Residential segregation between black and white Americans remains both strikingly high and deeply troubling. Black–white residential segregation is a major source of unequal opportunity for African Americans: among other things, it perpetuates an enormous wealth gap and excludes black students from many high-performing schools. While some see residential segregation as “natural”—an outgrowth of the belief that birds of a feather flock together—black–white segregation in America is mostly a result of deliberate public policies that were designed to subjugate black people and promote white supremacy.

Because the federal, state, and local policy arenas were the laboratory for engineering black–white residential segregation, that is where people must work to help undo it. In order for these heinous differences to be reversed, people in government at all levels have to be proactive in eliminating policy that supports segregation and in creating anti-segregation policies.

It is time for bold action. The first part of this report outlines why all Americans should care about black–white residential segregation: the perpetuation of an opportunity gap between blacks and whites. The second part delineates the ways in which black–white segregation is rooted primarily in deliberate government policies enacted over generations. And the last part of the report sketches a four-prong strategy for undoing this horrible creation.

First, policymakers should address the legacy of generations of racial discrimination in housing by implementing the “Affirmatively Furthering Fair Housing” provision of the Fair Housing Act and providing new mortgage assistance to buy homes in formerly “redlined” areas. Second, government should seek to reduce contemporary residential racial discrimination by increasing resources allocated to fair housing testers and reestablishing the federal interagency task force to combat lending discrimination. Third, officials should counter contemporary residential economic discrimination that disproportionately hurts African Americans by curbing exclusionary zoning, funding “disparate impact” litigation, adopting “inclusionary zoning” policies, banning source of income discrimination, and beefing up housing mobility programs. Fourth, policy officials should respond to the re-segregating effects of displacement that can come with gentrification by revising tax abatement policies that promote gentrification, implementing longtime owner occupancy programs, and investing in people, not powerbrokers.

How Black–White Segregation Perpetuates an Opportunity Gap

Residential segregation between black and white Americans remains very high more than fifty years after passage of the 1968 Fair Housing Act. An analysis of U.S. Census Data from 2013–17 found that the “dissimilarity index” between blacks and non-Hispanic whites for metropolitan areas was 0.526 for the median area—meaning that 52.6 percent of African Americans or whites would have to move for the area to be fully integrated. (A dissimilarity index of 0 represents complete integration between two groups, while 100 represents absolute apartheid.) The index for black–white segregation was higher than it was for segregation between non-Hispanic whites and Asians (0.467), and segregation between non-Hispanic whites and Hispanics (0.407).1 And while the nation is also seeing increasing residential segregation by income, racial segregation today remains starker and more pervasive than economic segregation.2 Analyzing data over time, Paul Jargowsky of Rutgers University writes of African Americans: “Few groups in American history have ever experienced such high levels of segregation, let alone sustained them over decades.”3

Residential segregation matters immensely, because where people live affects so much of their lives, such as their access to transportation, education, employment opportunities, and good health care. In the case of black–white segregation in particular, the separateness of African-American families and white families has contributed significantly to two entrenched inequalities that are especially glaring: the enormous wealth gap between these races, and their grossly unequal access to strong public educational opportunities.

It is well established that historical and contemporary racial discrimination has given rise to a substantial income gap between black and white Americans. African Americans make, on average, about 60 percent of what whites make.4 But housing segregation helps explain the ways in which African-American families are further disadvantaged compared to white families who have the same income and education levels. Typically, higher levels of education and income translate into higher levels of wealth and less exposure to concentrated poverty. In the case of African Americans, however, residential segregation by race imposes a penalty that interrupts these positive patterns. Stunningly, African-American households headed by an individual with a bachelor’s degree have just two-thirds of the wealth, on average, of white households headed by an individual who lacks a high school degree.5 Equally astonishingly, middle-class blacks live in neighborhoods with higher poverty rates than low-income whites.6 As the following sections will show, these negative outcomes are largely a result of residential segregation; furthermore, when black–white segregation is reduced, outcomes for black families are shown to improve.

How Residential Segregation Affects Wealth Accumulation

Racial residential segregation inhibits home value appreciation in predominantly African-American neighborhoods. Research finds that some white families remain distressingly resistant to buying homes in predominantly African-American neighborhoods; for example, even when all other characteristics of homes and neighborhoods are identical, white respondents view predominantly black neighborhoods as less safe and less desirable than predominantly white neighborhoods.7 Fewer potential buyers—particularly among the whiter and thus usually wealthier segment of the market—means significantly lower rates of home appreciation.

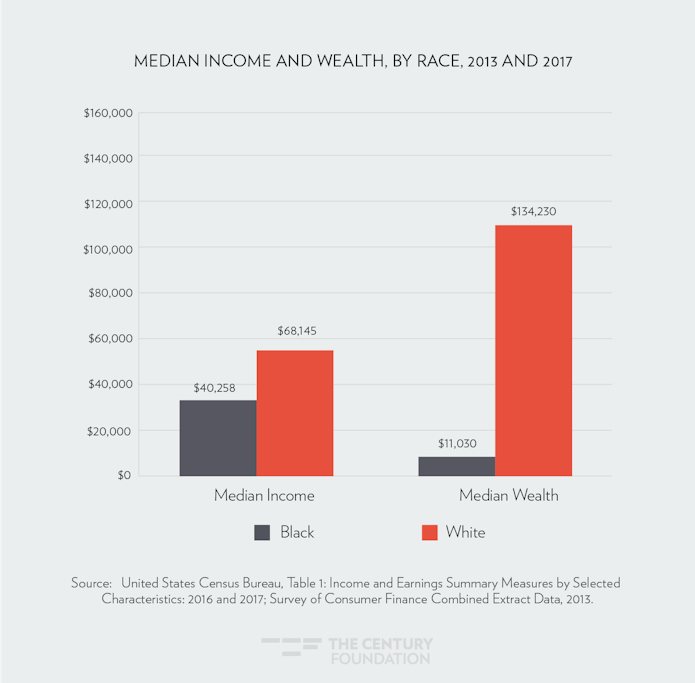

Because homes are typically the largest financial asset for most Americans, segregated markets significantly reduce the accumulated wealth of blacks. This phenomenon—on top of the penalties endured during the historical legacy of slavery and Jim Crow—helps explain why the black–white wealth gap is so much larger than the black–white income gap. While median income for black households is 59 percent that of white households, black median household net worth is just 8 percent of white median household net worth.8 (See Figure 1.)

Figure 1

The segregation-driven wealth gap imposes enormous burdens on African Americans. Having or lacking wealth influences many of life’s big decisions—from financing a child’s education to saving for retirement.

How Residential Segregation Affects Exposure to Concentrated Poverty, Particularly in Schools

Racial residential segregation also means that African Americans are more likely to be steered toward high-poverty neighborhoods, further contributing to the opportunity gap. Typically, families with higher levels of income have access to more-affluent neighborhoods, which tend to have more amenities, and, in particular, higher-performing public schools. Yet persistent racial residential segregation (and the wealth gap it creates) means even middle-class black families are more likely to live in concentrated poverty, and thus are more likely to send their children to high-poverty schools than are low-income whites. In fact, sociologist Patrick Sharkey finds that middle-class African Americans earning $100,000 or more per year live in neighborhoods with the same disadvantages as the average white household earning less than $30,000 per year.9 Living in a neighborhood with concentrated poverty is associated with a variety of learning disadvantages, including lower scores on cognitive tests. One study by Harvard University’s Robert Sampson and colleagues on African-American children in Chicago found that living in a high-poverty neighborhood was associated with lower scores on vocabulary and reading tests that were roughly the equivalent of a full grade of school learning.10

Even middle-class black families are more likely to live in concentrated poverty, and thus are more likely to send their children to high-poverty schools than are low-income whites.

