As we write, Congress and the Biden administration are debating the size of a new relief package needed to aid struggling households and right the economy. Mostly unnoticed in the negotiation, though, is that, thanks to a decision by the Trump Department of the Treasury earlier in the pandemic, many hard-hit families who received unemployment insurance benefits in 2020 are now facing unexpected tax bills that could run to the thousands of dollars per family.1 At a time when millions are unemployed,2 when families continue to face food and home insecurity,3 Congress and the Biden administration must act urgently to prevent these surprise tax bills, and to allow millions who have already paid tax on their 2020 benefits to receive a timely refund check.

Not only will this surprise tax bill hurt many workers who can’t afford it right now—there’s a strong legal argument that, according to current law these benefit payments should never have been taxed in the first place.

What Caused the Problem?

Approximately 40 million Americans received an aggregate of over $580 billion in unemployment insurance (UI) benefits in 2020. As a result of the pandemic, state UI offices fielded over 1 million new UI claims every week for forty-six consecutive weeks. Some of these workers were able to find new jobs, but at the end of 2020, over 18 million American workers were still unemployed and claiming benefits, in addition to the nearly 5 million who had exhausted all benefits prior to the end of the year.

Unemployment insurance benefits are usually considered taxable income (more on this later).4 This policy choice hurts lower-earning households, who have more difficulty making large one-time tax payments. The fear of these large payments can discourage participation in benefits programs. Thus, states are required to offer withholding for federal income taxes to UI beneficiaries at a standard 10 percent rate; that is, to allow recipients to elect to have the state set aside 10 percent of their UI benefits and transfer them to the IRS to pay for future tax liabilities.5 The 10 percent rate applies regardless of filing status (that is, whether single, married filing jointly or separately, head of household) or number of dependents.

Although the withholding option is, according to federal law,6 supposed to be available for payments “in the nature of unemployment compensation” no matter their sources,7 some states did not offer workers receiving benefits through CARES Act programs the option to withhold taxes. In addition, in the midst of a pandemic and recession fraught with new challenges and new expenses, many workers could not afford to take a 10 percent reduction in their UI benefits, given that UI benefits typically only replace approximately 40 percent of pre-layoff wages (and an even smaller share of wages plus benefits). As a result, millions of workers likely did not withhold federal income taxes for what could be tens of thousands of dollars in UI income per worker in 2020. As we head into tax filing season, millions of families will be in for a rude awakening when they discover they are on the hook for thousands of dollars in owed income taxes at the federal and, in some cases, the state level.8

Although the withholding option is supposed to be available . . . some states did not offer workers receiving benefits through CARES Act programs the option to withhold taxes.

Congress and the Biden administration have several options at their disposal to exempt pandemic-related unemployment benefits from federal income taxes. Under existing federal law, these payments should already be tax-free, and the Department of the Treasury should promptly say as much. If Congress fails to act on behalf of the millions of workers who faced joblessness in 2020 and relied on the UI system to feed and house their families, it’s imperative that the Department of the Treasury rule these benefits non-taxable.

Below, we outline the background on expanded unemployment benefits as a result of the pandemic, recession, and Congressional response to both in 2020; the extent and urgency of the problem; the legislative options before Congress as they head into negotiations on the next economic relief package; the administrative call to action for the Biden administration; and the legal argument for why these benefits are not taxable.

Expanded Unemployment Assistance in 2020

In addition to tremendous increases in the number of workers claiming state UI benefits, millions of workers became newly eligible for unemployment benefits, were eligible for additional weeks of benefits, and received higher benefit payments than they would under longstanding UI programs as a result of the CARES Act. The CARES Act, enacted in March 2020, established three programs targeted at jobless workers:

- Pandemic Extended Unemployment Compensation (PEUC) grants thirteen additional weeks of UI to workers eligible for state unemployment benefits who are still jobless when they exhaust their state benefits (which typically last twenty-six weeks). The Continued Assistance for Unemployed Workers Act (CAUW), passed in December 2020, increased this to twenty-four weeks, but the additional eleven weeks can only be paid out in 2021.

- Pandemic Unemployment Assistance (PUA) allows traditionally ineligible workers to access up to thirty-nine weeks of unemployment benefits (up to forty-six in some states). This includes self-employed workers, part-time workers, and low-wage earners, as well as workers unable to work for COVID-19-related reasons (such as school closures or COVID-19-related quits).

