This report is in a TCF series—The Cycle of Scandal at For-Profit Colleges—examining the troubled history of for-profit higher education, from the problems that plagued the post-World War II GI Bill to the reform efforts undertaken by the George H. W. Bush administration to the regulatory relapse under George W. Bush.

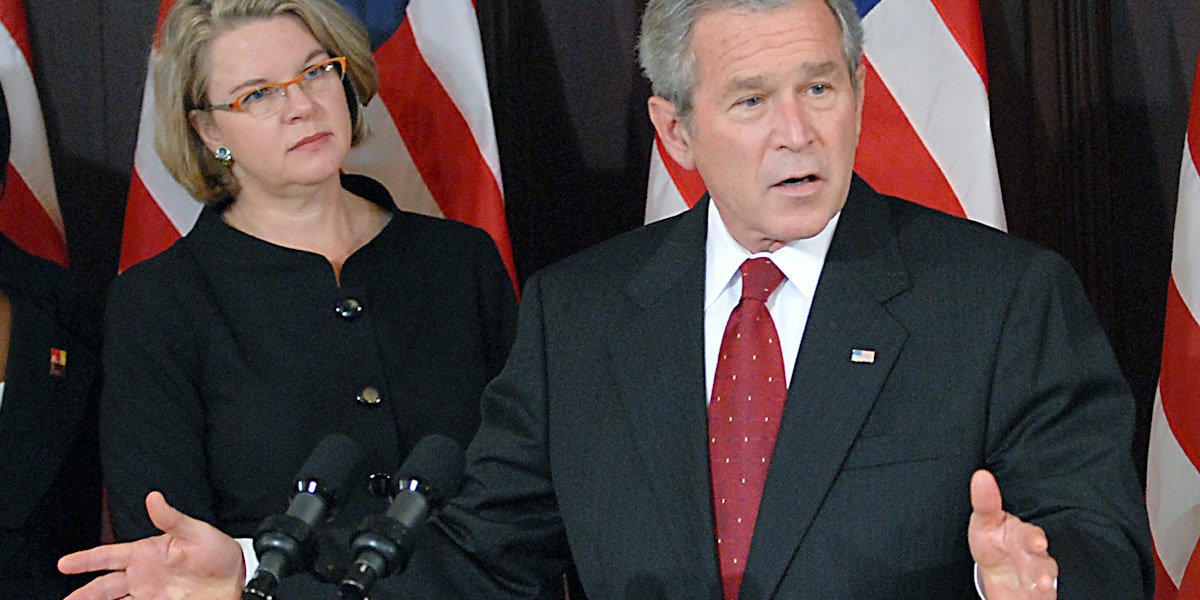

From President Dwight Eisenhower to President George H. W. Bush, Republican administrations witnessed and recognized the hazards of an unrestrained profit motive in education and took action to establish regulatory and legislative guardrails to prevent abuses. The administration of George W. Bush was a dramatic—and ultimately disastrous—break from that tradition. Rick Hess and his colleagues at the American Enterprise Institute summed up the legacy of the George W. Bush administration in their 2013 book on for-profit education by writing that

during the administration, more than a few dubious actors in the for-profit higher education industry showed themselves only too willing to take advantage of a regulatory scheme that had no consequences for poor performance or lousy results. Between 2001 and 2009, the Department of Education—with the enthusiastic support of the for-profit higher education industry—largely turned a blind eye to questions of problematic practices by for-profit colleges.1

How is it that, in little more than a decade—from the presidency of Bush the father to Bush the son, no less—GOP leadership would go from being for-profit higher education’s most vigilant watchdog to enabling its worst predatory excesses?

The Prelude to George W. Bush’s About-Face

Republican efforts to rein in wrongdoing in the for-profit higher education sector hit a rhetorical crescendo during the presidency of Ronald Reagan and a regulatory and legislative high-watermark during the presidency of George H. W. Bush. The scandals surrounding for-profit schools in the 1980s were so severe that President Reagan’s secretary of education, William Bennett, called them “an outrage perpetrated not only on the American taxpayer but, most tragically, upon some of the most disadvantaged, and most vulnerable members of society.”2 The investigation into these scandals eventually led to a 1992 rewrite of the Higher Education Act (HEA) that dramatically tightened accountability and oversight of the for-profit sector. When he signed the law near the end of his presidency in July 1992, President Bush said it was “not perfect” but “it contains a number of valuable program and loan default prevention provisions. In particular, these provisions will crack down on sham schools that have defrauded students and the American taxpayer in the past.”3 Implementation of the 1992 law during the administration of President Bill Clinton, especially a cutoff of federal funds to schools with high default rates, led to one of the largest reductions in history of the for-profit sector. During the Clinton administration’s eight years in office, 1,204 for-profit schools closed their doors.4

“The scandals surrounding for-profit schools in the 1980s were so severe that President Reagan’s secretary of education, William Bennett, called them “an outrage perpetrated not only on the American taxpayer but, most tragically, upon some of the most disadvantaged, and most vulnerable members of society.”

One of the 1992 law’s core reforms would use triggers—indicators of potential problems at schools—to prompt investigations by state oversight bodies (dubbed State Postsecondary Review Entities, or SPREs) and accrediting agencies. But according to higher education analyst and journalist Stephen Burd, the Clinton administration’s 1994 draft rule for implementing the SPRE provisions shifted the primary focus of the SPREs from weeding out unscrupulous schools to ensuring quality at all types of colleges. Its proposal to use “acceptable percentages” for various student outcomes sent a chill across traditional higher education.5

In education, the use of any bright-line proxy for quality is beset by problems, which is why Congress has historically given public and nonprofit institutions—along with their related accrediting agencies—the authority to make difficult judgments on quality. Problems in implementing the new legislation quickly emerged. In August 1994, the Department of Education notified almost 2,000 postsecondary institutions, many of them nonprofit (including public institutions), via letters saying that they had failed to meet at least one criteria, triggering further review. A few days later, however, the department rescinded the letters, saying they were based on incorrect data.6 The damage had already been done, however: the nonprofit higher education community feared that the department and states were preparing to launch a poorly designed crackdown that, in seeking to punish predatory schools, would throw the baby out with the bathwater. The taint of potentially being on a watch list subject to state review drove nonprofit universities and colleges to revolt against expanded state oversight;7 and in this fight, they were about to get an unusual, powerful ally.

In November 1994, Newt Gingrich and House Republicans introduced their Contract with America, calling on Congress to reduce government regulation. After Republicans gained control in the 1994 elections of both the House and Senate for the first time since 1953, the unpopular state oversight program proved an early target for defunding. The George H. W. Bush administration had promoted the SPRE initiative to curb abuses at for-profit schools, and in a historical irony, the GOP-led Congress withdrew federal funding for it in March 1995, ending implementation almost before it had barely begun. Three years later, in the 1998 HEA amendments, all references to the state oversight agencies were stricken from the law, as were requirements that accreditors assess institutional default rates and render judgments about the reasonableness of tuition levels in relationship to course length.8

More than 80 percent of the 1,028 schools that lost their Title IV eligibility from 1991 to 2000 were for-profit institutions.

While Congress shrank state oversight authority, a federal cutoff of schools with high default rates had a large impact. By the latter half of the 1990s, hundreds of for-profit schools with high default rates had lost their eligibility for student aid and gone out of business due to the 1992 HEA restrictions. High default rates of student loan borrowers, two years after leaving school, proved an effective if crude snapshot method of identifying and ejecting problem schools from the federal aid program. In theory, the 1992 HEA default rate restrictions were “universal” regulations that applied to all postsecondary institutions—a regulatory litmus test promoted by career schools, which opposed regulations that only targeted their sector. Yet, the default rate cutoff overwhelmingly impacted for-profit schools. More than 80 percent of the 1,028 schools that lost their Title IV eligibility from 1991 to 2000 were for-profit institutions.9

As the number of for-profit schools with high default rates plummeted, abuses at career schools faded from the news. Omer Waddles, the chief lobbyist for the for-profit colleges, told the Chronicle of Higher Education in 1997 that “We’ve seen a fire across the prairie, and that fire has had a purifying effect.” Waddles, like his predecessors, claimed the bad old days of trade school abuses were now in the past. “As our sector has weathered the storms of recent years,” Waddles told the Chronicle, “a stronger group of schools is emerging to carry, at a high level of credibility, the mantle of training and career development.”10 (Waddles, a former Senate Health, Education, Labor and Pensions committee aide to Senator Ted Kennedy [D-MA], subsequently became the president and chief operating officer of ITT Technical Institutes in 2002—which, ironically, did not survive the prairie fire and eventually went bankrupt in 2016, leaving behind a charred landscape of tens of thousands of indebted dropouts and borrowers without jobs).11

By 1998, Stephen Burd was reporting in the Chronicle of Higher Education that for-profit trade schools had won “newfound respect” in Congress and that lawmakers were on the verge of rolling back some of the restrictions placed on the sector in 1992. While the rift that had opened between proprietary school trade associations and nonprofit higher education groups remained,12 the 1998 HEA amendments relaxed the “85–15” rule to a “90–10” rule, such that for-profit schools had only to derive 10 percent of their revenues from outside of the Department of Education’s HEA programs (known as Title IV) to remain eligible for federal student aid, instead of 15 percent.