Some students can use public school choice policies to circumvent residential segregation to attend integrated magnet or charter schools outside their neighborhood, but most cannot. Seventy-five percent of American students attend a neighborhood public school—that is, they are simply assigned to the school nearest their homes.11 This inability of most students to attend schools beyond their neighborhood is troubling, because low-income students who are given the chance to attend socioeconomically integrated schools are shown to achieve at much higher levels than do low-income students in high-poverty schools. On the 2017 National Assessment of Educational Progress (NAEP) given to fourth graders in math, for example, low-income students attending schools that are more affluent scored roughly two years of learning ahead of low-income students in high-poverty schools.12 Controlling carefully for students’ family background, another study found that students in mixed-income schools showed 30 percent more growth in test scores over their four years in high school than peers with similar socioeconomic backgrounds in schools with concentrated poverty.13

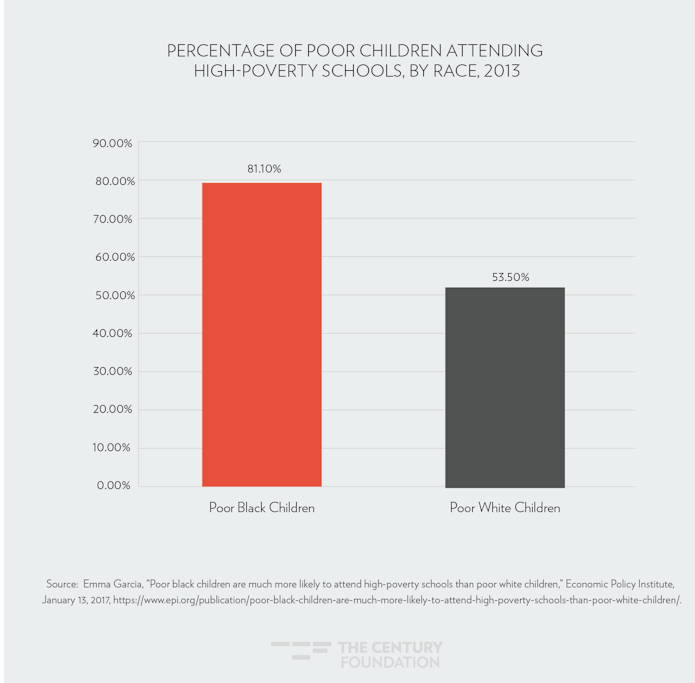

Because of racial residential segregation, low-income African Americans are much less likely to be afforded the opportunity to attend socioeconomically integrated schools. According to a 2017 analysis by Emma Garcia of the Economic Policy Institute, 81.1 percent of poor black children attended high poverty schools in 2013, compared with just 53.5 percent of poor white children.14 (See Figure 2.) That is to say, less than one in five poor black children had access to a predominantly middle-class school, compared to almost half of poor white children.

Figure 2

When Racial Segregation Is Reduced, African Americans Have Better Outcomes

Would outcomes for African Americans improve if residential racial segregation were reduced? Because levels of black–white segregation vary across the country, it is possible for researchers to examine different outcome levels for African Americans in communities with higher or lower levels of black–white segregation.

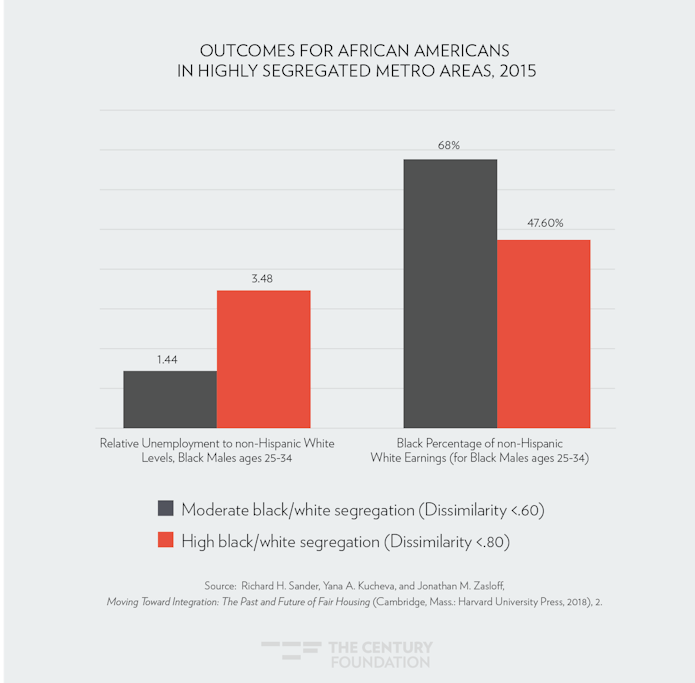

Scholars have found that African Americans in moderately segregated metropolitan areas have much better employment levels, earnings, and mortality rates than do African Americans in metropolitan areas with very high segregation levels. The University of California at Los Angeles’s Richard H. Sander and Jonathan M. Zazloff, along with Yana A. Kucheva of the City College of New York, looked at outcomes for African Americans in metropolitan areas where the black–white dissimilarity index was below 0.60 outcomes and compared them with outcomes for African Americans living in areas with a dissimilarity index above 0.80. The outcomes were consistently better for African Americans living in moderately segregated areas than highly segregated areas, both in absolute terms and when compared with non-Hispanic whites living in the same regions.15

The unemployment rate for black men ages 25–34, for example, was 17.4 percent in highly segregated areas, compared with 10.1 percent in moderately segregated areas. Unemployment was 3.48 times the level of non-Hispanic whites in highly segregated areas, but 1.44 times the level of non-Hispanic whites in moderately segregated areas. Earnings for black men aged 25–34 were $4,000 higher in moderately segregated areas than in highly segregated areas, and, relative to non-Hispanic whites, the earnings were higher—68 percent in moderately segregated areas compared with 47.6 percent in highly segregated areas. (See Figure 3.) Likewise, for all blacks, age-adjusted mortality (relative to non-Hispanic whites) was better in moderately segregated regions (1.14) than in highly segregated areas (1.42).16

Figure 3

Part of the reason for better outcomes, the authors of the study suggest, is that blacks are more likely to live in concentrated poverty in metropolitan areas with high levels of racial segregation than those with moderate levels of racial segregation. The researchers found, for example, that 17 percent of low-income blacks living in moderately segregated metro areas reside in concentrated poverty, compared with 33 percent of low-income blacks living in highly segregated areas.17

The Deliberate Social Engineering of Black–White Residential Segregation

Both currently and historically, segregation is best understood as a tool used to promote and preserve white supremacy, deployed to make it easier to isolate, divest from, surveil, and police black (and brown) people concentrated in certain communities. The ingenuity of this racist tool is that its evil use creates its own justification—that is, once employed, it creates perspectives and data that seem to support its further use. As communities of color suffer under the deprivations that come with segregation—economic disinvestment, political disenfranchisement, educational inequity, and unfair, ineffective policing practices—those who build and install resilient and enduring racist systems that sustain segregation explain their decisions in terms of protecting and promoting safety, strong schools, and stable housing markets. These indeed are desirable neighborhood attributes—but they are the very same attributes that the conditions of segregation disrupted for blacks.

The ingenuity of this racist tool is that its evil use creates its own justification—that is, once employed, it creates perspectives and data that seem to support its further use.

In fact, regarding neighborhood characteristics, African Americans express the same values and desires as most Americans, even though they have much more difficulty in realizing them. According to a study of black Long Islanders, residents considered the most important neighborhood characteristics to be a low crime rate (89 percent), landlords/homeowners who maintain their property (81 percent), high quality public schools (80 percent), and good public services (78 percent). Yet only 16 percent rated their local public schools as excellent, and 43 percent of residents reported feeling that their local government services were not a good value for the taxes that they pay.18

Extensive evidence suggests that black residents in many segregated communities do not believe that their needs and desires are met in their current environments. Survey results indicate that most Americans prefer integrated neighborhoods, but white and black Americans define “integrated” differently. For African Americans, an integrated community is one where between 20 to 50 percent of residents are African American. White definitions of integration indicate that they accept diversity only when they can continue to dominate, defining integration as a scenario where only 10 percent of neighborhood residents are black.19 A recent Pew Survey found that blacks are much more supportive of integrated schools than are whites, particularly when that integration necessitates children going to schools outside of their neighborhoods. Sixty-eight percent of blacks say that “students should go to schools that are racially and ethnically mixed, even if it means some students don’t go to school in their local community,” compared to just 35 percent of whites.20 Given the close relationship between housing and school integration, such data exposes how the African-American value of integrated school options is crushed by the reality of racially isolated neighborhoods.

Certainly, integration is not a panacea for past and present injustices. In fact, pro-integration advocates should respect the ways that integration might lead to new hardships for black folks—increased discomfort and fear of police encounters, elevated levels of surveillance and suspicion from neighbors, disproportionate discipline of black children in predominantly white schools, and so on.21 In large part due to the very attitudes that sustain segregation, communities of color have a reasonable desire to live in a safe and affirming space when living in a discriminatory society; and despite typically having fewer resources to work with, black and brown people so often foster loving, culturally rich, and affirming communities for themselves. And so one challenge of contemporary housing integration efforts becomes how to dismantle the racist system of policies that created and continue to sustain residential segregation without simultaneously destroying valuable cultural and economic institutions that black and brown communities have created in response to it.

Integration best functions (and is best incentivized) when public policies and private citizens tackle the myriad of inequities and indignities that complicate, and sometimes limit, the lives of African Americans. Despite this caveat, it remains true that (1) both historically and currently, black people have risked their comfort, livelihoods, and sometimes lives to gain access to integrated spaces; and, most importantly, that (2) segregation itself is a white supremacist practice that has proven both durable and highly effective at limiting black wealth and opportunity.

Racial housing segregation, residential poverty concentration, and diminished housing access did not emerge accidentally. Richard Rothstein, author of The Color of Law, contends that this enduring segregation results from “a century of social engineering on the part of federal, state, and local governments that enacted policies to keep African Americans separate and subordinate.”22 Those engineers were both liberal and conservative, dwelling in multiple branches and levels of government—as the following sections will show.