- Federal Pandemic Unemployment Compensation (FPUC) added $600 per week to unemployment benefit payments for seventeen weeks between April and July 2020. The last FPUC benefits were paid out the week ending July 26, and Congress did not extend the program in 2020. The CAUW Act reinstated the FPUC program for the 11 weeks between January and mid-March 2021, but at only $300 per week.

In addition to these new programs, Congress authorized full federal funding—up from the typical 50 percent federal contribution—of the existing Extended Benefits (EB) and short-time compensation (STC) programs. Finally, in August 2020, former President Trump issued an executive order establishing the Lost Wages Assistance (LWA) program, which provided $300 per week for four to seven weeks in August and September 2020.9

As a result of expanded unemployment assistance programs, workers were eligible for up to forty-seven weeks of unemployment compensation in 2020.10 For seventeen of these weeks, they could have received $600 per week in FPUC top-offs, and for seven, they could have received $300 per week in LWA top-offs. For example:

- A worker who was unemployed as of December 12, the reference week for the December Jobs Report, and had been unemployed for the average duration of unemployment (23.4 weeks), would have an average total UI income in 2020 of $12,835, after receiving some weeks of FPUC and six weeks of LWA.

- A worker who was laid off on March 15, in the initial wave of COVID-19 closure orders, who is still unemployed today, would have an average total UI income in 2020—if they were eligible for state UI, PEUC, FPUC, LWA, and EB—of $27,315.

- A self-employed worker who became unemployed on March 15 and was eligible for PUA benefits and remained unemployed through December 2020 (exhausting all PUA benefits in mid-December before additional weeks were added by CAUW) would have an average total UI income of $18,468 if they received seventeen weeks of FPUC and six weeks of LWA.

Fortunately for jobless Americans and the broader macroeconomy, expanded and enhanced unemployment insurance benefits provided a necessary backstop during the ongoing tumultuous period for labor markets and household finances. However, as we now detail, these substantial benefit payments may also result in very large tax bills.

The Extent, Distribution, and Urgency of the Tax Problem

We used the available public data to estimate the likely size of the surprise-tax wave. While states are not required to publish rates of tax withholding opt-in for UI benefits, they are required to report the amount of money transferred to the IRS for tax withholding.11 In 2020, $21.85 billion was transferred from state UI offices to the IRS for tax withholding. Since UI beneficiaries are only offered a standard withholding rate (10 percent), and there were $580 billion in total nationwide benefits, we can conclude that fewer than 40 percent of UI payments in 2020 had taxes withheld. Given that the average UI beneficiary received approximately $14,000 in UI income in 2020, there will be millions of families burdened by federal income tax bills.

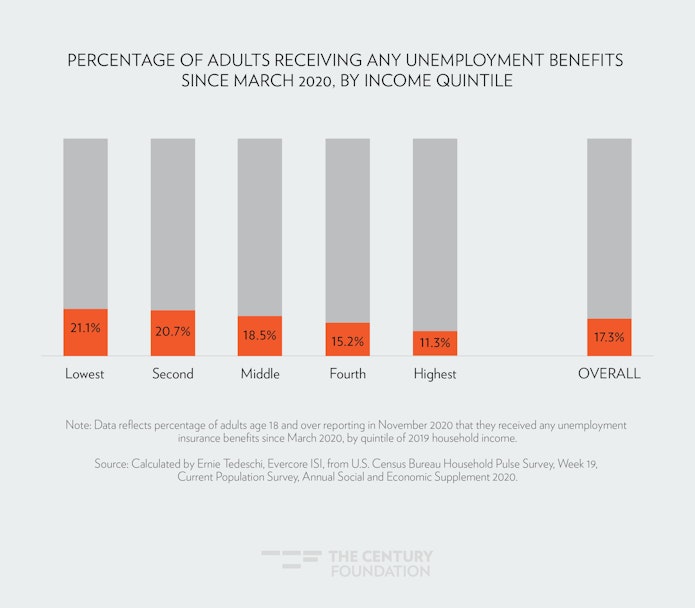

Tax relief for UI recipients would be targeted mostly to households with the greatest needs and highest marginal propensity to spend (that is, likely to spend a high portion of each dollar of income). Low-income workers are over-represented among UI recipients; according to the Census Household Pulse Survey, about half of adults receiving some unemployment assistance between March and November 2020 reported having a household income

below $50,000 in 2019 (see Figure 1).