Before long, the 1998 HEA amendments critically loosened the definition of when students were deemed to be in default on their loans, from 180 days of delinquency to 270 days of delinquency, effectively pushing more borrowers beyond the two-year window, artificially lowering the default rate. Meanwhile, the increase in borrowers’ use of deferments and forbearances—first spurred by the 1992 HEA cohort default rate cutoff restrictions—doubled between 1996 and 1999, from 10.1 percent to 21.7 percent, further deflating reported default rates.13 By the time the George W. Bush administration took office in 2001, the 1992 HEA default rate restrictions had largely been gutted, to the point where the default rate restrictions became inconsequential.14

As the impact of the 1992 HEA amendments faded, two profound but related shifts in higher education propelled the new respect that for-profit schools enjoyed by the time of the 1998 HEA reauthorization. The first shift was the spread of the Internet and the advent of online learning. Unlike the correspondence courses of the past, online learning could be interactive. Distance education no longer meant getting course materials in the mail, learning on your own, and studying with little or no communication with a qualified instructor. That technological breakthrough created an exciting array of new opportunities for innovative instruction and curriculum, computer-adaptive assessments of student learning, and the prospect of evaluating student progress based on mastery of career competencies, rather than by time spent in a seat in class. For-profit schools primarily served a demographic of older, working adults who responded to the convenience of online courses.

The precursors to online learning—the correspondence schools that frequently preyed upon unwitting active-duty soldiers and veterans alike—were no strangers to scandal.15 Their predatory practices in fact had led to a requirement in 1992 that schools that wanted to be eligible for federal aid could serve (essentially) no more than half of their students through correspondence (which included telecommunications courses). A home base of live, in-person teaching was required for the other half.16 In the face of technological change, however, the 1998 HEA amendments waived the “50 percent” rule in favor of a new demonstration program designed to both examine the quality and viability of distance education programs and to determine the most effective ways to deliver distance education.

By the time the Bush administration took office in 2001, publicly traded for-profit colleges were plainly big businesses. At mid-decade, the eight largest for-profit chains had a combined market value of $26 billion.

The second, seismic shift in the latter half of the 1990s was the rise of giant for-profit college chains, as companies publicly traded in the stock market. In 1991, DeVry, Inc. was the only for-profit university chain listed on the stock exchange. In 1994, the Apollo Group, Inc., owner of the University of Phoenix, went public and became highly profitable in a short period of time. By 1999, as many as forty for-profit colleges were listed on the stock exchange.17 According to some accounts, publicly traded for-profit colleges were the highest earning stocks of any industry from 2000 to 2003.18 By the time the Bush administration took office in 2001, publicly traded for-profit colleges were plainly big businesses. At mid-decade, the eight largest for-profit chains had a combined market value of $26 billion.19

While a few large for-profit college chains had existed before and been traded on the stock exchange, the giant for-profit corporations that emerged by 2001 had no precedent in the industry. At the time of the Apollo Group’s initial offering in 1994, the University of Phoenix had thirty-three campuses in eight states and enrolled fewer than 27,000 students. Ten years later, the University of Phoenix had more than 225,000 students,20 including more than 100,000 students enrolled online, and a bigger enrollment than any public university in the nation. By the time the Obama administration came into office, the Apollo Group’s schools enrolled nearly 400,000 students21 and the fifteen biggest accredited for-profit chains enrolled nearly 60 percent of all students in the sector. The Apollo Group’s earned revenues alone jumped from $12 million in 1994 to $1.34 billion by 2003, as the corporation’s stock price increased nearly ninety-fold, from 72 cents a share to $63.36 per share.22

An almost irrational exuberance seemed to envelop publicly traded for-profit colleges at the turn of the millennium. For the first time, career school chains were treated as pioneers on the cutting edge of technological change in higher education, rather than as poor second cousins to their peers at traditional universities and colleges. In a 1999 article in Change magazine entitled “For-Profit Higher Education: Godzilla or Chicken Little?” Williams College economist Gordon Winston concluded that “There’s a lot of Buck Rogers and Luke Skywalker in recent comments about higher education—a technological ebullience reminiscent of the days of sweeping engineering projects like the Grand Coulee and Hoover Dams, reinforced this time by the romanticism of privatization.”23 One college administrator, who authored a 2005 book on for-profit education, waxed that for-profit universities, with their “colorful and fiery founders, origin stories of beginnings as garage businesses, their populist beliefs in providing educational opportunities to first-generation college students, their Yankee innovation, hardworking, participatory management, and pure bravado, they are American as can be.”24

While size gave companies some advantages, such as economies of scale in developing curriculum across campuses, CEOs of the publicly traded companies now had to please shareholders and monitor the value of their stock daily. In effect, the stock market voted each day on the value of a for-profit chain. Inevitably, those market pressures meant for-profit chains had to regularly report signs of ongoing growth. The quest for growth led, among other trends, to recruiting more students with very low incomes who were eligible for the maximum Pell Grant, even when students were not ready to take on college-level work. At the same time, market pressures to demonstrate enrollment growth also drove for-profit chains to expand beyond certificate programs into baccalaureate and master’s degree programs.

Stephen Burd of the Chronicle of Higher Education reported that by 2006, publicly traded for-profits, “to keep their stock prices up and investors happy . . . must constantly show that they are expanding, even if doing so is not good for the colleges or their students.” David Hawkins of the National Association for College Admission Counseling issued an even blunter warning about the hazards of publicly traded for-profits. “The pressure to enroll that Wall Street places on these companies is almost unbearable and creates incentives to misbehave,” he told Burd. “Unfortunately, we’re seeing plenty of evidence that the ‘recruit at any cost’ mentality is becoming more the rule than the exception.”25

The Cycle Of Scandal At For-Profit Colleges Series

Read the series of papers focusing on the repeated for-profit college scandals of the past sixty years.The GOP Reversal on For-Profit Colleges in the George W. Bush Era

When President George H. W. Bush “Cracked Down” on Abuses at For-Profit Colleges

The Reagan Administration’s Campaign to Rein In Predatory For-Profit Colleges

Vietnam Vets and a New Student Loan Program Bring New College Scams

Truman, Eisenhower, and the First GI Bill Scandal

The For-Profit College Story: Scandal, Regulate, Forget, Repeat

The GOP Has a Long History of Cracking Down on “Sham Schools”

The Bush Administration’s Deregulation of For-Profit Schools

The Bush administration was far more friendly than its predecessors to for-profit schools, Democratic or Republican. For the first time, the assistant secretary for postsecondary education, Sally Stroup, came from the for-profit sector and was a lobbyist who had previously headed up government affairs for the Apollo Group and the University of Phoenix. Stroup’s deputy assistant secretary was Jeffrey Andrade, a consultant to a for-profit lobbying group, the Career College Association. The brother of White House chief of staff Andrew Card was a for-profit lobbyist. The new deputy secretary at the Department of Education, William Hansen, who had been representing student loan companies, would leave his post after a couple of years, and go on to work from 2006 to 2009 for a lobbying group that represented the Apollo Group, and would himself become a member of the corporate board at the University of Phoenix.

