bulletin-historical-tables-and-graphs.pdf.

- Sarah Flood, Miriam King, Steven Ruggles, and J. Robert Warren. Integrated Public Use Microdata Series, Current Population Survey: Version 4.0 [dataset] (Minneapolis: University of Minnesota, 2015), http://doi.org/10.18128/D030.V4.0.

- Barry Ritholtz, “The Middle-Class Squeeze Isn’t Made Up,” Bloomberg View, February 15, 2017, https://www.bloomberg.com/view/articles/2017-02-15/the-middle-class-squeeze-isn-t-made-up.

- Elise Gould, Tanyell Cooke, and Will Kimball, “What Families Need to Get By,” Economic Policy Institute, August 26, 2015, http://www.epi.org/publication/what-families-need-to-get-by-epis-2015-family-budget-calculator/.

- Bernadette D. Proctor, Jessica L. Semega, Melissa A. Kollar, “Income and Poverty in the United States: 2015,” United States Census Bureau, September 13, 2016, https://www.census.gov/library/publications/2016/demo/p60-256.html.

- U.S. Department of Agriculture, Economic Research Service, https://www.ers.usda.gov/webdocs/charts/82673/share%20of%20households%20with%20earnings%20welfare%20benefits-01.png?v=42808.

- David Cooper, “Balancing Paychecks and Public Assistance: How Higher Wages Would Strengthen What Government Can Do,” Economic Policy Institute, February 3, 2016, http://www.epi.org/publication/wages-and-transfers/#_note1.

- Angel Ross, “An Overview of America’s Poor,” National Equity Atlas, July 7, 2016, http://nationalequityatlas.org/data-in-action/overview-america-working-poor.

- Michael McCormack, “CFPB Rule Could Protect Low-Income Households From Short-Term Predatory Lending,” The Century Foundation, October 6, 2016, https://tcf.org/content/commentary/cfpb-rule-protect-low-income-households-predatory-short-term-lending/.

- Working class is defined as those households who earn $66,000 (in 2013 dollars), work for someone else, do not earn interest from dividends (not including pensions and stocks for retirement funds), do not have a broker to handle stock investments, and earn less than $500 in stock income in the survey year.

- Michael J. McCormack, “Financial Markets and the American Working Class: An Empirical Investigation of Financial Stress,” Master’s Thesis, University of Massachusetts Boston, 2016.

- David Leonhardt, “Our Broken Economy, in One Simple Chart,” New York Times, August 7, 2017, https://www.nytimes.com/interactive/2017/08/07/opinion/leonhardt-income-inequality.html?smid=tw-share.

- Bernadette D. Proctor, Jessica L. Semega, and Melissa A. Kollar, “Income, Poverty in the United States: 2015,” United States Census Bureau, https://www.census.gov/content/dam/Census/library/publications/2016/demo/p60-256.pdf.

- Elise Gould and Jessica Schneider, “By the Numbers: Income and Poverty, 2015,” Economic Policy Institute, September 13, 2016, http://www.epi.org/blog/by-the-numbers-income-and-poverty-2015/.

- Jeff Madrick, “The Austerity Myth,” Harper’s Magazine, October 2012, https://harpers.org/archive/2012/10/the-anti-economist/.

- The Economics Daily, “Median weekly earnings by educational attainment in 2014,” Bureau of Labor Statistics, January 23, 2015, https://www.bls.gov/opub/ted/2015/median-weekly-earnings-by-education-gender-race-and-ethnicity-in-2014.htm.

- Rob Valletta, “Higher Education, Wages, and Polarization,” Federal Reserve Bank of San Francisco, January 12, 2015, http://www.frbsf.org/economic-research/publications/economic-letter/2015/january/wages-education-college-labor-earnings-income/.

- Paul F. Campos, “White Economic Privilege Is Alive and Well,” New York Times, July 30, 2017, https://www.nytimes.com/2017/07/29/opinion/sunday/black-income-white-privilege.html.

- Anne Case and Angus Deaton, “Mortality and Morbidity in the 21st Century,” Brookings Institution, May 1, 2017, https://www.brookings.edu/wp-content/uploads/2017/03/casedeaton_sp17_finaldraft.pdf.