Figure 1

Due to their over-representation in the hardest hit sectors, stubborn levels of unemployment, and lengthy jobless spells, low-wage workers and workers of color are likely to have received high levels of unemployment insurance income. Economic relief should center these workers, and UI tax forgiveness is aligned with that important goal.

Low-wage workers and workers of color are likely to have received high levels of unemployment insurance income. Economic relief should center these workers, and UI tax forgiveness is aligned with that important goal.

More benefit payments have been received at the bottom-half of the income scale for the simple reason that job losses have been concentrated in sectors with low wages, such as leisure and hospitality. Compared to the financial sector, with an unemployment rate of 3.1 percent and an average weekly earnings of $1,470, leisure and hospitality workers faced an unemployment rate of 16.7 percent and average weekly earnings of $429 in December 2020.12 The unemployment rate for low-wage sectors has remained stubbornly high, suggesting that joblessness spells are longer for lower-wage workers. In addition, the average duration of unemployment for women is 17.2 weeks—two weeks longer than for men.13 And the average duration of unemployment for white workers (14.8 weeks) is lower than that of Black (19.6 weeks) and Asian (25.5 weeks) workers.14

Some have argued that exempting federal income taxes on all UI income is not a progressive economic relief proposal, because higher-income individuals will receive a higher monetary benefit—the higher your income, the higher your tax burden, so the greater amount of tax forgiveness granted by this proposal. This logic is far from bulletproof: households receiving large UI payments necessarily experienced very large drops in other income, and for most, UI replaced considerably less than 100 percent of their wages and benefits.

In addition, families with higher annual UI income weren’t necessarily high-wage earners or otherwise free from financial hardship. Total payments are a function of the length of joblessness, state UI system generosity, and pre-layoff wages. It’s difficult to argue that workers who were out of work all year are better off.

The application of federal taxes in effect punishes states that want to give workers more generous benefits.

More generally, as one of us has argued about taxing UI benefits generally, the application of federal taxes in effect punishes states that want to give workers more generous benefits.15 The fractured UI system, where states design and administer their own UI programs, often results in large disparities in generosity and eligibility. Even the fully federally funded CARES Act programs are conditioned on state eligibility determinations and other state rules. Thus, workers in states with more generous UI systems may have higher UI income totals than their peers in states with less generous UI systems—and thus will pay more in federal taxes. Usually, the federal government fiscally supports state safety-net programs, because those programs have benefits that spill over across borders. UI is the strange exception in which federal tax policy appears instead to discourage state efforts to fight recessions.

Some of the largest tax relief will also go to another group of workers who especially deserve it: those who were the victims of fraud and identity theft. State systems will likely issue tax reporting documents showing payments in the names and social security numbers of victims, even though, of course, those households did not actually receive payments. Similarly, the complex welter of programs this year resulted in a number of overpayments. Many states are in the process of clawing back excess payments, so that beneficiaries may well end up paying tax on benefits they will ultimately have to give back later. Some of those workers will be alert enough to file for a refund, but many likely will not.

Finally, perhaps the strongest economic and humanitarian argument for excluding unemployment benefits from taxable income is its effect on the Earned Income Tax Credit (EITC). UI benefits are considered taxable income, but are not classified as earnings eligible for matching under the EITC. As a result, UI can lower EITC amounts.16 Enhanced UI benefits have been critical lifelines for millions of low-income families over the past year, and the EITC is a longstanding program that’s provided important and significant financial relief to low- and moderate-income Americans.17 In addition to the surprise of large tax burdens as a result of these benefits, families could find that their expected tax refunds are reduced further because of the negative effects of UI on EITC phase-outs. Many workers are likely to still be jobless in a few months at the end of tax season,18 and the financial effects of long-term joblessness persist for years.19 There’s no reason to diminish support for these families by increasing tax burdens and reducing refunds.

There’s no sound or ethical rationale for requiring millions of Americans to search the couch cushions for pennies or forgo putting food on the table to pay tax bills they shouldn’t owe.