Industry-friendly Bush appointees soon started to deregulate the for-profit sector, undermining and undoing some of the consumer protection provisions in the 1992 HEA amendments that had been signed into law by President Bush’s father. George H. W. Bush’s newly appointed secretary of education, Lamar Alexander, had first proposed the 1992 ban prohibiting admissions-related personnel and recruiters from being compensated based on the number of students they signed up or the amount of federal aid they had secured.26 This ban on “bounty hunting” by for-profit school recruiters carried heavy penalties. In December 2000, just one month before George W. Bush took office, the Department of Education ordered Computer Learning Centers Inc. (CLC) to return $187 million in federal funds—all of the Title IV student aid that CLC had received since 1994—for alleged violations of the ban on commission-paid recruiters.27

Industry-friendly Bush appointees soon started to deregulate the for-profit sector, undermining and undoing some of the consumer protection provisions in the 1992 HEA amendments that had been signed into law by President Bush’s father.

Without the funds to pay the penalty or the creditor confidence to borrow it, CLC declared bankruptcy barely a month later. The for-profit chain abruptly closed its twenty-five schools in eleven states, leaving at least 3,800 students in the lurch and the federal government on the hook for assuming the students’ discharged debts.28 Beyond the apparent violations of the 1992 incentive ban, numerous students across the country and the Illinois attorney general had also successfully sued CLC, claiming that the company had exaggerated the job placement rate and earnings of its graduates and failed to pay refunds owed to students. The Illinois attorney general had won a $500,000 settlement for fifty-five students seeking full tuition aid refunds.29

The Department of Education’s decision in the CLC case had been made by career staff, not the few remaining Clinton appointees at the department. Nevertheless, Bush’s incoming education secretary, Rod Paige, opened an internal inquiry to determine if the CLC decision was warranted. Before long, the department was seeking to unravel the sweeping 1992 bounty ban, which prohibited institutions that received federal student aid from providing “any commission, bonus, or other incentive payment based directly or indirectly on success in securing enrollments or financial aid to any persons or entities engaged in any student recruiting or admission activities or in making decisions regarding the award of student financial assistance.”30

In October 2002, Secretary Paige adopted new regulations, creating not one but twelve “safe harbors” that allowed for-profit schools multiple ways to compensate salespersons and admissions based on their success in securing enrollments or financial aid, so long as they weren’t “solely” compensated on that basis. Under the first safe harbor, for example, a school could compensate its employees based on their success in securing enrollment or awarding financial aid so long as pay adjustments were not made more than twice in a calendar year and were not based solely on success in securing enrollments or the awarding of financial aid.

Secretary Paige confidently predicted that the twelve end-runs the department had authorized to the incentive compensation ban would not lead to a return of the multitude of abuses that had led to the 1992 ban. In the final regulations, Secretary Paige stated that he did not “agree with the commenters that the safe harbors will allow unscrupulous institutions to engage in the kinds of improper recruiting activities that took place during the 1980s and early 1990s.” The abuse of the system, said Paige, “is no longer possible today. . . . most of those unscrupulous institutions were terminated from participating in Title IV, HEA programs because of their high cohort default rates.”31

Paige’s assertion that it was “no longer possible” for schools to commit abuses in violation of the incentive ban was soon debunked, as recruiting abuses expanded anew after the ban was relaxed. The department’s own enforcement staff continued to discover for-profit schools that were not only violating the incentive ban, but also were cheating on tests used to determine the readiness of high school dropouts for programs funded by federal student aid.32 Yet at the same time the department loosened the ban, Bush appointees also reduced the penalty for violating what was left of it. Since the passage of the 1992 law, the department had typically directed an institution found to have violated the incentive ban to return the total amount of student aid provided for each improperly recruited student. Thus, the department directed Computer Learning Centers to return all the Title IV aid CLC had received since 1994 when it first allegedly began violating the ban, an enforcement action that effectively bankrupted and closed CLC. However, in an October 2002 memorandum, Deputy Secretary William Hansen directed that in the future, schools which violated the incentive compensation ban would merely be fined, rather than having to return all of their Title IV aid from the time when the school began violating the law.33

The Bush administration did not merely roll back regulations on for-profits; it actively extolled the virtues of the sector touted by industry spokespersons. Sally Stroup told the Consumer Bankers Association in December 2002 that proprietary colleges were doing a “great job cleaning up their act.” She praised the accrediting standards for measuring student achievement used by the national accreditors of for-profits as “better than [those used by] the big regional commissions” at nonprofit colleges, and added that, in the department’s view, for-profit colleges were “equals to four-year schools.”34

Despite the Bush administration’s receptiveness to the for-profit industry, it could only do so much by regulation to lift the restrictions that Congress had put on the industry in the 1992 HEA amendments. A committee that the administration convened to make recommendations for reforming Title IV student aid programs concluded in 2002 that both the “90–10” rule, requiring institutions to have at least 10 percent of revenues come from sources other than Title IV, and the “50 percent rule,” which barred federal aid to institutions where more than half of programs or students were enrolled in distance education courses, could only be changed by Congress.35 That is precisely where for-profit industry lobbyists next turned their efforts—and where, unlike twenty years earlier, GOP lawmakers this time gave for-profit colleges a warm reception.

The For-Profit Lobby Becomes a Congressional Powerhouse

As for-profit colleges mushroomed into an industry dominated by multi-billion dollar publicly traded companies, the industry’s lobbying power came to rival that of other powerhouse corporate industries in Congress. In 2003, Stephen Burd reported in the Chronicle of Higher Education that “For-profit colleges have never had more political clout with the White House and in Congress than they do now. Bush administration officials and Republican Congressional leaders have been lavishing the institutions with praise.”36 Three years later, in 2006, Congressman Michael Castle (R-DE) was still seconding that assessment, telling the New York Times: “The power of the for-profits has grown tremendously. They have a full-blown lobbying effort and gives lots of money to campaigns. In 10 years, the power of this interest group has spiked as much as any you’ll find.”37

For-profit lobbying on the Hill was driven overwhelming by the twin goals of eliminating government regulation and securing more federal revenues for career schools. In 2008, Arthur Keiser, chancellor of the for-profit Keiser University, sent a blunt e-mail message to dozens of people to encourage attendance at a fundraiser for career school booster Congressman Howard “Buck” McKeon (R-CA). “Tip O’Neill stated that campaign contributions are the mother’s milk to politics,” Keiser noted. “In a period of highly charged political activity . . . your involvement in the political process is absolutely critical.” Keiser concluded with a candid piece of advice: “I have learned during the past 30 years that although the student is our client, the government is our customer—the one who pays the bills.”38

While for-profit schools had long been a potent lobby among Democratic lawmakers, the companies’ lobbyists switched their focus and funding during the Bush administration to supporting Republican lawmakers, particularly those who served on the House Committee on Education and the Workforce. In the 2003–04 election cycle, the for-profit industry gave more than $228,000 to the chairman of the committee, Congressman John Boehner (R-OH), as well as Congressman Buck McKeon,39 who subsequently succeeded Boehner as chairman when Boehner became the speaker of the House in 2006. Furthermore, more than half of the $572,700 provided by the political action committee financing Boehner’s bid to become speaker was provided by employees and lobbyists of for-profit colleges and private student lender companies. Among the for-profit colleges, the largest single contribution ($17,500) to Boehner’s successful majority leader bid were the corporate officers and senior employees of Corinthian Colleges,40 which subsequently collapsed in an epic bankruptcy, saddled with tens of thousands of fraud claims.

As the chair of the committee, and later as the speaker, John Boehner proved to be a champion of career schools in the Congress. But quite apart from the hundreds of thousands of dollars that for-profit schools contributed to Boehner—and unlike many of his congressional peers—Boehner’s staunch support of for-profit schools was not just political but personal.

One of Boehner’s two daughters had gone to a state university in Ohio but dropped out because it was “not her thing” and moved home, according to Boehner. After working for a short stint, she decided to go to a for-profit school, which she attended for two years. “She graduated, she is gainfully employed,” Boehner stated at a 2005 committee hearing. “I am very happy about that. And she owns her own condo. She owns her car. She has a very good job that she was trained for. So while there are all of these horror stories or some horror stories that might exist, we should not paint the entire industry with a broad brush.”41 Boehner’s daughter worked at General Revenue Corporation, a student loan collection company in Cincinnati that became a subsidiary of Sallie Mae, one of Boehner’s biggest contributors. She was hired after her father had mentioned his daughter to the owners of the company, reportedly over a game of golf.42

In 2004, Boehner introduced legislation that amounted to a virtual wish list of the for-profit sector. His bill would have eliminated the 90–10 rule, enabling proprietary schools to have as much as 100 percent of students pay for their education solely out of federal student aid. Eliminating the 90–10 rule would provide an incentive to for-profit schools to both recruit very-low-income students with an expected family contribution of zero dollars to their college costs, and to set tuition and fees at a dollar figure equal to the maximum Pell Grant plus the maximum student loan amount, to avoid having to secure out-of-pocket tuition from students.