From Racial Zoning to Economic Zoning

Members of government and private entities began to deliberately segregate residential areas by race in the late nineteenth and early twentieth century, largely by prohibiting blacks from purchasing homes in majority-white neighborhoods. After the Civil War, those newly liberated black people dispersed throughout the United States, but an abrupt end to Reconstruction ushered in an era of heightened white paramilitary violence, exploitative sharecropping arrangements, and Jim Crow laws. As anti-black discrimination formalized and intensified, many communities systematically expelled African Americans, excluded them from public goods and services, and adopted policies that forbade blacks from residing in towns, or even remaining within town borders after dark.23 Communities who forbade blacks from being within their borders after dark came to be known as “sundown towns”; by 1930, at least 235 counties had “sundowned” black people, often enforcing their rules through violence.24

Pioneered by Baltimore in 1910, racial zoning quickly emerged as an effective way to further subjugate and segregate black folks. Baltimore’s then-mayor did not mince words when discussing the motivation for such an ordinance: “Blacks should be quarantined in isolated slums in order to reduce the incidence of civil disturbance, to prevent the spread of communicable disease into nearby white neighborhoods, and to protect property values among the white majority.”25 Soon, similar policies spread to other cities, including Atlanta, Birmingham, Dade County (Miami), Charleston, Dallas, Louisville, New Orleans, Oklahoma City, Richmond, St. Louis, and others.26

The U.S. Supreme Court in 1917 struck down explicit racial zoning with its decision in Buchanan v. Warley, arguing that such ordinances interfered with the rights of property owners.27 The ruling failed to put an end to segregation, however, instead motivating a new wave of racist creativity by white leaders and communities. Localities quickly found a way to circumvent the ruling and preserve the racial caste system in housing. Some localities created and enforced laws in flagrant violation of Buchanan. Richmond, Virginia, for example, passed a law prohibiting anyone from moving onto a block where they could not marry the majority of people on that block. Because the state had then-enforceable anti-miscegenation laws on the books, the ordinance effectively prevented neighborhood integration without explicitly mentioning race.28

Other localities were slightly more subtle. Switching from race-based zoning to economic zoning, cities and localities designed policies now known as “exclusionary zoning,” which require that neighborhoods consist exclusively of single-family homes, have minimum lot sizes, and/or have minimum square footage requirements. These policies rapidly proliferated. In 1916, just eight cities had zoning ordinances; by 1936, that number had risen to 1,246.29

The U.S. Supreme Court affirmed the practice of exclusionary zoning in Euclid v. Ambler (1926), finding that zoning ordinances were reasonable extensions of police power and potentially beneficial to public welfare. While arguments against placement of factories or landfills next to residences can reasonably be said to protect public safety, when it came to siting residences, the opinion in Euclid stated additional concerns: that an apartment could be “a mere parasite, constructed in order to take advantage of the open spaces and attractive surroundings created by the residential character of a neighborhood,” adding later that “apartment houses . . . come very near to being nuisances.”30 Of course, because many blacks could not afford to buy around the expensive housing restrictions, such “race-neutral” economic zoning policies had a racially discriminatory effect.

Restrictive Covenants, Redlining, and Racial Violence

This supposedly “race-neutral” form of economic discrimination emerged alongside longstanding, more explicit political and economic racism. In order to continue to exclude middle- and upper-class blacks from white neighborhoods, public and private interests conspired to establish a web of racist policies and practices surrounding housing and homeownership. One practice for many white homeowners was to band together and adopt racially restrictive covenants in their neighborhoods, which forbade any buyer from reselling a home to black buyers. Initially upheld in Corrigan v. Buckley (1926), the U.S. Supreme Court reasoned that covenants were private contracts not subject to the Constitution.31 But the Court’s logic was faulty, because (1) private contracts are not enforceable except through the power of the state, and (2) the state was using that power of enforcement. In city after city, courts and sheriffs successfully evicted African Americans from homes that they had rightly purchased in order to enforce racially restrictive covenants.32 The racist contracts were so widely accepted that the commissioner of the Federal Housing Administration continued to recommend their use well after the U.S. Supreme Court declared them unconstitutional in Shelley v. Kramer (1948), dismissing the ruling and declaring that it was not “the policy of the government to require private individuals to give up their right to dispose of their property as they see fit.”33 Still today, racially restrictive covenants appear in real estate records, even if they are unenforceable.34

In order to continue to exclude middle- and upper-class blacks from white neighborhoods, public and private interests conspired to establish a web of racist policies and practices surrounding housing and homeownership.

The official position of the Federal Housing Administration—which underwrote $120 billion in new housing construction between 1934 and 1962—was that blacks were an adverse influence on property values.35 In response, the FHA warned against insuring mortgages for homes in racially mixed neighborhoods, and counseled lenders to reject or give poor ratings to loan applicants from black and brown neighborhoods. Baking racial exclusion into programs designed to promote homeownership, an FHA manual suggested that the best financial bets were those where safeguards—such as highways separating communities—could prevent “the infiltration of lower class occupancy, and inharmonious racial groups.”36 The FHA’s chief economist Homer Hoyt designed a racial ranking system that positioned “Mexicans” and “Negroes” as the least desirable neighborhood residents, and worked with the Home Owners’ Loan Corporation to map cities and design areas into various risk categories congruent with that racial hierarchy. Homebuyers seeking to purchase in “red” zone neighborhoods—those with high percentages of black residents, regardless of the wealth of those residents—would likely be denied a mortgage loan and received no federal support. The FHA provided the strongest financial support to green-zoned areas that, as one appraiser noted, lacked “a single foreigner or Negro.”37 In 1940, the FHA actually denied insurance for a white developer with a project located near an African-American community until the builder agreed to construct a half-mile, six-foot high concrete wall to separate the two neighborhoods.38 Not only did this practice of redlining explicitly encourage and perpetuate racial segregation, it also shut black Americans out of key opportunities for one of the country’s most effective wealth-building strategies: homeownership. Of all of the homeownership loans approved by the government between 1934 and 1968, whites received 98 percent of them.39

The U.S. Supreme Court ultimately struck down racially restrictive covenants in Shelley v. Kramer (1948), but even then, many black families faced grave risks when attempting to move into white neighborhoods. Extralegal violence became an all-too-common method of maintaining segregation through intimidation and fear.40 In one case, when a middle-class black family moved into an all-white neighborhood in a suburb of Philadelphia, some 600 white demonstrators gathered in front of the house and pelted the home and family with rocks. Shortly after, several whites rented a unit next door to the family, hoisting up a Confederate flag and blaring music throughout the night. Klan and community members burned a cross in the family’s yard. Law enforcement largely declined to intervene, with one sergeant suffering a demotion to patrolman after objecting to his orders not to interfere with the rioters.41 In Richmond, California, members of the neighborhood homeowners association insisted that they could enforce a racially restrictive covenant against a black war veteran and his wife after they purchased a home there—four years after the Supreme Court had ruled such covenants unconstitutional. When the black family arrived, a mob of 300 gathered outside of their home, threw bricks at the house, and burned a cross in the front yard. As in Pennsylvania, the police refused to step in for several days, only intervening after the NAACP pressed the governor to do so. Still, no arrests were made.42 In Los Angeles, of the more than one hundred incidents of move-in bombings and vandalism between 1950 and 1965, only one led to arrest and prosecution.43 This harassment and racial terrorism was not declared a federal crime until the Fair Housing Act made it so in 1968. Still, the Southern Poverty Law Center found that, in 1985–86, only one-quarter of these incidents were prosecuted.44

Ongoing Discrimination by Realtors, Banks, and Government Officials

To this day, forms of discrimination stymie racial integration and housing opportunities for black Americans. Attorneys and academics alike identify realtor bias and racial steering as factors that continue to disadvantage black people in the housing market. African Americans frequently encounter discrimination when searching for housing at all stages: they are more likely to receive subpar service when interacting with realtors, and are shown fewer homes for sale or rent than are whites. A 2003 study found that realtor steering of residents away from neighborhoods due to their racial composition is shockingly persistent, even if illegal. The practice showed up in up to 15 percent of tests that made their determination based on clear and explicit indications by the realtor.45 Some scholars have explained that “agents typically accept the initial request as an accurate portrayal of a white’s preferences but adjust the initial request made by a black to conform to their preconceptions. In the case of houses with visible problems, agents refuse to accept the initial request that whites want such a house, but have no trouble making this inference for blacks.”46 Now, there is evidence that such discrimination might have moved onto new platforms, with technology reinforcing human and societal biases. In March 2019, the U.S. Department of Housing and Urban Development (HUD) announced a lawsuit against social media giant Facebook, alleging that the platform allowed advertisers to use data in order to exclude certain racial groups from seeing home or apartment advertisements.47

Relatedly, black homebuyers are also more likely to be steered toward high-interest and high-risk loans when seeking to purchase a home, regardless of income or creditworthiness. A black family that earns $157,000 per year is less likely to qualify for a prime loan than is a white family earning $40,000 per year, which means that white families can borrow heavily at favorable rates, while black families are far less likely to receive a safe, fair loan product.48 In 2006, 53.7 percent of blacks and 46.6 percent of Latinx applicants received high-priced loans; only 17.7 percent of white borrowers did. This pattern remains even after controlling for borrower characteristics (income, credit score) and the amount of the loan, though the gaps do become less stark. Interestingly, these disparities actually worsened at higher income levels.49 Because predatory lenders are more likely to set up shop in predominantly black neighborhoods, their actions wind up leading to generational wealth loss in communities of color. One study indicated that, since 2005, more than half of all borrowers who were issued subprime loans could have qualified for lower-cost loans with more favorable terms.50 Because of their costs and risky nature, subprime loans are more likely to result in foreclosures, which have been disproportionately located in low-income and predominantly black neighborhoods. In the run-up to the subprime mortgage crisis, federal regulators failed in their obligation to recognize the targeting of African Americans and enforce the laws against bad actors who participated in this predatory behavior. The result was a staggering collapse of wealth among black communities; in Prince George’s County, Maryland, for example, during the crisis, “high-earning blacks were 80 percent more likely to lose their homes than their white counterparts.”51

Current public policy choices hardly indicate that government will readily act as a reliable partner in seeking housing desegregation. To this day, public policy choices by state and local officials tend to steer public housing units, which are disproportionately occupied by black and brown residents, into high-poverty areas with fewer resources and opportunities. And the federal government’s two major programs that seek to help low-income people rent homes in the private market—the Low-Income Housing Tax Credit (LIHTC) program and Section 8 housing vouchers—often perpetuate economic and racial segregation.