Workers will soon know the price tag for the levy on UI benefits, as tax filing season is rapidly approaching. While the IRS announced that the 2021 tax filing season would be pushed back approximately two weeks, to February 12, they did not extend the filing season on the back end—taxes will still be due April 15.20 There is broad consensus among economists that there’s no chance the economy will be recovered by then.21 There’s no sound or ethical rationale for requiring millions of Americans to search the couch cushions for pennies or forgo putting food on the table to pay tax bills they shouldn’t owe.

Thus, with filing season approaching quickly, federal policymakers must act with urgency. In order to set up systems within the IRS and distribute information to taxpayers and preparers, action must be taken immediately.

The Impact of Forgiveness

Below, we outline several income and tax liability scenarios for workers who received UI income this year. For simplicity, we omit analysis of LWA, as it was not available uniformly in all states.

- Scenario 1: If a single worker with no dependents who made the average weekly wage ($972.08) was laid off on March 15, in the initial wave of COVID-19 closure orders, she would have received $10,693 in wage income before being laid off. Her effective annual tax rate (if she’d worked at that wage all year) would be 8.7 percent, and we assume her federal income tax withholding for the weeks she was employed would have been $926. After being laid off, if she received the average UI weekly benefit amount ($373.54) for twenty-six weeks, the typical maximum number of weeks for state UI, she would have received $9,712 in state UI benefits.22 In addition, she would have received the $600 FPUC supplement for seventeen weeks, totaling $10,200. After exhausting state UI benefits, she received thirteen weeks of PEUC benefits and two weeks of EB payments, totaling $5,603. Her total federally financed UI income in 2020 would be $15,803, and her total UI income would be $25,515. With her wage income, her total income would be $36,208. She did not opt-in to withholding on any UI benefits, so she would owe approximately $1,733 in federal income taxes. If all UI income were exempted from federal taxes, she would receive a refund of $1,320, a net benefit of $3,053.

- Scenario 2: If a single worker with no dependents made the average weekly wage and was laid off on March 15, but his employment was categorized as self-employment, he would have received $10,693 in net self-employment income before being laid off. After being laid off, if he received the average PUA weekly benefit ($212) for thirty-nine weeks, the maximum number of weeks allowed in most states, he would have received $8,268 in PUA benefits. Additionally, he received the $600 FPUC supplement for seventeen weeks, totaling $10,200. His total UI income, entirely federally financed, in 2020 would be $18,468. With his wage income, his total income would be $29,161. His state did not offer withholding for PUA or FPUC payments. We assume he made an estimated tax payment to cover the self-employment taxes he owes on his self-employment income. He would owe approximately $1,485 in federal income taxes. If all UI income were exempted from federal taxes, he would receive a refund of about $58, a net benefit of $1,543.

- Scenario 3: If a married worker who files jointly with no dependents made the average weekly wage and was laid off on March 15, he would have received $10,693 in wage income before being laid off. He withheld $926 before being laid off. If he received the average state UI payment for twelve weeks, the maximum duration for his state, he would have received $4,482 in state UI income. He received the $600 FPUC supplement for seventeen weeks, totaling $10,200. Following the exhaustion of state benefits, he received thirteen weeks of PEUC benefits, six weeks of EB benefits, and eight weeks of PUA benefits, exhausting the state and federal UI benefits available to him. His total federal UI income would be $20,286. His state offered 10 percent withholding for state benefit payments only, so he withheld $448. His spouse earned the average weekly wage for all fifty-two weeks ($50,548 in total) and withheld $4,379. Their tax liability is approximately $6,950 and their combined withholding is $5,753, leaving them with an estimated outstanding federal income tax liability of $1,197. If all UI income were exempted from federal taxes, they would receive a refund of $1,775, a net benefit of $2,972.

Legislative Action to Address the Issue of Taxability

Congress should immediately move to exempt unemployment benefits in 2020 from federal income taxes. In the medium-term, Congress should alter the tax code to reverse the taxability of UI benefits entirely, perhaps with a phase-in so that relatively high earners do pay some tax on their benefits.