Boehner’s legislation also would have eliminated the 50 percent rule for distance education courses, and legal distinctions in HEA between for-profits and other postsecondary institutions—a statutory issue with limited financial impact but one which had symbolic import to the for-profit sector.43 The latter change appeared to foster fairness—a “level playing field”—but ignored the underlying financial and control requirements imposed by law on nonprofit and public schools to protect consumers. The longstanding body of law that distinguished for-profits from nonprofit institutions, and that had restrained predatory behavior by nonprofits, were all but invisible in the debate over Boehner’s legislation.

In June 2004, Boehner chaired a House Committee on Education and the Workforce hearing on his bill that marked the culmination of the for-profit industry’s long quest to be treated with the same respect and accorded the same institutional privileges as other sectors of higher education. The very title of the hearing was a misleading rhetorical question—Are Students at Proprietary Institutions Treated Equitably Under Current Law?—that demonstrated Boehner and the for-profit sector’s desire to do away with HEA regulations that uniquely restricted for-profit institutions. Boehner himself opened the hearing by stating “Today, we ask the question, are students at proprietary colleges or proprietary institutions treated equitably under the current law? And I think the answer is no.”44

Both Boehner and the then CEO of Corinthian Colleges, David Moore, claimed at the hearing that the 90–10 rule for proprietary schools was an onerous, counterproductive statutory requirement. Boehner noted that the 90–10 rule required “proprietary institutions to show that least 10 percent of funds are derived from sources outside of Title IV student aid funding—and while this may not seem like too much to ask, looking closely at the rule shows how burdensome it may be.”45 “I believe and others believe,” Boehner stated, “that the accountability provisions still in the law are more than sufficient to prevent the abuses that we saw back in the 1980’s and early 1990’s.”46 The powerful American Council on Education (ACE), the chief lobby for public and other nonprofit colleges and universities, pointedly disagreed, noting in a letter to Boehner the irony of private sector companies opposing a requirement that they demonstrate “there is at least a miniscule private sector market for their service.”47

In his testimony, Corinthian Colleges CEO Moore did allow that the 90–10 rule stemmed from “justified concern about fraud and abuse perpetrated by certain for-profit institutions” in the late 1980s and early 1990s. But Moore, like Congressman Boehner, maintained that concerns about fraud and abuse were a thing of the past that had been “effectively addressed” by the 1992 HEA crackdown on for-profit schools.48 (A year after Moore testified, the GOP attorney general in Florida, Charlie Christ, opened an investigation into allegedly misleading sales tactics, job-placement rates, and promises of transferability of credits at Florida Metropolitan University, a Corinthian Colleges campus, after more than one hundred students filed four lawsuits against FMU).49 Moore told Boehner that he was “sure every one” of the roughly 2,500 Title IV eligible proprietary institutions “was bumping up against the 90–10 rule.”50 In point of fact, just two small for-profit schools lost their Title IV eligibility in the three-year period from 2000 through 2002 for violating the 90–10 rule.51 Nevertheless, President Bush promised on the campaign trail in 2004 that he would push Congress to relax the 90–10 rule.52

The Return of the Boom–Scandal–Bust Cycle

GOP support for the for-profit sector peaked around Boehner’s June 2004 committee hearing. In a matter of months, the long-running boom–scandal–bust cycle of federal regulation of for-profit institutions reasserted itself, shifting into the start of the scandal phase. At investor conferences, Corinthian Colleges CEO David Moore was already expressing alarm about burgeoning government investigations of for-profit chains by May 2004. At a Piper Jaffray conference, Moore told investors that the government investigations were “going to continue and probably going to get worse.”53 A Financial Times piece recounting Moore’s comments previewed a familiar litany of abuses that federal and state agencies were looking at: “Employee allegations that some schools tampered with student records; concerns that job placement rates are exaggerated; whether the schools’ aggressive sales pitches fraudulently portray the benefits of the degree; whether students’ loan-default rates are understated; and whether the schools offer student recruiters illegal performance-based compensation.”54

The scandal phase of the cycle accelerated in September 2004, when the U.S. Department of Education released, in response to a FOIA request, a damning forty-five-page staff report that examined admission practices at the University of Phoenix. The report concluded, as the Arizona Republic put it, that the university was using compensation and sales tactics that ranged “from illegal to unethical to aggressive.”55 Nearly 75 percent of the sixty Phoenix enrollment counselors and staff interviewed by department investigators said that their compensation was “always about the numbers—all about ‘butts in seats’ or ‘asses in classes’—to use the vernacular commonly heard at UOP.”56

According to the department’s report, Phoenix had incentivized staff to recruit unqualified students who could not benefit from their programs. In addition, the university had systematically concealed its schools’ use of compensation formulas that explicitly tied the salaries of admissions counselors to the number of students they enrolled, in violation of the incentive compensation ban governing eligibility for Title IV federal aid. Without admitting guilt, the university and the Department of Education settled the departmental audit for $9.8 million. It was at the time the largest fine ever levied by the department, but a tiny fraction of the more than $1.5 billion in federal student aid that the University of Phoenix could have been obliged to return.57

Shortly before the University of Phoenix settlement, the Career Education Corporation (CEC) reported that the Securities and Exchange Commission and the U.S. Justice Department had investigations underway into the practices of the fast-growing for-profit giant, and the Department of Education soon followed suit. CEC earned more than $1 billion in revenues in 2003 and had nearly 100,000 students (76,400 on sixty-eight campuses, plus 20,900 online). But shareholders and former employees had sued the company, claiming it was overstating enrollment, doctoring student records to obtain federal student loan aid, and exaggerating placement rates for program graduates. The business magazine, Forbes, memorably described CEC as a “company built to swallow Title IV funds in the way a whale gathers plankton.”58

In January 2005, CEC’s stock and reputation took another nosedive when 60 Minutes aired a damaging investigative report by CBS correspondent Steve Kroft entitled “For-Profit College: Costly Lesson.” The 60 Minutes report aired interviews by students who said that admission representatives at CEC’s Brooks College in Long Beach, California had lied to them about the placement rates of their fashion and design courses, telling the students that 98 percent of enrollees were placed in jobs when less than 40 percent of Brooks students even finished their programs. “Crooks College” was the pithy moniker that students had bestowed on the school. Former admission representatives at Brooks told 60 Minutes that they were expected to enroll three high school graduates a week, regardless of their ability to finish their program. One former salesman explained that “The enrollment fee was $50. You need $50, a pulse, and you’ve got to be able to sign your name. That’s about it.”

Not for the first time, an investigative news report used a hidden camera to show how a for-profit school misled its students during the admissions and enrollment process. 60 Minutes associate producer Jennifer MacDonald visited a Katherine Gibbs secretarial school in New York, where she asked about the school’s graduation rate. An admissions representative told her the graduation rate was 89 percent—sixty points higher than the school’s actual graduation rate of 29 percent.

At a CEC Sanford Brown Institute program that prepared students to become medical assistants, the admissions representative lied to MacDonald, telling her the school was highly selective. Taking a cue from the previous generation of investigative reporters, MacDonald promptly took every step she could think of to be denied admission to the program. She deliberately flunked the program’s admission test, answering 43 out of 50 questions incorrectly. MacDonald then took a second admissions test on which she answered 36 out of 50 questions incorrectly. The admissions representative told her that answering 14 out of 50 questions correctly showed that MacDonald had an ability to benefit from the program. Still, MacDonald persisted in her efforts to be denied admission. She told the admissions representative that she had a history of lousy grades and drug use. When that didn’t disqualify her, she told the representative that although she was applying to train to be a medical assistant, she had a “problem with blood.” The representative responded that “98 percent of our students have a problem with blood.”59

Under pressure from Democratic lawmakers on his committee, Congressman Boehner reconvened a hearing on his for-profit legislation in March 2005.60 But this time the tenor and the title of the hearing were very different than the previous year. Instead of examining the differential regulatory treatment of the for-profit sector, the 2005 hearing focused on the 60 Minutes report on the Career Education Corporation, and was entitled Enforcement of Federal Anti-Fraud Laws in For-Profit Education. Nick Glakas, president of the Career College Association, attempted to reassure Boehner that widespread abuses in the for-profit sector would never reoccur because the association’s 1,250 member-schools were “committed to and focused on compliance.” “We have to because of our past,” Glakas told the committee. “We simply cannot and will not allow what happened 15 years ago to happen again.”61