- Ibid.

- Campos, “White Economic Privilege Is Alive and Well.”

- Pew Research Center, “Demographic Trends and Economic Well-Being,” June 27, 2016, http://www.pewsocialtrends.org/2016/06/27/1-demographic-trends-and-economic-well-being/.

- Ibid.

- Kilolo Kijakazi, Rachel Marie Brooks Atkins, Mark Paul, Anne Price, Darrick Hamilton, and William A. Darity Jr., “The Color of Wealth in the Nation’s Capital,” A Joint Publication of the Urban Institute, Duke University, The New School, and the Insight Center for Community Economic Development, November 2016, http://www.urban.org/research/publication/color-wealth-nations-capital/view/full_report.

- Ira Katzelnelson, “Making Affirmative Action White Again,” New York Times, August 12, 2017, https://www.nytimes.com/2017/08/12/opinion/sunday/making-affirmative-action-white-again.html?emc=eta1&_r=0.

- William Darity, “Stratification economics: the role of intergroup inequality,” Journal of Economics and Finance 29, no. 2 (2005): 144–53.

- “Measuring the Wage Gap,” National Women’s Law Center, 2016, https://nwlc.org/issue/measuring-the-wage-gap/.

- Jasmine Tucker and Caitlin Lowell, “National Snapshot: Poverty among Women and Families, 2015,” National Women’s Law Center, 2015, https://nwlc.org/resources/national-snapshot-poverty-among-women-families-2015/.

- Nancy Folbre and Julie Nelson, “For Love or Money—or Both?” Journal of Economic Perspectives 14, no. 4 (Fall 2000): 123–40, https://www.aeaweb.org/articles?id=10.1257/jep.14.4.123.

- Randy Albelda, Robert Drago, and Steven Shulman, Unlevel Playing Fields: Understanding Wage Inequality and Discrimination, Economic Affairs Bureau, 4th ed. (Boston, Mass.: Dollars and Sense, 2013).

- Randy Albelda, “Time Binds: U.S. Antipoverty Policies, Poverty and Single Mother’s Well-being,” Feminist Economics 17, no. 4 (October 2011).

- Hilary Land, “The Family Wage,” Feminist Review 6 (1980): 55–77.

- Randy Albelda and Michael Carr, “Double-Trouble: U.S. Low-Wage and Low-Income Workers, 1979–2011,” Feminist Economics 20, no. 2 (2014).

- Randy Albelda, “Gender Impacts of the ‘Great Recession’ in the United States,” in Women and Austerity: The Economic Crisis and the Future of Gender Equality (New York: Routledge, 2014).

- Make It Work Campaign, http://www.makeitworkcampaign.org/about/.

- “The Labour Share in G20 Economies,” International Labor Organization and Organisation for Economic Cooperation and Development, February 2015, https://www.oecd.org/g20/topics/employment-and-social-policy/The-Labour-Share-in-G20-Economies.pdf.

- Josh Bivens and Lawrence Mishel, “Understanding the Historic Divergence between Productivity and a Typical Worker’s Pay,” Economic Policy Institute, http://www.epi.org/publication/understanding-the-historic-divergence-between-productivity-and-a-typical-workers-pay-why-it-matters-and-why-its-real/.

- “The Productivity-Pay Gap,” Economic Policy Institute, August 2016, http://www.epi.org/productivity-pay-gap/.

- John Schmitt, “The Minimum Wage Is Too Damn Low,” Center for Economic and Policy Research, 2013, http://cepr.net/documents/publications/min-wage1-2012-03.pdf.

- Jan De Loecker and Jan Eeckhout, “The Rise of Market Power and the Macreconomic Implications,” Working Paper, August 4, 2017, http://www.janeeckhout.com/wp-content/uploads/RMP.pdf.

- Alan B. Krueger, “Measuring labor’s share,” American Economic Review 89, no. 2 (1999): 45–51.

- Petra Dünhapt, “Determinants of Labour’s Income Share in the Era of Financialisation,” Cambridge Journal of Economics 41, no. 1 (January 2017): 283–306.

