This week, the Biden administration announced the approval of $7.7 billion in federal student loan discharges for borrowers eligible for Public Service Loan Forgiveness (PSLF); lower-income borrowers eligible for forgiveness under a newly-created repayment plan; and lower-income borrowers receiving relief as a result of the Biden administration’s fixes to income-driven repayment programs. This announcement brought the administration’s total student loan discharges to a staggering $167 billion since Biden took office.

The Biden administration has provided more student debt relief than has ever been provided by any administration since the inception of the student loan program. The administration’s debt relief efforts have brought life-altering debt relief to nearly 4.75 million student loan borrowers. That means that more than one in ten of all federal student loan borrowers have received relief through the Biden administration’s efforts.

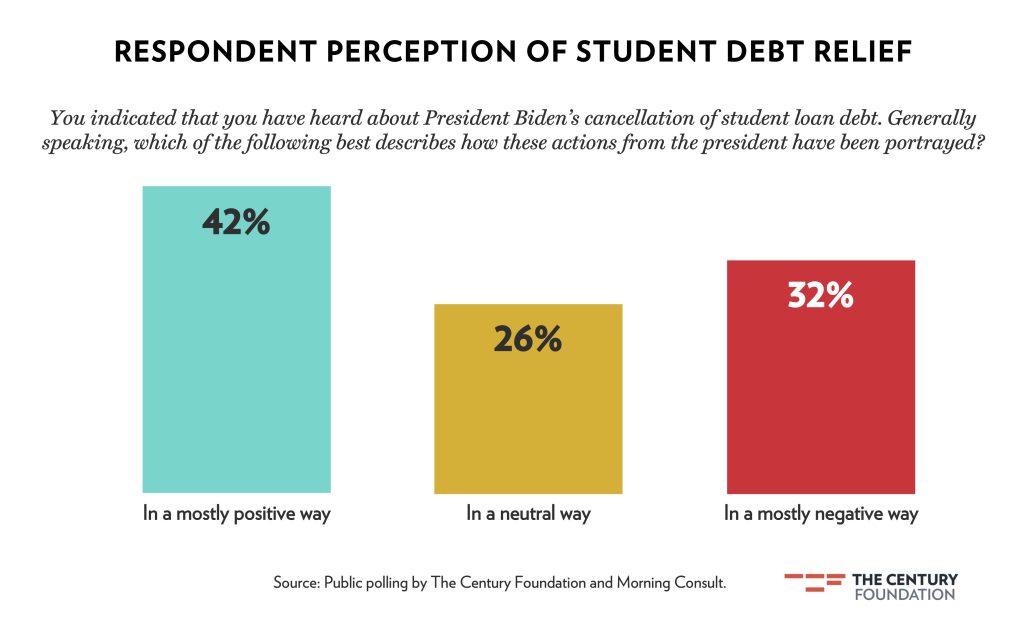

Despite the historic amount of loan relief provided, the administration’s efforts on student debt relief have elicited a relatively muted reaction from the public. Polling by The Century Foundation (TCF) and Morning Consult found that a significant slice of voters—29 percent—had heard little or nothing at all about Biden’s student loan debt relief successes. Moreover, of those who were aware of Biden’s student debt relief efforts, the majority had heard it described in a neutral or mostly negative way. What can explain this lukewarm or even negative response?

The public’s tepid response to Biden’s successes could reflect conservative media sources’ efforts to falsely spin student debt relief as something that mostly benefits higher-income people, or it could stem, in part, from the fact that a significant proportion of the American public—around 37 percent—has never attended college. In addition, the public’s response may stem, in part, from how the administration’s debt relief efforts have unfolded—in fits and starts, and with one significant stumble. That stumble came when Biden’s first student debt plan, announced in 2022, was halted when the U.S. Supreme Court ruled that the administration lacked statutory authority for the plan. The plan would have provided up to $20,000 in debt relief to most federal student borrowers. However, since that defeat, the administration has pursued a slew of successful alternative avenues that have resulted in substantial amounts of debt relief.

Biden’s successes include fixes to existing debt forgiveness programs to expand relief to borrowers working in public service, lower income borrowers, borrowers with disabilities, borrowers victimized by predatory for-profit colleges, and borrowers affected by abrupt school closures. The administration also developed a new, more generous student loan repayment program, Saving on a Valuable Education (SAVE), which provided additional paths to debt relief for lower-income borrowers. Finally, the Biden administration launched a rulemaking to create new regulatory pathways to student debt relief. These successful efforts have received less fanfare than Biden’s initial failed plan, but have led to varied and dramatic debt relief for millions of Americans.