To this day, public policy choices by state and local officials tend to steer public housing units, which are disproportionately occupied by black and brown residents, into high-poverty areas with fewer resources and opportunities.

The Low-Income Housing Tax Credit program, which allocates a certain number of tax credits for states to distribute to developers according to housing needs, allows consideration of several factors that help determine where new housing will be located. Because housing agencies can consider community support levels when determining housing locations, and more affluent areas are more likely to organize in opposition to such developments, this housing is more likely to be steered into already-low-income communities.52 The nation’s largest low-income housing program—Section 8 vouchers—is directed toward individuals rather than state agencies or developers, in theory giving people more control over where they live. But despite this program’s potential advantage for integration, the limited nature of the vouchers does not provide sufficient support for families to rent in higher-income and more-advantaged areas. Moreover, some states actually allow landlords to reject Section 8 housing vouchers, as income (unlike race) is not a protected class.53

Public Policy Remedies

Government is the laboratory in which many of the schemes for black–white segregation were (and still are) concocted; it is also, therefore, where much of the effort must be placed in order for racial segregation to be undone. Members of government who want to reverse segregation must work to remove policies that promote and protect white supremacy, and replace them instead with ones that actively fight segregation. The rest of this report outlines a four-part strategy to address the following four key facets of black–white segregation: (1) the legacy of generations of racial discrimination in housing; (2) contemporary residential racial discrimination; (3) contemporary residential economic discrimination that disproportionately hurts African Americans; and (4) the re-segregating effects of displacement that can come with gentrification.

Addressing the Legacy of Generations of Racial Discrimination in Housing

When Congress passed the Fair Housing Act (FHA) in 1968, it intended for the executive branch to take steps to reduce housing segregation, with several courts interpreting the FHA as assigning HUD a nonnegotiable “statutory duty to promote fair housing.”54 But it was not until decades later, in 2015, that the Obama administration introduced a rule to implement the Fair Housing Act’s “Affirmatively Furthering Fair Housing” (AFFH) requirement. The 2015 rule charged HUD with “taking meaningful actions, in addition to combating discrimination, that overcome patterns of segregation and foster inclusive communities free from barriers that restrict access to opportunity based on protected characteristics” and “replacing segregated living patterns with truly integrated and balanced living patterns.”55

The failure to implement the AFFH requirements for nearly a half century after passage of the Fair Housing Act allowed segregation to remain the norm—particularly in predominantly black areas. “Segregation decreases most quickly in metro areas with small black populations,” observes NYU’s Furman Center. “Conversely, metropolitan areas with large black populations living in poverty showed the highest levels of black–white segregation, as measured by the dissimilarity index, in 2010.”56 As noted in the first section of this report, while the black–white dissimilarity index has declined over time, it remains extremely high. Furthermore, although the portion of neighborhoods that have only a tiny share of black residents has declined, the proportion of black people living in racially integrated neighborhoods in certain communities has also declined. In New York City, for example, the proportion has actually decreased from 41 percent in 1970 to 21 percent in 2010.57 Rigorous enforcement of the AFFH rule is as important as ever.

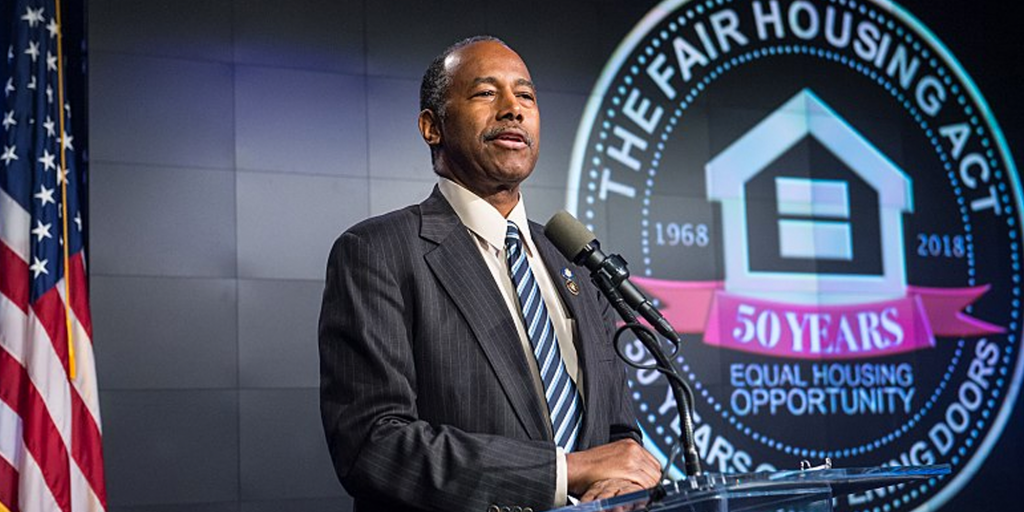

Despite this need, President Donald Trump and Secretary of Housing and Urban Development Ben Carson suspended the AFFH rule in 2018. HUD also removed, without public comment, the Assessment of Fair Housing (AFH) tool, which aided communities in determining housing needs and segregation patterns. This suspension aligns with Secretary Carson’s public disdain for the AFFH rule, which he unfairly derided as “social engineering” and “a tortured reading of fair housing laws.”58

Housing justice and the fulfillment of the Fair Housing Act should not be held hostage to the political whims of an administration led by a man who was himself investigated for racial discrimination in his own real estate holdings.59 Reinstatement and rigorous enforcement of the AFFH are clear next steps in the quest to narrow the black–white housing opportunity gap.

In addition, government should undertake efforts to address the legacy of discrimination in the financing of homes. Senator Elizabeth Warren (D-MA), for example, has appropriately proposed providing new mortgage assistance to buy homes in formerly redlined neighborhoods.

Addressing Contemporary Racial Residential Discrimination

Attacking contemporary racial discrimination will require additional tools specifically aimed at both racial bias in the sale and rental of properties and in the financing of residential purchases.

Increase the Number of, and Resources for, Fair Housing Testers and Enforcement

Fair housing testing is an effective means to uncovering evidence of discrimination in renting or purchasing homes. Typically responding to tips from prospective homebuyers belonging to a protected group, individual testers (with no true intent to purchase or rent a home) pose as potential buyers or renters for the purpose of gathering information on possible FHA violations. In accordance with the Fair Housing Act, testers are looking to uncover discrimination based on race, color, religion, national origin, sex, disability, and familial status.

When testing is conducted, results can be eye opening. A study by the Chicago Lawyers’ Committee for Civil Rights, “Fair Housing Testing Project for the Chicago Commission on Human Relations,” tested for source of income and racial discrimination in seventy properties in six Chicago neighborhoods. Of the tests conducted, thirty revealed one or both forms of discrimination.60

HUD funds many of these exercises through the Fair Housing Initiatives Program (FHIP), and should increase the resources allotted to the program to match the prevalence and gravity of the problem. Because discrimination can be difficult to prove, and because evidence indicates that it is quite widespread, increased resources for testing have been productively used to unearth cases of bias and secure remedies for victims of housing discrimination. When HUD offered grants to a small number of localities for testing programs in the mid-1990s, the Iowa Civil Rights Commission was able to conduct over 900 tests, found 136 possible violations, and filed 41 complaints. During the expansion of this program within Bill Clinton’s first term as president, HUD settled 6,517 cases out of court, took enforcement action on another 1,085, and received nearly $18 million in compensation for housing discrimination victims.61 Localities need more resources to continue the work of rooting out tough-to-prove acts of discrimination.

Reestablish and Strengthen Federal Interagency Taskforces That Combat Lending Discrimination

Established early in the Obama administration, the Financial Fraud Enforcement Task Force (FFETF) brought together a broad coalition of law enforcement, regulatory, and investigatory agencies to combat financial fraud. As part of its mandate, the FFETF looked closely at discrimination in lending practices, such as racialized loan steering.