- Arjun Jayadev, “Capital Account Openness and the Labour Share of Income,” Cambridge Journal of Economics 31, no. 3 (May 2007): 423–43.

- James Heintz, “Unpacking the U.S. Labor Share,” Political Economy Research Institute, March 2013, https://www.peri.umass.edu/media/k2/attachments/6.2Heintz.pdf.

- “Average Wages,” OECD, https://data.oecd.org/earnwage/average-wages.htm – indicator-chart.

- “The statistical concept of labour cost comprises remuneration for work performed, payments in respect of time paid for but not worked, bonuses and gratuities, the cost of food, drink and other payments in kind, cost of workers’ housing borne by employers, employers’ social security expenditures, cost to the employer for vocational training, welfare services and miscellaneous items, such as transport of workers, work clothes and recruitment, together with taxes regarded as labour cost.” “Earnings and Labour Cost: Description,” International Labour Organization, 2017, http://www.ilo.org/ilostat-files/Documents/description_EAR_EN.pdf.

- Neil Irwin, “How Underpaid German Workers Helped Cause Europe’s Debt Crisis,” New York Times, https://www.nytimes.com/2014/04/23/upshot/how-underpaid-german-workers-helped-cause-europes-debt-crisis.html?_r=0.

- Claire Jones, “German Wage Growth Low as Workers Look Beyond Pay Packets,” Financial Times, June 11, 2017, https://www.ft.com/content/a34ebea0-4b66-11e7-a3f4-c742b9791d43?mhq5j=e1.

- Niklas Engbom, Enrica Detragiache, and Faezeh Raei, “The German Labor Market Reforms and Post-Unemployment Earnings, International Monetary Fund, July 2015, https://www.imf.org/external/pubs/ft/wp/2015/wp15162.pdf.

- Josh Bivens and Lawrence Mishel, “Understanding the Historic Divergence between Productivity and a Typical Worker’s Pay,” Economic Policy Institute, September 2, 2015, http://www.epi.org/publication/understanding-the-historic-divergence-between-productivity-and-a-typical-workers-pay-why-it-matters-and-why-its-real/.

- Jeff Madrick, Age of Greed (New York: Alfred A. Knopf, 2011).

- Alejandro Reuss, “That ’70s Crisis,” Dollars and Sense, November/December 2009, http://www.dollarsandsense.org/archives/2009/1109reuss.html.

- Samuel Bowles, David Gordon, and Thomas Weisskopf, Beyond the Wasteland: A Democratic Alternative to Economic Decline (New York: Anchor Books, 1983).

- Michael Lind, “How Reaganism actually started with Carter,” Salon, February 8, 2011, http://www.salon.com/2011/02/08/lind_reaganism_carter/.

- Jeff Madrick, “Donald Trump, Don’t Use Reaganomics as Your Model,” The Century Foundation, December 13, 2016, https://tcf.org/content/commentary/donald-trump-dont-use-reaganomics-model/.

- Jacob S. Hacker The Great Risk Shift: The New Economic Insecurity and the Decline of the American Dream (New York: Oxford University Press, 2006).

- Matthew Sherman, “A Short History of Financial Deregulation in the United States,” Center for Economic and Policy Research, July 2009, http://cepr.net/documents/publications/dereg-timeline-2009-07.pdf.

- Arthur MacEwan and John A. Miller, Economic Collapse, Economic Change: Getting to the Roots of the Crisis (Armonk, N.Y.: ME Sharpe, 2011).

- Jonathan D. Ostry, Prakash Loungani, and David Furceri, “Neoliberalism: Oversold?” Finance and Development, June 2016, http://www.imf.org/external/pubs/ft/fandd/2016/06/ostry.htm.

- Daniel J. Wilson, “Fiscal Spending Jobs Multipliers: Evidence from the 2009 American Recovery and Reinvestment Act,” American Economic Journal: Economic Policy 4, no. 3(2012): 251–82, https://www.aeaweb.org/articles?id=10.1257/pol.4.3.251.