Yet despite Glakas’s assurances, the Phoenix and CEC scandals continued to throw cold water on the industry’s proposals to treat for-profit schools like every other postsecondary institution. In July 2005, a New York Times piece headlined “The School That Skipped Ethics Class” detailed how California’s Bureau for Private Postsecondary and Vocational Education had issued a new report that concluded CEC’s Brooks Institute for Photography in Santa Barbara has persuaded students to enroll by “willfully misleading” them and “falsifying and omitting critical information.” In a precedent that would be repeated a few short years later with Corinthian Colleges, California’s state agency had sent a “secret shopper” posing as a prospective student to the school. An admissions officer told the undercover state agency representative that she could expect her starting salary to be “$50,000 to $150,000” in her first year after graduating from Brooks, even though not a single student who graduated the previous year earned as much as $50,000, with the average graduate earning $26,000.62

A three-month investigation by the Chronicle of Higher Education of American InterContinetal University, CEC’s flagship school, was even more damning. The Chronicle found that AICU routinely admitted high-school dropouts without GEDs, sent other dropouts to unaccredited high schools to get their diploma for a fee of $100 to $200, and had admission officers and their family members sign up for programs they would never attend to artificially boost the number of “starts” AICU reported. Stephen Jerome, president of family-owned for-profit colleges in the Bronx and New Rochelle, New York told the Chronicle that the burgeoning scandals at publicly traded schools had been “a nightmare for the entire sector. For us who do it well, it’s like they’ve stuck a knife into us.”63

A second Chronicle piece underscored that outright fraud by for-profit schools was only a small piece of the predatory practices in the sector that exploited students.64 As part of a research experiment into corruption and duplicity in higher education, Joshua Woods, a doctoral student in sociology at Michigan State University, sent an electronic query to MSU and four for-profit colleges, posing as a thirty-one-year-old high school graduate who was working in construction and was fed up with his job. Woods’ fictional construction worker wanted to get an MBA and become a corporate executive. Woods included this barely literate message in his query to the five universities: “i want to get MBa but i only graduated highshol in many years ago in 1992 i work construction now can you help me?”

MSU responded to Woods’ query with one succinct two-sentence reply, informing him that applicants had to “have a bachelor’s degree to apply for an M.B.A. program” and directed him to the university’s website for additional information on undergraduate study. But all four for-profit colleges fanned the fictional high school graduate’s dreams that he could jump straight from high school to earning his MBA. Corinthian Colleges and ITT Technical Institute each contacted Woods eight times in the month after he submitted his initial query. The “guidance counselors” who responded, Woods found, consistently used “four basic sales themes: opportunity, ease, encouragement, and shame.”

One letter from Corinthian Colleges informed Woods: “Congratulations, you’ve committed to improving your life. We understand how hard it can be to get started, but we can help.” The University of Phoenix wrote “You can do this!” The dean of the American Graduate School of Management wrote Woods that “Research shows that people with a Masters’ degree typically earn significantly more over a lifetime and experience less unemployment.” None of the guidance counselors at the for-profit schools informed Woods that he would have to make sacrifices to enroll in their school, such as obtaining loans, incurring debt, and taking undergraduate prerequisites over a period of years. Woods concluded from his research experiment that “regulators of for-profit higher-education companies should bear in mind that sophisticated sales strategies can be just as misleading as fraud or outright lies.” The sad truth, Woods wrote, was that “All a college must do to boost enrollments is tap into a student’s personal aspirations and cultivate overconfidence with a little encouragement and persuasion. Why resort to fraud when high hopes are so easy to manipulate?”

As it turned out, and despite the aftermath of the 60 Minutes story, Congress didn’t make any progress in regulating fraud, much less in constricting the subtler predatory practices that Woods described. By the end of July 2005, Boehner’s education committee had dropped the provision from its bill to eliminate the 90–10 rule and had watered down the bill’s language to cover all institutions of higher education under a single definition in the Higher Education Act. What survived the legislative vetting and renewed attention to for-profit abuses—as was the cases in previous Congresses—was a bipartisan provision. Boehner’s effort to eliminate the 50 percent rule, which had been part of the 1992 HEA amendments, was quietly tucked into a 2005 budget bill. The repeal of the 50 percent rule enabled unlimited federally funded enrollment growth in online programs and provided for federally funded schools that existed only in the cloud.

The 50 percent rule had prohibited schools from receiving federal student aid if they offered more than 50 percent of their courses by correspondence, or had more than 50 percent of students enrolled in correspondence courses. The 2005 budget act, which provided relief in the aftermath of Hurricane Katrina, maintained the 50 percent limitations for correspondence courses but did away with them for telecommunications/distance learning courses.65 Both Democrats and Republicans believed postsecondary institutions should be doing more to expand online learning, and Katrina helped facilitate the lifting of the 50 percent rule by giving lawmakers a reason to authorize distance education courses for students displaced by the hurricane. To prevent the abuses that had plagued correspondence education, Congress subsequently decided in 2008 to add the requirement that aid-eligible online learning programs had to have “regular and substantive” interaction between students and instructors.

While the CEC and University of Phoenix scandals scotched congressional attempts to eliminate the 90–10 rule and to do away with regulatory distinctions between for-profit schools and other postsecondary institutions, the closing years of the Bush administration nonetheless laid the groundwork for another round of scandals and abuses that took place during the Obama administration. In particular, the elimination of the 50 percent rule in distance education courses66 generated an explosion of online for-profit college programs that qualified for Title IV aid, including those that offered online-only programs to students. In an eerie replay of the early 1970s, when correspondence courses suddenly mushroomed with access to guaranteed student loans and Pell Grants, the abrupt expansion of aid-eligible online programs recreated many of the same abuses that had plagued correspondence courses thirty years earlier.

In 2003, fewer than 50,000 students nationwide enrolled in exclusively online programs in all sectors of higher education.67 Within two years of the lifting of the 2006 elimination of the 50 percent rule, online-only education was no longer an anomaly. The Senate Health, Education, Labor, and Pensions (HELP) committee investigation of the for-profit industry found that eleven for-profit companies alone had enrolled 435,000 students in exclusively online programs by the start of the 2008–09 school year.68 By the fall of 2016, nearly 60 percent of the 1.4 million students enrolled at for-profit institutions were enrolled in exclusively online programs.69 Many other for-profit students had shifted to “brick-and-clicks” for-profit institutions where only a minority of students attended brick-and-mortar classrooms. Of the fourteen large publicly traded for-profit chains evaluated in 2010 by the Senate HELP committee, at least seven of the chains had more than half of their students in exclusively online curriculum.70

A case in point was the dramatic expansion into online education by the Education Management Corporation (EDMC). EDMC was founded in 1962 and acquired the Art Institute of Pittsburgh in 1970. For the next quarter-century, EDMC enjoyed steady growth, establishing Art Institute programs in other cities, and a reputation for providing quality instruction and preparation for jobs in the visual arts, television, and film industries.71 In 1996, EDMC went public and started to expand rapidly from its modest roots, acquiring dozens of colleges in a host of career fields. But its online program remained relatively small. Of the 70,000 students enrolled systemwide in 2006, less than one in ten were enrolled in fully online programs.