In 2015, based upon the work of the coalition, the U.S. Department of Justice filed its largest residential fair lending suit in history against Countrywide Financial Corporation and its subsidiaries. The complaint alleged that Countrywide engaged in a widespread practice of discrimination against more than 200,000 qualified African-American and Hispanic borrowers in their mortgage lending between 2004 and 2008. Countrywide did so by charging them higher fees and interest rates, and by steering thousands of black and Hispanic borrowers into subprime mortgages when non-Hispanic white borrowers with similar credit profiles received prime loans. Disturbingly, the suit also alleged that Countrywide was aware of this racial discrimination and took no meaningful action to stop it or prevent it from continuing.

The federal government, which at one time was itself a purveyor of racist lending and housing practices, should provide the appropriate resources and coordination to seek justice for continued fallout of financial racism on the well-being of black Americans.

This was the first time that the Department of Justice alleged and obtained relief for victims of loan steering, but the process of investigating and organizing the suit made clear how challenging these cases are to prove and bring forth. The federal government, which at one time was itself a purveyor of racist lending and housing practices, should provide the appropriate resources and coordination to seek justice for continued fallout of financial racism on the well-being of black Americans.

Addressing Ongoing Economic Discrimination That Disproportionately Hurts African Americans

Action should also be taken to curb the discrimination against African Americans (which is illegal) cloaked as income discrimination (which, unfortunately, frequently is still legal).62 As noted above, after the U.S. Supreme Court struck down racial zoning laws in 1917, jurisdictions rapidly adopted economically exclusionary zoning policies that ban apartment buildings and other multifamily units, in order to achieve much the same result. Today, exclusionary zoning is pervasive in the United States and has been found to exacerbate both economic and racial segregation. Jonathan Rothwell and Douglas Massey have found that “a change in permitted zoning from the most restrictive to the least would close 50 percent of the observed gap between the most unequal metropolitan area and the least, in terms of neighborhood inequality.”63

In another study, Rothwell concludes that local and exclusionary land-use regulations are largely responsible for differences in racial segregation between cities.64 One study by Harvard researcher Matthew Resseger finds that in Massachusetts, census blocks “zoned for multi-family housing have black population shares 3.36 percentage points higher and Hispanic population shares 5.77 percentage points higher than single-family zoned blocks directly across a border from them.”65

To address contemporary income discrimination, we need a five-pronged approach: (1) adoption of an Economic Fair Housing Act that launches a direct assault on exclusionary zoning; (2) funding of disparate impact litigation under the Fair Housing Act that challenges exclusionary zoning when it disproportionately affects people of color; (3) adoption of “inclusionary zoning” policies that set aside a portion of new housing developments for families of modest means; (4) adoption of laws outlining “source of income” discrimination targeting public housing residents; and (5) adoption of “mobility programs” modeled after the federal Moving to Opportunity Act, which provided residents of public housing the chance to live in high opportunity neighborhoods. Each of these approaches will reduce economic segregation and also reduce, indirectly, racial segregation.

Institute an Economic Fair Housing Act

We need an Economic Fair Housing Act—to parallel the 1968 Fair Housing Act—to curb explicit economic discrimination in the form of exclusionary zoning laws.66 The concept of an Economic Fair Housing Act is straightforward: just as it is illegal to discriminate in housing based on race, it should be illegal for municipalities to employ exclusionary zoning policies (such as banning apartment buildings, townhouses, or houses on modestly sized lots) that discriminate based on income and exclude the non-rich from many neighborhoods and their associated schools. At the individual housing unit level, free market forces would continue to discriminate by income, because some apartments and houses will be more expensive than others—that simply is what markets do. But government zoning policies should not, on top of that, discriminate based on income by rendering off-limits entire communities where it is impossible to rent an apartment, live in a townhouse, or purchase a home on a modest plot of land.

One alternative to a complete ban on exclusionary zoning would be a federal (or state) policy to reduce the amount of mortgage interest that a family can deduct in jurisdictions that practice exclusionary zoning, as the University of North Carolina’s John Boger has suggested.67 Another variation would bar federal funding for infrastructure to municipalities that insist on exclusionary zoning policies. For example, HUD currently allocates $50 billion for a variety of forms of public housing, including $5 billion in community planning and development grants. Although exclusive suburbs do not often rely on these housing grants, there are other federal spending programs that can provide leverage over wealthy communities.68

Federal legislators have begun to propose action along these lines. Senator Cory Booker (D-NJ), for example, has proposed legislation to curtail exclusionary zoning.69 Under Booker’s proposal, states, cities, and counties would receive $16 billion in a variety of infrastructure programs, and would be required to develop strategies to reduce barriers to housing development and increase the supply of housing. Plans could include authorizing more high density and multifamily zoning and relaxing lot size restrictions. The goal is for affordable housing units to comprise not less than 20 percent of new housing stock.

Senator Elizabeth Warren (D-MA), likewise, has proposed a comprehensive housing plan that includes a new $10 billion infrastructure program with powerful incentives to reduce exclusionary zoning rules, such as “minimum lot sizes or mandatory parking requirements.” As she explained in March 2019, “to even apply for these grants,” localities “must reform land-use rules to allow for the construction of additional well-located affordable housing units.”70

Similar legislation to reduce exclusionary zoning, particularly near mass transit hubs, has been introduced and debated in California. Spurred by affordability concerns (even more than concerns about segregation), Massachusetts and Seattle have also considered proposals to curtail exclusionary zoning. And in Minneapolis, the city recently adopted a proposal to end single-family zoning restrictions entirely.

California activist Brian Hanlon notes that progressives are rightfully proud of their openness to immigrants, so why, he asks, are some standing by exclusionary zoning, which says, “we welcome outsiders—but you’ve got to have a $2 million entrance fee to live here.”71

Fund Disparate Impact Litigation

Government should devote greater resources to bringing litigation to challenge economic zoning laws that don’t explicitly discriminate based on race but have a “racially disparate” impact. Over time, the courts interpreted the Fair Housing Act to allow plaintiffs to bring such lawsuits targeting policies that have a discriminatory impact on minorities, even absent a discriminatory intent. The U.S. Supreme Court affirmed this interpretation of the act in the 2015 case of Texas Department of Housing and Community Affairs v. Inclusive Communities Project.72

Adopt Inclusionary Zoning Policies

More localities should support “inclusionary zoning” policies. Under such programs, a developer must set aside a portion of new housing units to be affordable for low- and moderate-income residents. In exchange, the developer receives a “density bonus,” allowing them to develop a larger number of high-profit units than the area is zoned for. This benefit for developers has proven critical to the idea’s political acceptance. Among the states most dedicated to inclusionary zoning are New Jersey, Massachusetts, Maryland, and California.73 In all, about 400 municipalities have inclusionary zoning programs.74 According to researcher David Rusk, 11 percent of Americans now live in jurisdictions with inclusionary zoning policies.75

A leading example is Montgomery County, Maryland, which adopted a groundbreaking program in 1974. Under the policy, when a developer builds more than a certain number of units, 12.5 percent to 15 percent of a developer’s new housing stock must be affordable for low-income and working-class families. Between 1976 and 2010, the program produced more than 12,000 moderately priced homes, of which the housing authority has the right to purchase one-third for public housing.76 Unfortunately, almost 90 percent of American municipalities lack any inclusionary zoning policies.

Expand Housing Choice Vouchers and Ban of Source-of-Income Discrimination

More states and localities should pass legislation to ban discrimination based on “source of income”—that is, discrimination against individuals using government subsidies to pay for part of their rent. According to the Poverty and Race Research Action Council, as of May 2017, fourteen states and sixty localities had passed legislation to bar source of income discrimination.77 Senator Warren has also called for making it illegal for landlords to discriminate against renters with federal housing vouchers.78 In addition to banning discrimination based on source of income, the Housing Choice Vouchers Program (formerly known as Section 8 housing assistance) should be fully funded. Housing Choice Vouchers (along with a few other smaller programs) served only 4.7 million households in 2016 of the 25.7 million who qualified.79 The combination of full funding and reduced discrimination could greatly reduce economic and racial segregation in America.

Expand Housing Mobility Programs

“Housing mobility” programs, which allow public housing residents to live in high-opportunity neighborhoods, should be expanded. The primary federal foray into this area was the federal Moving to Opportunity Act, a 1990s experiment in housing mobility that eventually produced substantial wage gains for people who moved to higher-opportunity areas as children.80 Harvard’s Raj Chetty and his colleagues found that the total mean income for those who moved before age 13 was 31 percent higher than for the control group. The researchers also observed in this group a 16 percent increase in the likelihood of attending college between the ages of 18 and 20.83 Such programs, which reduce both income and black–white segregation, should be expanded.