Relief for Borrowers Who Work in Public Service

One of the most dramatic successes of the Biden administration’s student debt relief is its overhaul of the Public Service Loan Forgiveness (PSLF) program. As a result of Biden’s overhaul of the program, Americans who have devoted their careers to public service have now received a full $68 billion in loan relief.

The PSLF program was designed to attract college graduates into comparatively low-paying but highly socially valuable work such as teaching, social work, nursing, fire fighting, and other types of government service. The program promises college graduates that if they choose service-oriented careers and work to pay off their loan, they will be relieved of their remaining federal student loan debt after ten years of payments. However, complex eligibility requirements, coupled with misconduct from the loan servicers, prevented most eligible borrowers from accessing relief under the program.

The Biden administration took several effective steps to address these barriers to accessing relief under the program. First, the administration created a one-time waiver to permit borrowers who had been in the wrong repayment program or in the wrong federal loan type to have their payments count toward PSLF forgiveness. The administration also amended the PSLF regulations to expand opportunities for borrowers to earn credit toward PSLF while in deferment or forbearance. These changes helped open the floodgates for PSLF relief. The number of borrowers who have received PSLF forgiveness leaped from just 7,000 at the start of the Biden administration to more than 942,000.

Relief for Victims of Predatory Colleges and School Closures

The Biden administration also provided much-needed relief to borrowers who were preyed upon by predatory for-profit colleges or who attended schools that closed abruptly while they were enrolled. So far, the administration has provided over $28.5 billion in debt discharges to more than 1.6 million of these borrowers. This relief includes relief provided via a sweeping settlement that challenged the Trump administration’s failure to implement federal rules that provide for relief for defrauded students.

Relief for Lower-Income Borrowers

Lower-income borrowers who have been in repayment for decades are also getting relief under the Biden administration. So far, nearly 1 million borrowers have received close to $51 billion in debt relief as a result of the administration’s tweaks to a program known as Income Driven Repayment (IDR), a program that links monthly loan payment amounts to a borrowers’ income. Under the program, borrowers who have been in repayment for twenty or twenty-five years can qualify for forgiveness of their remaining student debt. The administration made changes to expand the types of payments that qualify for relief, giving borrowers additional credit toward forgiveness and helping more than 1 million borrowers receive discharges for their remaining balances.

Relief for Disabled Borrowers

The Biden administration’s actions have also extended debt relief to more than half a million disabled borrowers, totalling more than $14 billion in debt relief. This relief came from fixes to existing rules that provide for debt relief to student loan borrowers who are totally and permanently disabled or have disabilities that limit their ability to work for an extended period. Disabled borrowers faced onerous administrative hurdles that prevented many eligible borrowers from receiving this relief. Under Biden, the U.S. Department of Education implemented a change to the federal rules on debt relief to eliminate paperwork obstacles and expand eligibility for relief. Before these reforms, many borrowers with disabilities did not apply because they did not know that they were eligible for a loan discharge or were unable to access relief due to the cumbersome and complex application process. The rule is expected to lead to billions of dollars in additional loan relief over the next ten years.

Relief through the SAVE Loan Repayment Plan

The Biden administration has also enacted rules establishing a new loan repayment program, the Saving on a Valuable Education (SAVE) Plan, which provides additional avenues for debt relief, including a new, shortened time-to-forgiveness benefit for borrowers with smaller loans. These borrowers can qualify for discharges of their remaining loan balance after ten years of repayment. This new avenue for debt relief has already resulted in more than $5.5 billion in loan discharges to more than 414,000 borrowers.

Expanding Relief to Millions More Borrowers through Rulemaking

In April, the Biden administration released a new proposed rule that would extend student loan relief to as many as 30 million borrowers when combined with the administration’s other debt relief actions. The new plan relies on different statutory authority than the plan that faced hurdles at the Supreme Court.

The plan would provide relief to several categories of borrowers, including borrowers who have seen their debt grow because of unpaid interest. It would cancel up to $20,000 in interest for borrowers who owe more than they originally borrowed. The new plan would eliminate paperwork hurdles to debt relief by providing automatic loan cancellation for borrowers eligible for loan forgiveness under certain existing debt relief programs. The plan would also cancel debt for borrowers who entered repayment more than twenty years ago.