In March 2006, a month after President Bush signed into law the elimination of the 50 percent rule, EDMC went private, after three private equity firms, led by Goldman Sachs, purchased the corporation for $3.4 billion. Under the direction of a former CEO from the Apollo Group (owner of the University of Phoenix), EDMC began aggressively recruiting more marginally qualified students and more students for online-only programs. Barmak Nassirian of the American Association of Collegiate Registrars and Admission Officers told the Huffington Post “2006 was the significant year, because that was the year that the smartest people [from Goldman Sachs] figured out how easy it was going to be to grow geometrically. . . . . You’d have to be from Mars not to know that they were smelling an easy path to big bucks.”72 Indeed, by 2010, four short years later, EDMC’s enrollment had nearly doubled, to more than 150,000 students, while its online-only enrollment had increased almost ten-fold during the same time-period, to 42,000 students.73

As had happened so many times in the past, EDMC’s astonishing growth stemmed in part from the use of predatory recruiting tactics by EDMC salespersons, who were instructed to re-dub themselves as the “assistant director of admissions” on calls with potential customers. Like the correspondence school salespersons of the 1970s, and later, the sales force of Trump University,74 EDMC recruiters were encouraged to “find the pain” in potential students to use the prospective students’ past failures in careers and education to trigger their interest in enrolling. One EDMC sales call handout obtained by the Huffington Post instructed recruiters to follow three steps when talking to a new prospective student: “1. Build em Up! … 2. Break Em Down! Find the PAIN!… 3. Build em Up!” Recruiters told prospective students with felony records that earning a criminal justice degree would allow them to achieve their dream of joining the FBI, though the FBI is barred from hiring individuals with felony records. Students without a computer or access to the Internet were encouraged to enroll in online-only courses.75

Recruiters, moreover, seemed to be compensated based almost entirely on how many students they enrolled and signed up for federal aid, despite EDMC’s nominal bow to other “quality” factors in paying recruiters. In 2007, whistleblowers alleged that EDMC had been illegally compensating recruiters based on how many students they enrolled, leading the company to falsely claim federal student aid of roughly $11 billion in previous years. In 2011, the U.S. Department of Justice joined the whistleblowers’ lawsuit, along with dozens of states. EDMC adamantly denied the allegations, but in 2015, without admitting guilt, EDMC reached a $95.5 million settlement with the federal government. The $95.5 million settlement was the largest False Claims Act settlement with a for-profit chain in history, and in announcing the settlement, U.S. Attorney General Loretta Lynch denounced EDMC as a “high pressure recruitment mill.” Secretary of Education Arne Duncan went further, saying that EDMC had “outright lied” when it certified that it complied with the incentive compensation ban. Separately, EDMC also agreed to forgive $103 million in student loans that the company had made directly to 80,000 former students, or roughly $1,300 per student.76

Like EDMC, Bridgepoint Education, Inc. enjoyed a similar explosion in federal funding after the elimination of the 50 percent distance education rule. In 2005, Bridgepoint Education purchased a small, struggling liberal arts college in Clinton, Iowa, that had fewer than 350 students, The Franciscan University of the Prairies. Bridgepoint renamed the school Ashford University and used the school’s accreditation as a platform to launch a giant online-only learning program supported largely with federal student aid. In 2005–06, Ashford University had 1,850 online students receiving $16 million in federal student aid. Four years later, by the 2009–10 school year, Ashford University’s online-only enrollment had increased forty-fold, to about 75,000 online students, and federal student aid funds had soared to $613 million.

In a two-year period alone, the number of enrollment advisors for Ashford jumped from one hundred recruiters to nearly one thousand. An audit by the Department of Education’s inspector general, Kathleen Tighe, determined that Ashford’s compensation plan for its enrollment advisors did not qualify for the regulatory safe harbors established by the Bush administration, and concluded that Bridgepoint was violating the incentive ban on paying recruiters based on the number of students they enrolled.77 Just as was the case with EDMC, Bridgepoint recruiters used high-pressure sales pitches reminiscent of the correspondence programs of the 1970s. The 2012 Senate HELP report found that Bridgepoint recruiters used a sales technique known as “overcoming objections.” If a prospective student objected that the cost of a program was too high, recruiters were instructed to respond with questions like “Investing in yourself. . . . You’re worth it right?” or told to tell students that financing options were available “for those who qualify.”

As Bridgepoint expanded rapidly, the U.S. Department of Education, the Consumer Financial Protection Bureau, the Securities and Exchange Commission, and five state attorneys general would soon launch investigations of Bridgepoint or sue the company for fraud and a variety of deceptive acts or practices.78 In 2014, without admitting wrongdoing, Bridgepoint agreed to pay the state of Iowa $7.25 million for alleged violations of the state’s Consumer Fraud Act that included making false or misleading statements and utilizing high-pressure sales-tactics to get students to enroll.79 (In the Trump administration, Secretary of Education Betsy DeVos subsequently hired Bridgepoint’s chief compliance officer, Robert Eitel, as a senior adviser.)

The elimination of the 50 percent distance education rule was not the sole federal action that set the stage for a new round of abuses in the for-profit sector. A series of other little-noticed legislative changes at the end of the Bush administration helped precipitate a veritable flood of scandals, for-profit bankruptcies, and lawsuits in the Obama administration. In the Higher Education Opportunity Act (HEOA) of 2008, Congress reduced the limited impact of the 90–10 rule by requiring that for-profit schools had to violate the rule not for one year but for two years in a row to be cut off from Title IV aid—allowing for-profit schools to alternate years in which they received more than 90 percent of aid from Title IV without fear of being sanctioned. Similarly, HEOA’s temporary program to allow for-profit institutions to provide institutional loans to students that counted as revenues against the 90–10 cap propelled institutions to provide private loans to hundreds of thousands of low-income students at high interest rates.

Meanwhile, the dramatic expansion of educational benefits to veterans, service personnel, and their spouses in the 2008 post-9/11 GI Bill and 2008 tuition assistance program legislation drove for-profit schools to intensively recruit tens of thousands of veterans, often with predatory sales tactics, to enable institutions to circumvent the 90–10 rule. Congress’s expansion of loans for graduate students, and its lifting of borrowing caps for graduate students in 2006, led to a concurrent explosion in borrowing by minority students in graduate schools, particularly at poorly performing for-profit law schools.

Deregulation by the Bush administration, including the introduction of safe harbors that allowed for-profit recruiters to skirt the incentive compensation ban, led to widespread recruitment of marginal students who were unprepared for college programs. So too did the dramatic growth of giant, publicly traded for-profit chains, which faced market pressures to show constant growth in enrollment, fueling a return of the misleading ads and job placement claims that have plagued the for-profit sector since the days of the 1944 GI Bill of Rights.

In short, by the end of the Bush administration, all the financial incentives for for-profit colleges pointed in the wrong direction—away from accountability for program performance, and away from investing in quality education and training for students. Incentives matter, and not just in market theory. Getting incentives right is no guarantee that markets will function well. But getting incentives consistently wrong is an invitation to cutting corners, deception, fraud, and predatory marketing.

The GOP-controlled Congress and the Bush administration’s deregulatory agenda ultimately led to the resurgence in the Obama years of the very abuses that leaders of the for-profit sector had zealously insisted were a thing of the past. Lessons had been learned and the bad old days would never return—or so for-profit leaders claimed during the Bush years. In 2018, the Trump administration and the GOP-led Congress, with its deregulatory agenda, is at a similar inflection point to that of the Bush administration in 2001. The question now is what, if anything, will the Trump administration and lawmakers learn from the history of the past sixty years of federal regulation of for-profit schools?

Timeline of For-Profit Higher Education

Scroll through the below timeline to view the history of for-profit higher education.

Notes

- Frederick M. Hess, Michael B. Horn, and Whitney Downs, “Introduction,” in Private Enterprise and Public Education, ed. Frederick M. Hess, Michael B. Horn (New York: Teachers College Press, 2013), 5.

- Letter from Secretary of Education William Bennett to Senator Edward Kennedy, quoted in “Bennett Asks Congress to Put Curb On ‘Exploitative’ For-Profit Schools,” Education Week, February 17, 1988.

- “Statement on Signing the Higher Education Amendments of 1992,” The American Presidency Project, July 23, 1992.

- Stephanie R. Cellini, Rajeev Darolia, Lesley J. Turner, “Where Do Students Go When For-Profit Colleges Lose Federal Aid?” National Bureau of Economic Research, NBER Working Paper 22967, December 2016, 12, 28. The numbers in the December 2016 paper are based on comprehensive administrative data from the U.S. Department of Education. Professor Cellini provided a supplementary breakdown of the administrative data tallies in the NBER paper in a September 19, 2017 email to the author.

- Stephen Burd, interview with author, May 8, 2018.

- Ibid.

- William A. Morrill and Rebecca Adamson, “Gatekeeping,” Mathtech, Inc., Report submitted the U.S. Department of Education, Office of the Undersecretary, Planning and Evaluation Service, Contract No. EA94078001, April 10, 1997, 15. Under the SPRE regulations, a postsecondary institution and the Department of Education had to resolve disputed infractions before they were referred to the SPREs. Before the SPRE program was shut down, the department ultimately notified SPREs in seven states (where the department had approved state standards for reviewing institutions) of the schools that the department had flagged for review. All told, the department referred 147 schools to the seven SPREs for further investigation—90 proprietary schools, 16 public institutions, and 41 private institutions.