- Jeff Brady, “After Solyndra Loss, U.S. Energy Loan Program Turning a Profit,” National Public Radio, November, 13 2014, http://www.npr.org/2014/11/13/363572151/after-solyndra-loss-u-s-energy-loan-program-turning-a-profit.

- Council of Economic Advisers, “Benefits of Competition and Indicators of Market Power,” Council of Economic Advisers Issue Brief, May 2016, https://obamawhitehouse.archives.gov/sites/default/files/page/files/20160502_competition_issue_brief_updated_cea.pdf.

- Germán Gutiérrez, Thomas Philippon, “Investment-Less Growth: An Empirical Investigation,” National Bureau of Economic Research, Working Paper 22897, December 2016, http://www.nber.org/papers/w22897.

- David Autor, David Dorn, Lawrence F. Katz, Christina Patterson, John Van Reenen, “Concentrating on the Fall of the Labor Share,” National Bureau of Economic Research, Working Paper 23108, January 2017, www.nber.org/papers/w23108.

- David Harvey, A Brief History of Neoliberalism (New York: Oxford University Press, 2007).

- Steven Greenhouse, The Big Squeeze: Tough Times for the American Worker (New York: Anchor Books, 2009).

- Bureau of Labor Statistics, “Union Membership News Release,” January 26, 2017, https://www.bls.gov/news.release/union2.htm.

- Jake Rosenfeld, Patrick Denice and Jennifer Laird, “Union Decline Lowers Wages of Nonunion Workers,” Economic Policy Institute, August 30, 2016, http://www.epi.org/publication/union-decline-lowers-wages-of-nonunion-workers-the-overlooked-reason-why-wages-are-stuck-and-inequality-is-growing/.

- Colin Gordon, “Union Density and Income Inequality in Two Charts,” Economic Policy Institute, June 5, 2012, http://www.epi.org/blog/union-decline-rising-inequality-charts/.

- Elise Gould and Will Kimball, “’Right-to-Work’ States Still Have Lower Wages,” Economic Policy Institute, http://www.epi.org/publication/right-to-work-states-have-lower-wages/.

- Kate Bronfenbrenner, “The Effects of Plant Closing or Threat of Plant Closing on the Right of Workers to Organize,” Cornell University ILR School, September 30, 1996, http://digitalcommons.ilr.cornell.edu/cgi/viewcontent.cgi?article=1000&context=intl.

- Shaun Richman, “Labor’s Bill of Rights,” The Century Foundation, July 18, 2017, https://tcf.org/content/report/labors-bill-rights/.

- Shayna Strom and Mark Schmitt, “Protecting Workers in a Patchwork Economy,” The Century Foundation, April 7, 2016, https://tcf.org/content/report/protecting-workers-patchwork-economy/.

- Drew DeSilver, “5 Facts about the Minimum Wage,” Pew Research Center’s’ Fact Tank, January 4, 2017, http://www.pewresearch.org/fact-tank/2017/01/04/5-facts-about-the-minimum-wage/.

- “Minimum Wage Tracker,” Economic Policy Institute, July 10, 2017, http://www.epi.org/minimum-wage-tracker/#/min_wage/Washington D.C.

- Chris Opfer and Benn Penn, “Wage and Hour Division Cuts Raise Enforcement Concerns,” Bloomberg BNA, November 2, 2015, https://www.bna.com/wage-hour-division-n57982063011/.

- Steven Greenhouse, “Labor Agency Is Failing Workers, Report Says,” New York Times, March 24, 2009, http://www.nytimes.com/2009/03/25/washington/25wage.html.

- Ian Kullgren, “Everything You Need to Know about Trump’s Budget,” Politico, May 24, 2017, http://www.politico.com/tipsheets/morning-shift/2017/05/24/everything-you-need-to-know-about-trumps-budget-220486.

- Table 5.4—Discretionary Budget Authority by Agency: 1976–2022, Office of Management and Budget Historical Tables, https://www.whitehouse.gov/omb/budget/Historicals.