Addressing Displacement from Gentrification that Fosters Re-Segregation

New tools are also needed to dismantle the ills caused by gentrification and displacement. As formerly segregated neighborhoods become more diverse, they do not automatically become more equitable, as rising costs often displace long-term residents and threaten cultural institutions and practices. Washington, D.C. provides many recent examples of this common phenomenon. Residents of an expensive, high-rise, majority white apartment in the historically black Shaw neighborhood allegedly complained about go-go music—a cultural institution of working-class black D.C.—loudly playing from a longstanding neighborhood shop run by a black owner. After the owner was forced to turn down the music, black Shaw and D.C. residents began to protest, not only arguing that the music was the enduring soundtrack of the block, but that this was but one example of how white gentrifiers wanted the economic benefits of the neighborhood but lamented their actual neighbors.84 Not far from the site of these protests, students at Howard University, one of the nation’s oldest and most esteemed historically black colleges and universities (HBCUs), decried that new white residents of the surrounding neighborhood used the private university’s historic yard as a dog park. When a news station interviewed a white male neighbor about the controversy, he suggested that if students of the 152-year-old historic institution did not want dogs on the yard, they should “just move the campus.”85 Incidents like these highlight how residents of color frequently experience gentrification as colonization rather than as revitalization.

Racially concentrated poverty is an evil that public policy must address, but pro-integration housing plans should seek solutions that respect and amplify the economic and cultural power of the longstanding institutions and people in that neighborhood.

Reconsider Tax Abatements and Implement Longtime Owner Occupancy Programs

In a desire to revitalize disinvested neighborhoods, policymakers frequently introduce laws that entice wealthy individuals and investors into the area but ultimately underserve or harm current residents. One example of such a policy is long-term tax abatements, which allows owners of newly constructed or significantly renovated properties in underserved neighborhoods to avoid paying property taxes for an extended time period.

Offering wealthy investors long-term tax relief, with no guarantees that those investments will materially improve the lives and economic stations of current residents, prioritizes property over poor people. Such policies allow the wealthy to live and operate in a neighborhood while having no obligation to contribute to the public good of it—the upkeep of its streets and parks, its public safety, its schools, and so on. Meanwhile, the neighborhood’s original residents continue to shoulder this burden because they have received no such tax abatements. This type of trickle-down real estate might spur growth, but such growth will be inequitable.

From 2014 to 2016, for example, the City of Philadelphia’s controversial ten-year tax abatement on new property applied to nearly 4,300 properties, forgoing more than $420 million in revenue. A conservative estimate based on recent market trends found that, over the next decade, the struggling Philadelphia School District could lose out on nearly $1 billion in property tax revenue due to this abatement plan.86

However, Philadelphia’s Longtime Owner Occupants Program (LOOP) seeks to productively respond to the possibility of the displacement of long-term residents. LOOP assists those below 150 percent area median income (AMI) who have lived in their homes for over ten years and have experienced at least a three-fold increase in assessed home values. Too often long-term residents experiencing this increase lack the liquidity to pay outright the higher taxes imposed on the newly appreciated property. The average LOOP participant is a senior citizen who purchased their home in the 1970s and 1980s.87 An April 2018 report by the Federal Reserve Bank of Philadelphia found that LOOP had proven effective in both reducing tax delinquencies and reducing displacement in gentrifying areas.88

Localities need to strongly consider reevaluating tax abatement programs, making them shorter or partial, or writing stipulations into them that encourage investors to focus on equity (as explained further below). Simultaneously, they should design programs that protect black, brown, and low-income people whose intellect, labor, and creativity helped shape the original neighborhood.

Invest in People, Not Power-Brokers

Why are people who craft public policy so eager to provide funding to area newcomers—who are unlikely to hail from the same racial or socioeconomic station as long-term residents—but unlikely to offer black, brown, and poor folks in the same area that same opportunity? First, this choice likely reflects society’s consistent favoritism of fiscal capital above the social and cultural capital created and accumulated by poor and nonwhite communities. This preference makes sense only if the benefits of those financial advantages are redistributed, and thereby consistently felt by the residents with the greatest need. Unfortunately, this is no guarantee. Second, the choice of policymakers to invest in newcomers over long-term and legacy residents seems to reveal a historical tendency to distrust people of color with self-governance. The tendency of many Americans to assign moral judgment to poverty and wealth—alongside the nation’s enduring current of racism—has led some policymakers to conclude that segregated, marginalized communities struggle due to the moral and intellectual failings of their residents, rather than due to the moral and political failings of those who ensured that their poverty was intractable. Lawmakers pursuing any and all neighborhood revitalization plans that might lead to gentrification should also consider the following actions to prevent displacement and re-segregation:

- If tax abatements are deemed necessary for growth, offer them with enforceable stipulations that new businesses must employ, at a living wage, members of the community that host it. Offer tax abatements first to already existing small businesses to allow them to expand and employ more people.

- Invest in educational programs, community gardens, health care facilities, and job programs in equal or greater amounts as the investments made in real estate.

- Require that new housing developments set aside a percentage of homes at affordable rates. AMI for the entire city is an insufficient threshold for inclusion. “Affordable” should be scaled to median and below-median incomes for the neighborhood in which the new development is located.

- Regard long-term residents as decision makers in their neighborhood. Developers and policymakers should not only consult with, but also take direction from the democratic representatives of community members when determining what gets built and where.

Conclusion

Black–white racial segregation, deliberately created by whites over decades to subjugate black people, continues to thwart opportunities for millions of African Americans. Of the many ways in which American society unfairly treats black people, the continued segregation of residential areas remains a central source of racial inequality. Taking bold action of the type outlined in this report would constitute an important step in cleansing this enduring stain from the fabric of American society, and making it solely the resident of history.

Notes

- “Residential Segregation Data for U.S. Metro Areas,” Governing, https://www.governing.com/gov-data/education-data/residential-racial-segregation-metro-areas.html.

- Richard Fry and Paul Taylor, “The Rise of Residential Segregation by Income,” Pew Research Center, August 1, 2012, http://www.pewsocialtrends.org/2012/08/01/the-rise-of-residential-segregation-by-income/. See also Paul Jargowsky, “Segregation, Neighborhoods and Schools,” in Choosing Homes, Choosing Schools, ed. Annette Lareau and Kimberly Goyette (New York: Russell Sage Foundation, 2014), 107–8 (finding a poor/non-poor dissimilarity index of 0.354 but noting that the poor/non-poor and black–white dissimilarity indexes “cannot be compared directly. In part, the lower levels [of income segregation] stem from the fact that income is continuous, so something just above the poverty line is hardly distinguishable from someone just below it. In contrast, race and ethnicity are categorical measures and reflect sharper and more visible distinctions between groups”). The poor/affluent dissimilarity index (roughly first and fourth quintile by income) was 0.46 in 2009.

- Paul Jargowsky, “Segregation, Neighborhoods and Schools,” in Choosing Homes, Choosing Schools, ed. Annette Lareau and Kimberly Goyette (New York: Russell Sage Foundation, 2014), 103-4.

- Carmen DeNavas-Walt, Bernadette D. Proctor, and Jessica C. Smith, “Income, Poverty and Health Insurance Coverage in the United States, 2009,” U.S. Census Bureau, Current Population Reports, P60-238, 2010, http://www.census.gov/prod/2010pubs/p60-238.pdf, 5, Table 1.

- William Darity Jr., “A New Agenda for Eliminating Racial Inequality in the United States: The Research We Need,” William T. Grant Foundation (2019), 1, https://wtgrantfoundation.org/library/uploads/2019/01/A-New-Agenda-for-Eliminating-Racial-Inequality-in-the-United-States_WTG-Digest-2018.pdf.

- John R. Logan, “Separate and Unequal: The Neighborhood Gap for Blacks, Hispanics and Asians in Metropolitan America,” US2010 Project, July 2011, 5.

- See, e.g., Maria Krysan, Reynolds Farley and Mick P. Couper, “In the Eye of the Beholder: Racial Beliefs and Residential Segregation, Du Bois Review 5, no. 1 (2008): 5–26, https://igpa.uillinois.edu/system/files/cas/media/pubs/Krysan_Farley_Couper_2008.pdf; and Robert Cervero and Michael Duncan, “Neighbourhood Composition and Residential Land Prices: Does Exclusion Raise or Lower Values?” Urban Studies, February 2004, http://usj.sagepub.com/content/41/2/299.

- Kayla Fontenot, Jessica Semega, and Melissa Kollar, “Income and Poverty in the United States: 2017,” United States Census Bureau, September 12, 12, 2018, “Table 1: Income and Earnings Summary Measures by Selected Characteristics: 2016 and 2017,” https://www.census.gov/library/publications/2018/demo/p60-263.html; Survey of Consumer Finance Combined Extract Data, 2013.

- Patrick Sharkey, “Spatial Segmentation and the Black Middle Class,” American Journal of Sociology 119, no. 4 (2014): 903–54, http://www.ncbi.nlm.nih.gov/pubmed/25032266.

- Robert Sampson, Patrick Sharkey and Stephen Raudenbush, “Durable Effects of Concentrated Disadvantage on Verbal Abilities among African American Children,” Proceedings of the National Academy of Sciences 105 (3): 845-52 (2008).