- See Terese Rainwater, “The Rise and Fall of SPRE: A Look at Failed Efforts to Regulate Postsecondary Education in the 1990s,” American Academic 2 (2006): 111–12; and Leah K. Matthews, “Toward Institutional Autonomy or Nationalization? A Case Study of the Federal Role in U.S. Higher Education Accreditation,” PhD. Dissertation, College of Education and Human Development, George Mason University, April 30, 2012,34, 102–03.

- Nearly 850 of the schools, or 82 percent of the 1,028 schools that lost their Title IV eligibility from 1991 to 2000, were for-profit schools (844 schools). Stephanie R. Cellini, Rajeev Darolia, Lesley J. Turner, “Where Do Students Go When For-Profit Colleges Lose Federal Aid?” National Bureau of Economic Research, NBER Working Paper Series, Working Paper 22967, December 2016, 10, 25, and 28. A supplementary breakdown of Education Department administrative data used in the December 2016 NBER paper was provided by Professor Stephanie Cellini of George Washington University to the author in a September 19, 2017 email.

- Quoted in Stephen Burd, “The Subprime Student Loan Racket,” Washington Monthly, November/December 2009.

- Waddles resigned from ITT in July 2004, after ITT acknowledged it was under investigation by the California attorney general, the SEC, and after federal agents from the Justice Department raided ITT’s headquarters and ten campuses in search of documents related to the company’s student placement, retention, attendance records, and other data integral to the company’s participation in federal student aid programs. Prior to resigning, but before the company disclosed it had been under investigation by the California attorney general since October 2002 for falsifying student grades and attendance to obtain federal student aid, Waddles sold 100,000 shares of ITT common stock for $3.9 million. See Consolidated Class Action Complaint, City of Austin Police Retirement System v. ITT Educational Services, Inc., et al., U.S. District Court, (S.D., Indiana, Indianapolis Division), Civil Action No.: 1:04-cv-00390-DFH-TAB, August 19, 2004, 3–6, 52, 55–57, http://securities.stanford.edu/filings-documents/1030/ESI04-01/2004819_r01c_04cv0380.pdf. Also see Elizabeth F. Farrell, “President of ITT Resigns: Company Denies Any Link to Shareholders’ Suit and Federal Inquiry,” Chronicle of Higher Education, July 13, 2004.

- See Stephen Burd, “For-Profit Trade Schools Win New Respect in Congress,” Chronicle of Higher Education, September 4, 1998, A47. Burd reported that “trade schools are verging on winning back much of what they lost in 1992.” Among other provisions, Burd noted that the House version of the 1998 Higher Education Act amendments rewrote HEA’s definition of “institutions of higher education” to include proprietary schools, a change long sought by for-profit trade school associations (but which was ultimately dropped from the 1998 law). Burd did note that the traditional higher education lobby, led by the American Council of Education (ACE), continued to oppose a number of statutory changes proposed by the trade school lobby. The Career College Association wanted House lawmakers to require, not just allow, the Department of Education to hold appeal proceedings for maintaining Title IV eligibility for institutions that met the standards for serving needy students—defined as schools that served at least 70 percent disadvantaged students and had at least 70 percent of a given class earning degrees or making good progress toward their degrees. ACE’s new president, Stanley Ikenberry, in a letter on behalf of twenty-seven higher education groups, urged Congress not to mandate appeal proceedings, saying the change could “render the default rate cutoff meaningless” and warned that lawmakers should “exercise caution” about incentivizing schools to recruit students out of unemployment lines. In 2002, the Career College Association, the major lobbying group for the for-profit industry, withdrew from ACE, citing its inability to agree on goals with ACE for reauthorization of HEA. CCA’s general counsel, Nancy Broff, complained to the Chronicle of Higher Education that CCA was “tired of being treated like second-class citizens.” Terry Hartle, ACE’s senior vice-president for government and public affairs, responded that “CCA suffers from a Rodney Dangerfield complex. They feel they don’t get enough respect from anyone. Despite that, they’re very effective lobbyists.” Anne Marie Borrego, “For-Profit Colleges Pull Out of Higher-Education Group,” Chronicle of Higher Education, October 18, 2002, A28.

- See the testimony of Thomas Carter, Deputy Inspector General, U.S. Department of Education, in Enforcement of Federal Anti-Fraud Laws in For-Profit Education, Hearing before the House Committee on Education and the Workforce, 109th Cong., 1st Sess., Serial No. 109-2, March 1, 2005, 37. Thomas testified that when the OIG recalculated an alternative/adjusted default rate that excluded borrowers in deferments or forbearance and also included defaults in the ninety-day period following the two-year cohort period, the adjusted default rate in FY 1999 was 8.4 percent, 50 percent higher than the official 5.7 percent figure.

- Apart from the expanded use of deferments, forbearances, and prolonged delinquencies to artificially lower default rates, a generous appeals process allowed sanctioned schools with high default rates to avoid the loss of Title IV eligibility as well. From 2005 to 2007, the federal government didn’t sanction any schools for exceeding the default rate cutoffs, and from 1999 to 2014 just eleven sanctioned colleges were ultimately removed from the Title IV student aid programs due to high cohort default rates. A 2015 Senate HELP committee white paper prepared for Senator Lamar Alexander concluded that “the number of institutions actually kicked out of the federal student aid program [for having high default rates] is shockingly small.” “Risk-Sharing/Skin-in-the Game Concepts and Proposals,” Staff White Paper prepared for Senator Lamar Alexander, Chairman of the Senate Health, Education, Labor, and Pensions, March 23, 2015, 3–4.

- David Whitman, “Vietnam Vets and a New Student Loan Program Bring New College Scams,” The Cycle of Scandal at For-Profit Colleges, The Century Foundation, February 13, 2017, https://tcf.org/content/report/vietnam-vets-new-student-loan-program-bring-new-college-scams/.

- To be more precise, institutions that offered more than 50 percent of their courses by correspondence, or where more than 50 percent of students were enrolled in correspondence courses, were barred from receiving federal student aid.

- Richard Ruch, Higher Ed, Inc: The Rise of the For-Profit University (Baltimore, Md.: John Hopkins University Press, 2001), 63.

- Cited in Daniel Golden, “Hardselling the Homeless,” Bloomberg Businessweek, May 3–10, 2010.

- Melanie Hirsch, “What’s In a Name? The Definitions of an Institution Higher Education and Its Effect on For-Profit Postsecondary Schools,” Legislation and Public Policy 9 (2006): 822.

- See Kevin Kinser, From Main Street to Wall Street: The Transformation of For-Profit Higher Education: ASHE Higher Education Report 31, no. 5 (February 2006), 47; and Emily Hanford, “The Story of the University of Phoenix,” American Radioworks, September 2012.

- Cited in Daniel L. Bennett, Adam R. Lucchesi, and Richard K. Vedder, “For-Profit Higher Education: Growth, Innovation, and Regulation,” Center for College Affordability and Productivity, July 2010, 15–16. A 2010 Senate report from Senator Tom Harkin’s HELP committee notes that in the first quarter of 2010, the Apollo Group reported an enrollment of 458,600 students, “more than the undergraduate enrollment of the entire Big Ten conference.” “Emerging Risk?: An Overview of Growth, Spending, Student Debt and Unanswered Questions in For-Profit Higher Education,” Senate Health, Education, Labor, and Pensions Committee, June 24, 2010, 2.

- Suzanne Mettler, Degrees of Inequality: How the Politics of Higher Education Sabotaged the American Dream (New York: Basic Books, 2014), 88.

- Gordon C. Winston, “For-Profit Higher Education: Godzilla or Chicken Little?” Change, January/February 1999, 18. Other coverage at the time that suggested publicly traded for-profit colleges constituted a new breed of colleges included James Traub, “Drive-Thru U,” New Yorker, October 20, 1997, 114–23, https://www.newyorker.com/magazine/1997/10/20/drive-thru-u.

- Gary A. Berg, Lessons from the Edge: For-Profit and Nontraditional Higher Education in America (Westport, Conn.: Praeger, 2005), 11. Berg was dean of extended education at California State University Channel Islands.

- Stephen Burd, “Promises and Profits,” Chronicle of Higher Education, January 13, 2006, A21.