- “Just Pay: Improving Wage and Hour Enforcement in the United States Department of Labor,” National Employment Law Project, 2010; Yuki Noguchi, “Labor Department Starts to Rollback Obama Overtime Rule,” National Public Radio, July 26, 2017, http://www.npr.org/2017/07/26/539438892/labor-department-starts-to-roll-back-obama-overtime-rule.

- David Cooper and Teresa Kroeger, “Employers Steal Billions form Workers’ Paychecks Each Year,” Economic Policy Institute, May 10, 2017, http://www.epi.org/publication/employers-steal-billions-from-workers-paychecks-each-year-survey-data-show-millions-of-workers-are-paid-less-than-the-minimum-wage-at-significant-cost-to-taxpayers-and-state-economies/.

- Ibid.

- John Schmitt, “Failing on Two Fronts: The U.S. Labor Market since 2000,” Center for Economic and Policy Research (CEPR), February 2015, http://cepr.net/publications/reports/failing-on-two-fronts.

- “Atypical restraint on compensation increases has been evident for a few years now, and appears to be mainly the consequence of greater worker insecurity.” The Federal Reserve Board, “Testimony of Chairman Alan Greenspan,” The Federal Reserve’s semiannual monetary policy report, February 26, 1997, https://www.federalreserve.gov/boarddocs/hh/1997/february/testimony.htm.

- Conrad De Aenlle, “The Market is Watching the Fed,” New York Times, July 16, 2017; J. W. Mason, “The Fed Does Not Work for You,” Jacobin, January 6, 2016, https://www.jacobinmag.com/2016/01/federal-reserve-interest-rate-increase-janet-yellen-inflation-unemployment/.

- Madrick, “The Deliberate Low-Wage, High-Insecurity Economic Model.”

- Ibid.

- “Overcoming Short-termism: A Call for a More Responsible Approach to Investment and Business Management,” The Aspen Institute, September 2009, https://assets.aspeninstitute.org/content/uploads/files/content/docs/pubs/overcome_short_state0909_0.pdf.

- William Lazonick et al., “U.S. Pharma’s Financialized Business Model,” Institute for New Economic Thinking, July 2017, https://www.ineteconomics.org/research/research-papers/us-pharmas-financialized-business-model.

- William Lazonick, “Profiting without Prosperity,” Harvard Business Review, September 2014, https://hbr.org/2014/09/profits-without-prosperity.

- Jeff Madrick, “Reagonomics Redux, But Worse,” Washington Spectator, June 5, 2017, https://washingtonspectator.org/reaganomics-redux-worse-madrick/.

- Peter Diamond and Emmanuel Saez, “The Case for a Progressive Tax: From Basic Research to Policy Recommendations,” Journal of Economic Perspectives, Fall 2011, https://www.aeaweb.org/articles?id=10.1257/jep.25.4.165.

- Dean Baker, Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer (Washington, D.C.: Center for Economic and Policy Research, 2016).

- NPR Morning Edition, “The Forces Driving Middle-Aged White People’s Deaths of Despair,” March 23, 2017, http://www.npr.org/sections/health-shots/2017/03/23/521083335/the-forces-driving-middle-aged-white-peoples-deaths-of-despair.

- Will Kimball and Robert Scott, “China Trade, Outsourcing and Jobs,” Economic Policy Institute, December 2014, http://www.epi.org/publication/china-trade-outsourcing-and-jobs/.

- St. Louis FRED Data, “All Employees: Government,” https://fred.stlouisfed.org/graph/?g=exvt.

- Andrew Stettner and Michael McCormack, “Is the President Trumping the Recovery by Freezing Government Jobs?” The Century Foundation, February 3, 2017, https://tcf.org/content/commentary/president-trumping-recovery-freezing-government-jobs/.

- Adam Looney et al., “A Record Decline in Government Jobs: Implications for the Economy and America’s Workforce,” Brookings Institution, August 3, 2012, https://www.brookings.edu/blog/jobs/2012/08/03/a-record-decline-in-government-jobs-implications-for-the-economy-and-americas-workforce/.

- Robert Pollin, “Austerity Economics and the Struggle for the Soul of US Capitalism,” Social Research 80, no. 3 (2013): 749–80.