Senator Dick Durbin (D–IL) introduced the Coronavirus Unemployment Benefits Tax Relief Act in September 2020,23 and again this month with Representative Cindy Axne (D–IA),24 to exempt the first $10,200 of unemployment compensation from federal income taxes in 2020. This amount, equal to the maximum amount of FPUC an unemployed worker could have received, is a good place to start, but it comes up short of solving the whole problem. This legislation was not included in the $900 billion relief package passed in December 2020.

Senator Bernie Sanders (I–VT) recently called for tax forgiveness on UI benefits through the pandemic via reconciliation.25 President Biden’s American Rescue Plan, the underlying framework for the reconciliation package introduced last Tuesday, did not call for tax exemption for UI benefits.26

Now that the House and Senate Budget Committees have introduced reconciliation instructions, the House Ways and Means Committee and the Senate Finance Committee should recommend UI tax forgiveness in the upcoming reconciliation bill.

In addition to forgiving income taxes for UI income, Congress should appropriate funds to the IRS to assist with the costs of implementing this policy. Among other costs, IRS will need added budget authority for communication to taxpayers about this change. To prevent millions of taxpayers from having to file amended returns, IRS should be given added resources to deal with the burden of managing millions of adjustments and potential refund checks.

Administrative Action to Address the Issue of Taxability

There is a strong legal argument that none of the benefits authorized as part of the pandemic response are taxable. The Tax Code already excludes from income any payment from any “Federal, State, or local government . . . in connection with a qualified disaster in order to promote the general welfare.”27 COVID-19 has been declared a qualifying disaster, and the benefits authorized by the CARES Act were provided in direct response. These benefits plainly come from a qualifying source. The only question is whether they are paid “in order to promote the general welfare.”

In our view, the effort to provide economic stimulus meets the plain English definition of “promote the general welfare.” Further, “general welfare” is a term of art in tax law, and longstanding IRS rulings hold that unemployment insurance benefits indeed are payments to promote the general welfare.28 Admittedly, it is less clear whether payments under traditional state UI programs were issued “in connection with a qualified disaster,” and so our recommendation to the Department of the Treasury is limited to payments affected by the 2020 legislative changes. While Congress did first make UI benefits taxable in 1978,29 and increased the amount subject to taxation in 1982, this year’s pandemic programs are categorically different—among other reasons, because as disaster-relief payments, they are exempt even if another legal provision would make them taxable.

The administrative burden on IRS and tax filers becomes much greater with partial exemption, so a legislative or administrative option that exempts all UI benefit payments is preferable. However, if Treasury coordinates with the Department of Labor to obtain detailed reporting from states, implementing adjustments to individual returns could be more straightforward. Either way, however, action after tax-filing season is well underway will likely mean that thousands or millions of workers will have to file amended tax returns in order to receive their refunds. The best outcome would thus be if Treasury worked with the Department of Labor to obtain updated tax reporting documents, known as the 1099-G, from states. States or IRS could send notifications to taxpayers with the updated information.

As a result, Treasury Secretary Janet Yellen can and should act if Congress fails to. She should immediately direct the IRS to exempt unemployment benefits from taxable income for tax year 2020. She should also use her authority under the Stafford Act to either extend the tax filing deadline for workers claiming UI income in 2020, or exempt them from interest on filing extensions.30

If the Department of the Treasury does not act, we think it is reasonable to expect that thousands—or even millions—of taxpayers around the country will eventually file suit to contest the IRS’s existing position. In our view, these taxpayers would have a strong argument and could well prevail in court in the long run. It makes little sense to force struggling households to wait months or years, and to go through the expense and hassle of contesting their taxes, if they will ultimately claim their benefits anyway. Many taxpayers will never realize that they could have filed a challenge, meaning that the benefits of a court ruling will go only to the best-advised (and probably the least needy) families.

Conclusion

Federal policymakers must act with urgency, compassion, and regard for the law and exempt unemployment insurance benefits from federal income taxes for 2020 and the duration of the pandemic. Doing so would provide economic relief for tens of millions of Americans this tax filing season.

Notes

- “Unemployment Compensation is Taxable; Have Tax Withheld Now and Avoid a Tax-Time Surprise (IR-2020-185), Internal Revenue Service, August 18, 2020, https://www.irs.gov/newsroom/irs-unemployment-compensation-is-taxable-have-tax-withheld-now-and-avoid-a-tax-time-surprise#:~:text=By%20law%2C%20unemployment%20compensation%20is,Withholding%20is%20voluntary.