Importantly, the administration’s new rule would also complement the administration’s work, through passage of the Gainful Employment Rule, to hold colleges accountable for providing programs that benefit students by granting loan relief to borrowers who enrolled in low-value programs that left them with few job prospects and unmanageable debt. The plan would cancel student debt for borrowers that took out loans to attend programs that lost their eligibility to participate in federal student aid because they cheated or took advantage of students, or because they offered programs that failed to provide any earnings boost to students.

The administration has also announced that it plans to issue additional proposed rules to cancel debt for certain borrowers experiencing hardship that prevents them from fully paying back their loans.

Looking Ahead

The Biden administration has provided billions of dollars in student debt relief and laid the groundwork for billions more in relief to go to millions more Americans with the implementation of new rules. This debt relief will bring life-changing relief for millions of borrowers, permitting them to move forward with major milestones like buying a home and starting a family. The Biden administration’s accomplishments warrant public recognition and celebration.

Editorial note: This commentary was updated on May 24, 2024 to include additional student debt relief announced by the Biden administration.

Tags: higher education, student loan, federal student aid

Biden’s Unrecognized Successes on Student Debt Relief

This week, the Biden administration announced the approval of $7.7 billion in federal student loan discharges for borrowers eligible for Public Service Loan Forgiveness (PSLF); lower-income borrowers eligible for forgiveness under a newly-created repayment plan; and lower-income borrowers receiving relief as a result of the Biden administration’s fixes to income-driven repayment programs. This announcement brought the administration’s total student loan discharges to a staggering $167 billion since Biden took office.

The Biden administration has provided more student debt relief than has ever been provided by any administration since the inception of the student loan program. The administration’s debt relief efforts have brought life-altering debt relief to nearly 4.75 million student loan borrowers. That means that more than one in ten of all federal student loan borrowers have received relief through the Biden administration’s efforts.

Despite the historic amount of loan relief provided, the administration’s efforts on student debt relief have elicited a relatively muted reaction from the public. Polling by The Century Foundation (TCF) and Morning Consult found that a significant slice of voters—29 percent—had heard little or nothing at all about Biden’s student loan debt relief successes. Moreover, of those who were aware of Biden’s student debt relief efforts, the majority had heard it described in a neutral or mostly negative way. What can explain this lukewarm or even negative response?

The public’s tepid response to Biden’s successes could reflect conservative media sources’ efforts to falsely spin student debt relief as something that mostly benefits higher-income people, or it could stem, in part, from the fact that a significant proportion of the American public—around 37 percent—has never attended college. In addition, the public’s response may stem, in part, from how the administration’s debt relief efforts have unfolded—in fits and starts, and with one significant stumble. That stumble came when Biden’s first student debt plan, announced in 2022, was halted when the U.S. Supreme Court ruled that the administration lacked statutory authority for the plan. The plan would have provided up to $20,000 in debt relief to most federal student borrowers. However, since that defeat, the administration has pursued a slew of successful alternative avenues that have resulted in substantial amounts of debt relief.

Biden’s successes include fixes to existing debt forgiveness programs to expand relief to borrowers working in public service, lower income borrowers, borrowers with disabilities, borrowers victimized by predatory for-profit colleges, and borrowers affected by abrupt school closures. The administration also developed a new, more generous student loan repayment program, Saving on a Valuable Education (SAVE), which provided additional paths to debt relief for lower-income borrowers. Finally, the Biden administration launched a rulemaking to create new regulatory pathways to student debt relief. These successful efforts have received less fanfare than Biden’s initial failed plan, but have led to varied and dramatic debt relief for millions of Americans.

Relief for Borrowers Who Work in Public Service

One of the most dramatic successes of the Biden administration’s student debt relief is its overhaul of the Public Service Loan Forgiveness (PSLF) program. As a result of Biden’s overhaul of the program, Americans who have devoted their careers to public service have now received a full $68 billion in loan relief.

The PSLF program was designed to attract college graduates into comparatively low-paying but highly socially valuable work such as teaching, social work, nursing, fire fighting, and other types of government service. The program promises college graduates that if they choose service-oriented careers and work to pay off their loan, they will be relieved of their remaining federal student loan debt after ten years of payments. However, complex eligibility requirements, coupled with misconduct from the loan servicers, prevented most eligible borrowers from accessing relief under the program.