- Annabelle Mourougane, Jarmila Botev, Jean-Marc Fournier, Nigel Pain and Elena Rusticelli, “Can an Increase in Public Investment Sustainably Lift Economic Growth?,” Organization of Economic Cooperation and Development, November 24, 2016, https://www.oecd.org/eco/Can-an-increase-in-public-investment-sustainably-lift-economic-growth.pdf.

- Mark Paul, William Darity Jr and Darrick Hamilton, “Why We Need a Federal Jobs Guarantee,” Jacobin, February 4, 2017, https://www.jacobinmag.com/2017/02/federal-job-guarantee-universal-basic-income-investment-jobs-unemployment/.

- Andrew Stettner, Joel Yudken, and Michael McCormack, “Why Manufacturing Jobs are Worth Saving,” The Century Foundation, June 13, 2017, https://tcf.org/content/report/manufacturing-jobs-worth-saving/.

- See Louis Uchitelle, Making It: Why Manufacturing Still Matters (New York: New Press, 2017).

- Josh Bivens, “The Short— and Long-Term Impact of Infrastructure Spending on Employment and Economic Activity in the U.S., Economic Policy Institute, July 1, 2014, http://www.epi.org/publication/impact-of-infrastructure-investments/.

- Wei, Max, Shana Patadia, and Daniel M. Kammen, “Putting renewables and energy efficiency to work: How many jobs can the clean energy industry generate in the US?” Energy Policy 38, no. 2 (2010): 919–31.

- “USDA Rural Development 2016 Progress Report,” United States Department of Agriculture, https://www.rd.usda.gov/files/USDARDProgressReport2016.pdf.

- Binyamin Appelbaum, “Lack of Workers, Not Work, Weighs on Nation’s Economy,” New York Times, May 17, 2017, https://www.nytimes.com/2017/05/21/us/politics/utah-economy-jobs.html?mcubz=0.

- Sarah Ayres Steinberg and Ethan Gurwitz, “The Underuse of Apprenticeships in America,” Center for American Progress, July 22, 2014, https://www.americanprogress.org/issues/economy/news/2014/07/22/93932/the-underuse-of-apprenticeships-in-america/.

- Halley Potter, “The Benefits of Universal Access in Pre-K and ‘3-K for All,’” The Century Foundation, April 28, 2017, https://tcf.org/content/commentary/benefits-universal-access-pre-k-3-k/.

- “The Benefits of Socioeconomically and Racially Integrated Schools,” The Century Foundation, February 10, 2016, https://tcf.org/content/facts/the-benefits-of-socioeconomically-and-racially-integrated-schools-and-classrooms/.

- Josh Eidelson, “Labor Activists Applaud First ‘Fair Scheduling’ Law,” Bloomberg Politics, August 9, 2017, https://www.bloomberg.com/news/articles/2017-08-09/labor-activists-applaud-first-statewide-fair-scheduling-law.

- Julie Kashen, Halley Potter and Andrew Stettner, “Quality Jobs, Quality Care: The Case for a Well-Paid, Diverse Early Education Workforce,” The Century Foundation, June 13, 2016, https://tcf.org/content/report/quality-jobs-quality-child-care/.

- Richman, “Labor’s Bill of Rights.”

- Brad Voracek, “The Basic Income and Jobs Guarantee are Complementary, Not Opposing Policies,” The Minskys, December 7, 2016, http://theminskys.org/basic-income-and-job-guarantees-are-complementary-policies/.

- Jeff Madrick, “The People Have Spoken: They Want More Government,” The Nation, April 26, 2017, https://www.thenation.com/article/the-people-have-spoken-they-want-more-government/.

- Timothy Smeeding, “Public Policy and Economic Inequality: The United States in Comparative Perspective,” Luxembourg Income Study Working Paper Series, February 2004, https://www.econstor.eu/bitstream/10419/95397/1/472624288.pdf; Stanford Center on Poverty and Inequality, “State of the Union: Poverty and Inequality Report,” Pathways, 2016, http://inequality.stanford.edu/sites/default/files/Pathways-SOTU-2016.pdf.