- “Public School Choice Programs,” National Center for Education Statistics, https://nces.ed.gov/fastfacts/display.asp?id=6 (indicating that 13 percent of public school parents choose a school outside their neighborhood; roughly 10 percent use private school).

- See Richard D. Kahlenberg, Halley Potter and Kimberly Quick, “A Bold Agenda for School Integration,” The Century Foundation, April 8, 2019, Figure 1, https://tcf.org/content/report/bold-agenda-school-integration/.

- G. Palardy, “Differential school effects among low, middle, and high social class composition schools,” School Effectiveness and School Improvement 19, no. 1 (2008): 37.

- Emma Garcia, “Poor black children are much more likely to attend high-poverty schools than poor white children,” Economic Policy Institute, January 13, 2017, https://www.epi.org/publication/poor-black-children-are-much-more-likely-to-attend-high-poverty-schools-than-poor-white-children/.

- Richard H. Sander, Yana A. Kucheva and Jonathan M. Zasloff, Moving Toward Integration: The Past and Future of Fair Housing (Cambridge, Massachusetts: Harvard University Press, 2018), 1–4.

- Richard H. Sander, Yana A. Kucheva and Jonathan M. Zasloff, Moving Toward Integration: The Past and Future of Fair Housing (Cambridge, Massachusetts: Harvard University Press, 2018), 2, Table 0.1

- Richard H. Sander, Yana A. Kucheva and Jonathan M. Zasloff, Moving Toward Integration: The Past and Future of Fair Housing (Cambridge, Massachusetts: Harvard University Press, 2018), 4, Table 0.2.

- “Housing and Neighborhood Preferences of African Americans on Long Island, 2011 Survey Research Report,” ERASE Racism, February 2012, http://www.racialequitytools.org/resourcefiles/ERASE_Racism_Housing.pdf.

- Richard Rothstein, The Color of Law: A Forgotten History of How Our Government Segregated America (New York: Liveright Publishing Corp/W. W. Norton, 2017), 223–24.

- “Americans See Advantages and Challenges in Country’s Growing Racial and Ethnic Diversity,” Pew Research Center, May 8, 2019, https://www.pewsocialtrends.org/2019/05/08/americans-see-advantages-and-challenges-in-countrys-growing-racial-and-ethnic-diversity/.

- Sandra E. Garcia, “Black Boys Feel Less Safe in White Neighborhoods, Study Shows,” The New York Times, August 14, 2018, https://www.nytimes.com/2018/08/14/us/black-boys-white-neighborhoods-fear.html.

- Richard Rothstein, The Color of Law: A Forgotten History of How Our Government Segregated America (New York: Liveright Publishing Corp/W. W. Norton, 2017), 237.

- Ibid.

- Jeannine Bell, Hate Thy Neighbor: Move-In Violence and the Persistence of Racial Segregation in American Housing (New York: NYU Press, 2013), 14.

- Elizabeth Brown and George Barganier, Race and Crime: Geographies of Injustice (Oakland: University of California Press, 2018), 168.

- Ibid., 47. See also Douglas Massey, “Residential Segregation and Neighborhood Conditions in U.S. Metropolitan Areas,” in America Becoming: Racial Trends and Their Consequences, vol. I, ed. Neil J. Smelser, William Julius Wilson, and Faith Mitchell (Washington, D.C.: National Academies Press, 2001), 392 (“As [African Americans] moved into urban areas from 1900 to 1960 . . . their segregation indices rose to unprecedented heights, compared with earlier times”).

- Buchanan v. Warley, 245 U.S. 60 (1917).

- Katie Nodjimbadem, “The Racial Segregation of American Cities Was Anything But Accidental,” Smithsonian Magazine, May 30, 2017, https://www.smithsonianmag.com/history/how-federal-government-intentionally-racially-segregated-american-cities-180963494/.

- William A. Fischel, “An Economic History of Zoning and a Cure for its Exclusionary Effects,” Urban Studies 41, no. 2 (February 2004), http://journals.sagepub.com/doi/abs/10.1080/0042098032000165271.

- Euclid v. Ambler, 272 U.S. 365 (1926), at 394–95.

- Corrigan v. Buckley, 271 U.S. 323 (1926).

- Richard Kahlenberg, “An Economic Fair Housing Act,” The Century Foundation, August 2017, https://tcf.org/content/report/economic-fair-housing-act/#easy-footnote-bottom-25.

- Richard Rothstein, The Color of Law: A Forgotten History of How Our Government Segregated America (New York: Liveright Publishing Corp/W. W. Norton, 2017), 86.

- Kimberly Quick, “The Myth of the Natural Neighborhood,” The Century Foundation, March 2016, https://tcf.org/content/commentary/11312/; see also, Margalynne J. Armstrong, “Race and Property Values in Entrenched Segregation,” University of Miami Law Review 52, no. 4 (January 1997): 1051–65, https://repository.law.miami.edu/cgi/viewcontent.cgi?article=1686&context=umlr.

- Ibid.

- Richard Rothstein, The Color of Law: A Forgotten History of How Our Government Segregated America (New York: Liveright Publishing Corp/W. W. Norton, 2017), 67.

- Ta-Nehisi Coates, “The Case for Reparations,” The Atlantic, June 2014, https://www.theatlantic.com/magazine/archive/2014/06/the-case-for-reparations/361631/.

- Ibid, 76; Richard D. Kahlenberg, “An Economic Fair Housing Act,” The Century Foundation, August 3, 2017. https://tcf.org/content/report/economic-fair-housing-act/.

- Sam Fulwood III, The United States’ History of Segregated Housing Continues to Limit Affordable Housing, Center for American Progress (December 2016), https://www.americanprogress.org/issues/race/reports/2016/12/15/294374/the-united-states-history-of-segregated-housing-continues-to-limit-affordable-housing/, citing Testimony of George Lipsitz of the University of California-Santa Barbara before the National Commission on Fair Housing and Equal Opportunity.

- Jeannine Bell, Hate Thy Neighbor: Move-In Violence and the Persistence of Racial

- Richard Rothstein, The Color of Law: A Forgotten History of How Our Government Segregated America (New York: Liveright Publishing Corp/W. W. Norton, 2017), 140–42.

- Ibid., 139–40.

- Ibid., 147.

- Ibid.

- Michael B. de Leeuw, Megan K. Whyte, Dale Ho, Catherine Meza, and Alexis Karteron, “The Current State of Residential Segregation and Housing Discrimination: The United States’ Obligations Under the International Convention on the Elimination of All Forms of Racial Discrimination,” Michigan Journal of Race and Law 13, 2 (2008): 337, https://repository.law.umich.edu/mjrl/vol13/iss2/1.

- Jan Ondrich et al., “Now You See It, Now You Don’t: Why Do Real Estate Agents Withhold Available Houses from Black Customers? Review of Economics and Statistics 85, (2003): 872; Bo Zhao et. al., “Why Do Real Estate Brokers Continue to Discriminate? Evidence from the 2000 Housing Discrimination Study,” Journal of Urban Economics 59, (2006): 394.

- Katie Benner, Glenn Thrush, and Mike Isaac, “Facebook Engages in Housing Discrimination With Its Ad Practices, U.S. Says,” New York Times, March 28, 2019, https://www.nytimes.com/2019/03/28/us/politics/facebook-housing-discrimination.html.

- Amanda Kolson Hurley, “The Problem of Resegregation in Suburbia,” CityLab, February 15, 2016, https://www.citylab.com/equity/2016/02/the-problem-of-resegregation-in-suburbia/462396/.

- Michael B. de Leeuw, Megan K. Whyte, Dale Ho, Catherine Meza, and Alexis Karteron, “The Current State of Residential Segregation and Housing Discrimination: The United States’ Obligations Under the International Convention on the Elimination of All Forms of Racial Discrimination,” Michigan Journal of Race and Law 13, 2 (2008): 337, https://repository.law.umich.edu/mjrl/vol13/iss2/1.

- Rick Brooks and Ruth Simon, “Subprime Debacle Traps Even Very Credit-Worthy,” Wall Street Journal, December 3, 2007 (citing analysis showing that 55 percent of subprime loans issued in 2005 went to borrowers with credit scores high enough to qualify for conventional loans with far better terms; this figure rose to 61 percent by the end of 2006).

- Nathalie Baptiste, “Them That’s Got Shall Get,” American Prospect, October 12, 2014, https://prospect.org/article/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated.

- Richard D. Kahlenberg, “An Economic Fair Housing Act,” The Century Foundation, August 3, 2017. https://tcf.org/content/report/economic-fair-housing-act/.

- Ibid.

- Hills v. Gautreaux, 425 U.S. 284, 302 (1976); “Poverty and Race Research and Action Council to Office of the General Counsel,” Department of Housing and Urban Development, October 15, 2018, https://prrac.org/pdf/affh_anpr_letter_of_civil_rights_and_Fair_housing_organizations.pdf.

- Ibid.; 24 CFR § 5.512, https://www.law.cornell.edu/cfr/text/24/5.152.

- “NYU Furman Center to Department of Housing and Urban Development,” October 15, 2018, https://prrac.org/pdf/furman_center_comments.pdf.