- Heidi Shierholz, “Unemployment Claims Topped 1.1 Million Last Week,” Economic Policy Institute, February 4, 2021, https://www.epi.org/blog/unemployment-claims-topped-1-1-million-last-week-congress-must-pass-bold-relief-measures-to-keep-crucial-programs-from-expiring/.

- Tracking the COVID-19 Recession’s Effects on Food, Housing, and Employment Hardships,” Center on Budget and Policy Priorities, updated January 28, 2021, https://www.cbpp.org/research/poverty-and-inequality/tracking-the-covid-19-recessions-effects-on-food-housing-and.

- 26 U.S. Code §85, Unemployment compensation, https://www.law.cornell.edu/uscode/text/26/85.

- “Withholding Tax Information on UI Benefit Payments,” U.S. Department of Labor, Employment and Training Administration, updated November 19, 2020, https://oui.doleta.gov/unemploy/taxinfo.asp.

- “Unemployment Insurance Program Letter No. 17-95: Withholding of Income Tax From Unemployment Compensation – Amendments Made by Public Law 103-465,” U.S. Department of Labor, Employment and Training Administration, February 28, 1995, https://wdr.doleta.gov/directives/corr_doc.cfm?DOCN=423

- 26 U.S. Code § 85, Unemployment compensation, https://www.law.cornell.edu/uscode/text/26/85.

- Michele Evermore, “Why Millions of Unemployed Workers May Face Unexpected Tax Bills,” The Washington Post, January 28, 2021, https://www.washingtonpost.com/opinions/2021/01/28/why-millions-unemployed-workers-may-face-unexpected-tax-bills/#click=https://t.co/lgoB3qped8.

- “Memorandum on Authorizing the Other Needs Assistance Program for Major Disaster Declarations Related to Coronavirus Disease 2019,” The White House, August 8, 2020, https://trumpwhitehouse.archives.gov/presidential-actions/memorandum-authorizing-needs-assistance-program-major-disaster-declarations-related-coronavirus-disease-2019/; Andrew Stettner and Michele Evermore, “Trump’s Lost Wage Assistance Program No Substitute for Federal Unemployment Benefits,” The Century Foundation, August 20, 2020, https://tcf.org/content/commentary/trumps-lost-wage-assistance-program-no-substitute-federal-unemployment-benefits/.

- Typically, most workers are eligible for twenty-six weeks of state UI. If laid off after January 27, 2020, they would have also been eligible for thirteen weeks of PEUC. After exhausting PEUC, they could have claimed six to twenty weeks of EB benefits, if their state was triggered on. If the sum of all weeks claimed across all programs was less than thirty-nine (or forty-six in High Unemployment Period states), they could have been eligible for the difference through PUA.

- “UI Financial Transaction Summary (ETA 2112),” U.S. Department of Labor, Employment and Training Administration, accessed January 29, 2021, https://oui.doleta.gov/unemploy/DataDownloads.asp.

- “Labor Force Statistics from the Current Population Survey, A-31. Unemployed Persons by Industry, Class of Worker, and Sex,” U.S. Bureau of Labor Statistics, accessed on January 31, 2021,https://www.bls.gov/web/empsit/cpseea31.htm; “Current Employment Statistics, Employment and Earnings Table B-3a. Average Hourly and Weekly Earnings of All Employees on Private Nonfarm Payrolls by Industry Sector, Seasonally Adjusted,” U.S. Bureau of Labor Statistics, accessed on January 31, 2021, https://www.bls.gov/web/empsit/ceseeb3a.htm.

- “Labor Force Statistics from the Current Population Survey, A-36. Unemployed Persons by Age, Sex, Race, Hispanic or Latino Ethnicity, Marital Status, and Duration of Unemployment,” U.S. Bureau of Labor Statistics, accessed on January 31, 2021, https://www.bls.gov/web/empsit/cpseea36.pdf.

- “Labor Force Statistics from the Current Population Survey, A-36. Unemployed Persons by Age, Sex, Race, Hispanic or Latino Ethnicity, Marital Status, and Duration of Unemployment,” U.S. Bureau of Labor Statistics, accessed on January 31, 2021, https://www.bls.gov/web/empsit/cpseea36.pdf.