The Biden administration took several effective steps to address these barriers to accessing relief under the program. First, the administration created a one-time waiver to permit borrowers who had been in the wrong repayment program or in the wrong federal loan type to have their payments count toward PSLF forgiveness. The administration also amended the PSLF regulations to expand opportunities for borrowers to earn credit toward PSLF while in deferment or forbearance. These changes helped open the floodgates for PSLF relief. The number of borrowers who have received PSLF forgiveness leaped from just 7,000 at the start of the Biden administration to more than 942,000.

Relief for Victims of Predatory Colleges and School Closures

The Biden administration also provided much-needed relief to borrowers who were preyed upon by predatory for-profit colleges or who attended schools that closed abruptly while they were enrolled. So far, the administration has provided over $28.5 billion in debt discharges to more than 1.6 million of these borrowers. This relief includes relief provided via a sweeping settlement that challenged the Trump administration’s failure to implement federal rules that provide for relief for defrauded students.

Relief for Lower-Income Borrowers

Lower-income borrowers who have been in repayment for decades are also getting relief under the Biden administration. So far, nearly 1 million borrowers have received close to $51 billion in debt relief as a result of the administration’s tweaks to a program known as Income Driven Repayment (IDR), a program that links monthly loan payment amounts to a borrowers’ income. Under the program, borrowers who have been in repayment for twenty or twenty-five years can qualify for forgiveness of their remaining student debt. The administration made changes to expand the types of payments that qualify for relief, giving borrowers additional credit toward forgiveness and helping more than 1 million borrowers receive discharges for their remaining balances.

Relief for Disabled Borrowers

The Biden administration’s actions have also extended debt relief to more than half a million disabled borrowers, totalling more than $14 billion in debt relief. This relief came from fixes to existing rules that provide for debt relief to student loan borrowers who are totally and permanently disabled or have disabilities that limit their ability to work for an extended period. Disabled borrowers faced onerous administrative hurdles that prevented many eligible borrowers from receiving this relief. Under Biden, the U.S. Department of Education implemented a change to the federal rules on debt relief to eliminate paperwork obstacles and expand eligibility for relief. Before these reforms, many borrowers with disabilities did not apply because they did not know that they were eligible for a loan discharge or were unable to access relief due to the cumbersome and complex application process. The rule is expected to lead to billions of dollars in additional loan relief over the next ten years.

Relief through the SAVE Loan Repayment Plan

The Biden administration has also enacted rules establishing a new loan repayment program, the Saving on a Valuable Education (SAVE) Plan, which provides additional avenues for debt relief, including a new, shortened time-to-forgiveness benefit for borrowers with smaller loans. These borrowers can qualify for discharges of their remaining loan balance after ten years of repayment. This new avenue for debt relief has already resulted in more than $5.5 billion in loan discharges to more than 414,000 borrowers.

Expanding Relief to Millions More Borrowers through Rulemaking

In April, the Biden administration released a new proposed rule that would extend student loan relief to as many as 30 million borrowers when combined with the administration’s other debt relief actions. The new plan relies on different statutory authority than the plan that faced hurdles at the Supreme Court.

The plan would provide relief to several categories of borrowers, including borrowers who have seen their debt grow because of unpaid interest. It would cancel up to $20,000 in interest for borrowers who owe more than they originally borrowed. The new plan would eliminate paperwork hurdles to debt relief by providing automatic loan cancellation for borrowers eligible for loan forgiveness under certain existing debt relief programs. The plan would also cancel debt for borrowers who entered repayment more than twenty years ago.

Importantly, the administration’s new rule would also complement the administration’s work, through passage of the Gainful Employment Rule, to hold colleges accountable for providing programs that benefit students by granting loan relief to borrowers who enrolled in low-value programs that left them with few job prospects and unmanageable debt. The plan would cancel student debt for borrowers that took out loans to attend programs that lost their eligibility to participate in federal student aid because they cheated or took advantage of students, or because they offered programs that failed to provide any earnings boost to students.

The administration has also announced that it plans to issue additional proposed rules to cancel debt for certain borrowers experiencing hardship that prevents them from fully paying back their loans.

Looking Ahead

The Biden administration has provided billions of dollars in student debt relief and laid the groundwork for billions more in relief to go to millions more Americans with the implementation of new rules. This debt relief will bring life-changing relief for millions of borrowers, permitting them to move forward with major milestones like buying a home and starting a family. The Biden administration’s accomplishments warrant public recognition and celebration.

Editorial note: This commentary was updated on May 24, 2024 to include additional student debt relief announced by the Biden administration.

Tags: higher education, student loan, federal student aid