- Ibid., citing Ronald J. O. Flores and Arun Peter Lobo, “The Reassertion of a Black/Non-Black Color Line: The Rise in Integrated Neighborhoods without Blacks in New York City,” 1970–2010, Journal of Urban Affairs 35 (2012): 266.

- Ben S. Carson, “Experimenting with failed socialism again,” Washington Times, July 23, 2015, https://www.washingtontimes.com/news/2015/jul/23/ben-carson-obamas-housing-rules-try-to-accomplish-/.

- Decades-Old Housing Discrimination Case Plagues Donald Trump,” NPR, September 29, 2016, https://www.npr.org/2016/09/29/495955920/donald-trump-plagued-by-decades-old-housing-discrimination-case.

- “Fair Housing Testing in Chicago Finds Discrimination Based on Race and Source of Income,” National Low Income Housing Coalition, January 28, 2019, https://nlihc.org/resource/fair-housing-testing-chicago-finds-discrimination-based-race-and-source-income; source of income discrimination is defined as discrimination based on a renter’s alternative means to pay for the rental property, such as a housing choice voucher.

- Kathryn Lodato, Krista Joy Martinelli, Larissa Ng, Richard Todd Schwartz, and Lara Vinnard, “Investigatory Testing as a Tool for Enforcing Civil Rights Statutes Current Status and Issues for the Future,” Public Law Research Institute, http://gov.uchastings.edu/public-law/docs/plri/testing.pdf.

- Portions of this section are drawn from Richard D. Kahlenberg, “An Economic Fair Housing Act,” The Century Foundation, August 3, 2017, https://tcf.org/content/report/economic-fair-housing-act/.

- Jonathan Rothwell and Douglas Massey, “Density Zoning and Class Segregation in U.S. Metropolitan Areas,” Social Science Quarterly 91, no. 5 (December 2010): 1123–43, http://www.ncbi.nlm.nih.gov/pmc/articles/PMC3632084/

- Jonathan Rothwell, “Racial Enclaves and Density Zoning: The Institutionalized Segregation of Racial Minorities in the United States,” American Law and Economics Review 13 (2011): 290–358, https://academic.oup.com/aler/article-abstract/13/1/290/182611/Racial-Enclaves-and-Density-Zoning-The.

- Matthew Resseger, “The Impact of Land Use Regulation on Racial Segregation: Evidence from Massachusetts Zoning Borders,” November 26, 2013, https://scholar.harvard.edu/files/resseger/files/resseger_jmp_11_25.pdf.

- Richard D. Kahlenberg, “An Economic Fair Housing Act,” The Century Foundation, August 3, 2017, https://tcf.org/content/report/economic-fair-housing-act/.

- Richard Rothstein, The Color of Law: A Forgotten History of How Our Government Segregated America (New York: Liveright Publishing Corp/W. W. Norton, 2017), 204–06 (referencing proposal by Jack Boger).

- “FACT SHEET: The President’s Fiscal Year 2017 Budget: Overview,” U.S. Department of Housing and Urban Development, February 9, 2016, https://portal.hud.gov/hudportal/documents/huddoc?id=ProposedFY17FactSheet.pdf. Of course, the conditioning of federal funds would have to comply with the U.S. Supreme Court’s ruling in National Federation of Independent Business v. Sebelius, 567 U.S. 519 (2012).

- In 2018, Booker introduced the Housing, Opportunity, Mobility and Equity (HOME) Act the provided incentives to reduce exclusionary zoning in states, cities and counties receiving federal funding under the $3.3 billion federal Community Development Block Grant. See Richard D. Kahlenberg, “Taking on Class and Racial Discrimination in Housing: Cory Booker’s big idea to rein in exclusionary zoning,” The American Prospect, August 2, 2018. In June 2019, Booker expanded the proposal along the lines outlined in the text. See Cory Booker, “Cory’s Plan to Provide Safe, Affordable Housing for All Americans,” Medium, June 5, 2019, https://medium.com/@corybooker/corys-plan-to-provide-safe-affordable-housing-forall-americans-da1d83662baa.

- Elizabeth Warren, “My Housing Plan for America,” Medium, March 16, 2019, https://medium.com/@teamwarren/my-housing-plan-for-america-20038e19dc26.

- Hanlon, quoted in Farhad Manjoo, “America’s Cities are Unlivable. Blame Wealthy Liberals,” New York Times, May 22, 2019, https://www.nytimes.com/2019/05/22/opinion/california-housing-nimby.html.

- Texas Department of Housing and Community Affairs v. The Inclusive Communities Project, Inc. (2015).

- Brian R. Lerman, “Mandatory Inclusionary Zoning—The Answer to the Affordable Housing Problem,” Boston College Environmental Affairs Law Review 33 (2006): 383–416, http://socialeconomyaz.org/wp-content/uploads/2011/06/Mandatory-Inlusionary-Zoning-The-Answer-to-Affordable-Housing-Problem-Brian-R.-Lerman.pdf.

- National Low Income Housing Coalition, “40 Years Ago: Montgomery County, Maryland Pioneers Inclusionary Zoning,” May 16, 2014.

- David Rusk, cited in Nicholas Brunick and Patrick Maier, “Renewing the Land of Opportunity,” Journal of Affordable Housing 19, no. 2 (2010), http://socialeconomyaz.org/wp-content/uploads/2011/06/RenewingtheLandofOpportunity.pdf.

- Carl Chancellor and Richard D. Kahlenberg, “The New Segregation,” Washington Monthly, November/December 2014; Heather Schwartz, “Housing Policy Is School Policy,” in The Future of School Integration, ed. Richard D. Kahlenberg (New York: The Century Foundation, 2012).

- “Expanding Choice: Practical Strategies for Building a Successful Housing Mobility Program APPENDIX B: State, Local, and Federal Laws Barring Source-of-Income Discrimination,” Poverty and Race Research Action Council, May 2017, http://www.prrac.org/pdf/AppendixB.pdf.

- Rachel M. Cohen, “Elizabeth Warren Introduces Plan to Expand Affordable Housing and Dismantle Racist Zoning Practices,” The Intercept, September 28, 2018, https://www.theintercept.com/2018/09/28/elizabeth-warren-affordable-housing-bill.

- Corianne Payton Scally, Samantha Batko, Susan J. Popkin, and Nicole DuBois, “The Case for More, Not Less Shortfalls in Federal Housing Assistance and Gaps in Evidence for Proposed Policy Changes,” Urban Institute, January 2018, https://www.urban.org/sites/default/files/publication/95616/case_for_more_not_less.pdf.

- Raj Chetty, Nathaniel Hendren and Lawrence F. Katz “The Effects of Exposure to Better Neighborhoods on Children: New Evidence from the Moving to Opportunity Experiment,” American Economics Review 106, no. 4 (2016): 855–902, 875, Figure 1, https://scholar.harvard.edu/files/lkatz/files/chk_aer_mto_0416.pdf.

- Raj Chetty, Nathaniel Hendren, and Lawrence F. Katz, “The Effects of Exposure to Better Neighborhoods on Children: New Evidence from the Moving to Opportunity Experiment,” National Bureau of Economic Research, working paper no. 21156, May 2015, 2–3, www.nber.org/papers/w21156.81

Recently, in a rare moment of bipartisanship, Congress approved $28 million in competitive grants for more than a dozen housing mobility programs.82 “Housing Mobility—coming to a PHA near you?” Poverty and Race Research Action Council, February 21, 2019, https://prrac.org/prrac-update-housing-mobility-coming-to-a-pha-near-you/.

- Christian Paz, “Thousands Rally to Preserve Go-Go Culture as Gentrification Debate Continues in DC,” NBC Washington, May 8, 2019, https://www.nbcwashington.com/news/local/Thousands-Rally-to-Preserve-DCs-Go-Go-Culture-as-Gentrification-Debate-Continues-in-the-District-509645931.html.

- Theresa Vargas “The Howard University controversy was never just about dogs. It was about respect.” Washington Post, April 24, 2019, https://www.washingtonpost.com/local/the-howard-university-controversy-was-never-just-about-dogs-it-was-about-respect/2019/04/24/e0286c14-66a2-11e9-a1b6-b29b90efa879_story.html.

- Darrell L. Clarke, “Time for an Honest Discussion about Fair Taxation in Philly,” The Philadelphia Inquirer, January 22, 2018, https://www.philly.com/philly/opinion/commentary/darrell-clarke-allan-domb-property-taxes-philadelphia-city-council-20180122.html.

- Jared Brey, “Who’s Paying For Public Services in a Changing City?” Next City, July 2, 2018, https://nextcity.org/daily/entry/who-paying-for-public-services-in-a-changing-city.

- Lei Ding and Jackelyn Hwang, “Effects of Gentrification on Homeowners: Evidence from a Natural Experiment,” Federal Reserve Bank of Philadelphia, April 2018, https://www.philadelphiafed.org/-/media/community-development/publications/discussion-papers/discussionpaper-effects-of-gentrification-on-homeowners.pdf?la=en.