- Brian Galle, “How to Save Unemployment Insurance,” Arizona State Law Journal 50, no. 4 (2018): 1009, https://arizonastatelawjournal.org/wp-content/uploads/2019/02/Galle-Pub.pdf.

- Elaine Magg, “Unemployment Benefits are Taxable Income: That May Reduce EITC Refunds Next Spring,” Tax Policy Center, September 15, 2020, https://www.taxpolicycenter.org/taxvox/unemployment-benefits-are-taxable-income-may-reduce-eitc-refunds-next-spring.

- Michael Cassidy, “The EITC–Our Biggest Program for the Working Poor,” The Century Foundation, April 10, 2015, https://tcf.org/content/commentary/the-eitc-our-biggest-program-for-the-working-poor/.

- “An Overview of the Economic Outlook: 2021 to 2031” Congressional Budget Office, February 1, 2021, https://www.cbo.gov/publication/56965.

- Austin Nichols, Josh Mitchell, and Stephan Lindner, “Consequences of Long-term Unemployment,” Urban Institute, July 2013, https://www.urban.org/sites/default/files/publication/23921/412887-Consequences-of-Long-Term-Unemployment.PDF?source=post_page.

- “2021 Tax Filing Season Begins Feb. 12; IRS Outlines Steps to Speed Refunds During Pandemic (IR-2021-16),” Internal Revenue Service, January 15, 2021, https://www.irs.gov/newsroom/2021-tax-filing-season-begins-feb-12-irs-outlines-steps-to-speed-refunds-during-pandemic.

- Amelia Thomson-DeVeaux and Neil Paine, “Don’t Expect A Quick Recovery. Our Survey of Economists Says it Will Likely Take Years,” FiveThirtyEight, May 26, 2020, https://fivethirtyeight.com/features/dont-expect-a-quick-recovery-our-survey-of-economists-says-it-will-likely-take-years/.

- Amelia Thomson-DeVeaux and Neil Paine, “Don’t Expect A Quick Recovery. Our Survey of Economists Says it Will Likely Take Years,” FiveThirtyEight, May 26, 2020, https://fivethirtyeight.com/features/dont-expect-a-quick-recovery-our-survey-of-economists-says-it-will-likely-take-years/.

- “Durbin Introduces Bill to Give Unemployed Americans Tax Relief,” The Office of U.S. Senator Dick Durbin, September 29, 2020, https://www.durbin.senate.gov/newsroom/press-releases/durbin-introduces-bill-to-give-unemployed-americans-tax-relief.

- “Durbin, Axne Introduce Legislation to Provide Tax Relief for Unemployed Americans,” The Office of U.S. Senator Dick Durbin, February 2, 2021, https://www.durbin.senate.gov/newsroom/press-releases/durbin-axne-introduce-legislation-to-provide-tax-relief-for-unemployed-americans.

- Bernie Sanders, “This is the Agenda Democrats Should Pursue Under Biden’s Leadership,” CNN, January 19, 2021, https://amp.cnn.com/cnn/2021/01/19/opinions/democrats-agenda-joe-biden-administration-sanders/index.html

- Bernie Sanders, “This is the Agenda Democrats Should Pursue Under Biden’s Leadership,” CNN, January 19, 2021, https://amp.cnn.com/cnn/2021/01/19/opinions/democrats-agenda-joe-biden-administration-sanders/index.html

- 26 U.S. Code §139, Disaster relief payments, https://www.law.cornell.edu/uscode/text/26/139.

- “Revenue Ruling 63-136: Section 61—Gross Income Defined: 26 CFR 1.61-1: Gross income,” General Counsel Memo 34424, February 8, 1971, https://www.irs.gov/pub/irs-tege/rr63_136.pdf.

- Julie M. Whittaker, “Taxation of Unemployment Benefits,” Congressional Research Service, November 16, 2015, https://fas.org/sgp/crs/misc/RS21356.pdf.

- Daniel Hemel, “Is It True That We Can All Stop Paying Taxes Until the Coronavirus Is Over?” Medium, https://medium.com/whatever-source-derived/is-it-true-that-we-all-can-stop-paying-taxes-until-the-coronavirus-is-over-6a79dad44bca.