- Reauthorization of the Higher Education Act of 1965, Part 1, Senate Subcommittee on Education, Arts, and Humanities, Senate Labor and Human Resources Committee, 102nd Cong., 1st. Sess., S. Hrg. 102–221, Part 1, April 11, 1991, 674, 678. With the support of the Gerald Ford administration, Congress had enacted an early version of the ban in 1976 that barred programs that used commissioned salespersons who promoted “the availability of any [Title IV] loan program . . . at [their] institution” from the guaranteed student loan program. See Public Law 94-482, 90 STAT. 2130, October 12, 1976.

- Amy Joyce, “Computer Learning Targeted; Agency Tells Va. Firm to Return $187 Million,” Washington Post, December 16, 2000, p. E1. Years earlier, Gerald Ford’s Federal Trade Commission had laid out the rationale for a ban on commissioned recruiters. An FTC staff report found that, at problem schools,“Salespeople work under the ‘carrot’ of commission and the ‘stick’ of quotas, often under strong pressures to produce enrollments no matter what the student’s needs and capabilities are and no matter what methods are used to make the sale.” Quoted in Proprietary Vocational and Home Study Schools, Final Report to the Federal Trade Commission and Proposed Trade Regulation Rule, Federal Trade Commission, December 10, 1976, 125, https://drive.google.com/file/d/0B7aqIo3eYEUtQUhtUXRmOTFzZFk/view?usp=sharing.

- “CLC completes bankruptcy sale, collecting $23M,” Washington Business Journal, April 16, 2001. Other sources indicate that CLC had nearly 10,000 students, not 3,800 students when it declared bankruptcy. See “In Brief,” Washington Post, April 17, 2001 and Stephen Burd, “For-Profit Colleges Praise a Shift in Attitude at the Education Department,” Chronicle of Higher Education, November 9, 2001. A long takeout on CLC’s collapse in the Chronicle of Higher Education reported that the company had 9,000 students when it closed. Anne Marie Borrego, “How a Computer-Training Chain Crashed in Plain Sight,” Chronicle of Higher Education, February 16, 2001.

- Robert MacArthur, Online Education Fraud: The Diary of a Short Seller (Ridgefield, Conn.: Alternative Research Services, Inc., 2014), 5,6, 232.

- Higher Education Amendments of 1992, 102nd Cong., 1st sess., 1992, https://www.congress.gov/bill/102nd-congress/senate-bill/1150.

- “Department of Education, Final Regulations, 34 CFR Parts 600, 668, 673, 674, 675, 682, 685, 690, and 694, Federal Student Aid Programs,” Federal Register 67, no. 212 (November 1, 2002). Secretary Paige’s quote is at p. 67,054. The twelve safe harbors to the incentive compensation ban are detailed and discussed at pp. 67,053–057. Secretary Paige signed the safe harbors final regulations on October 23, 2002.

- The Interboro Institute was one of the fastest-growing proprietary schools in New York State from 2001 to 2006, with enrollment quadrupling from 1,000 students to 4,000 students. Interboro deliberately recruited low-income students who had dropped out of high school, in part through New York City subway ads that offered students an opportunity to earn a GED and two-year college degree in sixteen months. For several years, more than 90 percent of students applying to enroll in Interboro purportedly passed their ability-to-benefit tests, demonstrating that they could be expected to handle college-level work. But investigations by the state education department and U.S. Department of Education determined that Interboro executives and admission officers were cheating, enabling students to access federal student aid who had not passed their ability-to-benefit tests. Following its investigation, the U.S. Department of Education ordered Interboro to repay the federal government $2.5 million in improperly awarded federal student aid. See Karen W. Arenson, “Commercial College Ordered to Repay U.S. $2.5 Million,” New York Times, August 17, 2007; Karen W. Arenson, “Investors Say Flaws at School Are Deeper,” New York Times, July 24, 2006; and Karen W. Arenson, “A College Is Accused of Cheating in Aid Process,” New York Times, December 6, 2005. As reports of abuse by Interboro and other for-profit schools piled up, the New York State Board of Regents imposed a moratorium on opening new for-profit colleges in the state in January 2006, and that same month Governor George Pataki, a Republican, proposed that the state withhold financial aid from college students who had not graduated from high school. Karen W. Arenson, “New York Moves to Limit Colleges that seek Profit,” New York Times, January 21, 2006.

- Memorandum from William D. Hansen, Deputy Secretary to Terri Shaw, Chief Operating Officer, Federal Student Aid, “Enforcement Policy for violations of incentive compensation prohibition by institutions participating in student aid programs,” U.S. Department of Education, October 30, 2002.

- Elizabeth F. Farrell, “A Common Yardstick?” Chronicle of Higher Education, August 15, 2003, A25.

- “Department of Education: Proposed Rules, 34 CFR Parts 600, 668, 673, 675, 682, 685, 690, and 694,” Federal Register 67, no. 154 (August 8, 2002): 51,719.

- Stephen Burd, “For-Profit Colleges Want a Little Respect,” Chronicle of Higher Education, September 5, 2003, A23.

- Sam Dillon, “Online Colleges Receive a Boost from Congress,” New York Times, March 1, 2006, https://www.nytimes.com/2006/03/01/us/online-colleges-receive-a-boost-from-congress.html.

- Quoted in Jeffrey J. Selingo, “News Analysis: ACE’s New President Faces Challenging Terrain,” Chronicle of Higher Education, January 17, 2008.

- Cited in Carolyn Kleiner Butler, “Commercial Schools Lobby for Relaxation of Rules,” New York Times, July 27, 2005.

- Thomas B. Edsall, “Controversial Industries Have Backed Boehner,” Washington Post, January 29, 2006, http://www.washingtonpost.com/wp-dyn/content/article/2006/01/28/AR2006012801009.html.

- Enforcement of Federal Anti-Fraud Laws in For-Profit Education, Hearing before the House Committee on Education and the Workforce, 109th Cong., 1st Sess., Serial No. 109-2, March 1, 2005, 74.

- Stephen Koff, “Boehner in Line to be House majority leader,” Cleveland Plain Dealer, January 10, 2006. Also see Larry Margasak and Sharon Theimer, Associated Press, “House leader Boehner built empire with some similarities to DeLay’s,” Salt Lake Deseret News, February 5, 2006, https://www.deseretnews.com/article/635181808/House-leader-Boehner-built-empire-with-some-similarities-to-DeLays.html.

- The Higher Education Act, as amended in 1998, contained two separate definitions of an institution of higher education (IHE). One section of the law, 20 U.S.C. sec. 1002, governs when an IHE is eligible for Title IV aid. Under sec. 1002, for-profit schools were already eligible for all of the major components of federal student aid—Pell Grants, Stafford Loans, Federal PLUS loans, Supplemental Equal Opportunity Grants (SEOG), and so on.

The second definition of an IHE in the Higher Education Act, contained in 20 U.S.C. sec. 1001, is a general definition that determines institutional eligibility for non-Title IV programs. The general definition of an IHE does not include proprietary schools, excluding them from eligibility for institutional grants in non-Title IV programs.

Non-Title IV programs are mostly reserved for colleges and universities that serve special niches in the public and nonprofit sector. Title III-A competitive and discretionary grants largely go to community colleges to help them become self-sufficient and better serve low-income students; Title III-B discretionary grants go largely to Historically Black Colleges and Universities (HBCUs) to establish or strengthen their physical plants, financial management, and academic resources, with a smattering of grants for tribal colleges. Title V grants support the development of Hispanic-Serving Institutions (HSIs).

Congressman Boehner and for-profit industry leaders maintained that the two different definitions of IHEs in the Higher Education Act, and the exclusion of for-profits from non-Title IV programs, was an unfair form of differential treatment that made proprietary schools “second-class citizens.” However, it was not clear that, even if the HEA established a single universal definition of an IHE, for-profits could compete for a substantial, new influx of institutional grants, and students themselves would certainly not be qualifying for additional direct federal aid. Not even for-profit college executives lobbying for the definitional change, such as Corinthian College CEO David Moore, believed that many for-profits would have the time, inclination, and grant writers to compete with other postsecondary institutions for these grants.

Under pressure from community colleges, HBCUs, and HSIs, Boehner amended his bill to clarify that for-profit schools would continue to remain ineligible for Title III and Title V grants. Boehner’s amended bill would have merely allowed for-profit institutions to compete for some comparatively modest federal teaching training grants, state need- and merit-based grants, and non-HEA grants (for example, from the National Science Foundation).