Overview

New York’s $15 Fast-Food Minimum Wage

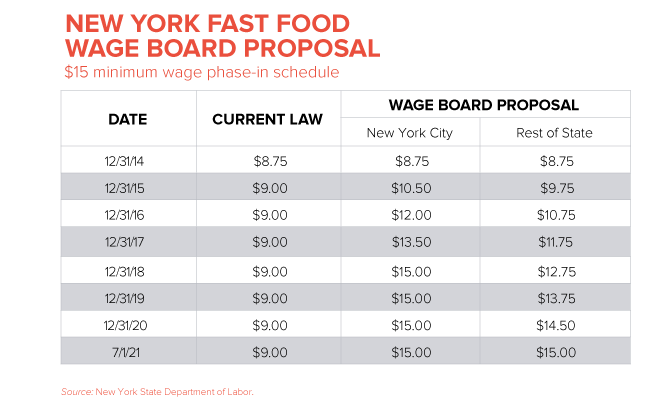

On July 22, 2015, the Fast Food Wage Board empaneled by New York Governor Andrew Cuomo recommended a $15 minimum wage for the employees of the national chains who dominate the industry in the state. The move was the latest in a string of high-profile, big city victories for low-wage workers and their advocates—a winning streak that has included Seattle ($15), San Francisco ($15), Los Angeles ($15), Chicago ($13), and Washington, D.C. ($11.50). With the Wage Board’s report having formally been filed on July 31, 2015, New York’s Acting Labor Commissioner Mario J. Musolino now has until mid-September to accept, reject, or modify the Board’s recommendations.

Figure 1

In this issue brief, The Century Foundation explains who earns the minimum wage in New York and assesses what proportion will benefit from Governor Cuomo’s proposed increase for fast-food workers, to be phased in between 2015 and 2021 (see Figure 1). We then make two key policy recommendations to improve the New York minimum wage plan.

Our findings:

- Four times as many New Yorkers earn the minimum wage as reported by official government statistics—some 560,000 workers in all.

- Fewer than one in five minimum wage earners in New York are employed by national fast-food chains.

- New York’s minimum wage workforce defies stereotypes, with many workers struggling both to support families and to overcome the longstanding labor market disadvantages their demographic groups have endured.

- Wide variation in prices—across place, but also over time—mean that minimum wages that do not respect cost-of-living differences put workers on uneven and unstable footing.

Our recommendations:

- New York’s new minimum wage should be continuously adjusted for cost-of-living differences. Prices and purchasing power vary predictably across place and over time. Prudent minimum wage policy anticipates and proactively accounts for this variation.

- New York should pursue an across-the-board minimum wage increase that applies to all workers, regardless of industry. Confining the minimum wage raise to a narrow sector is neither economically justified nor is it required by law.

Finding 1

Over Half A Million New Yorkers Earn The Minimum Wage, Far More Than The 137,000 Reported By Official Government Statistics

The simplest question we can ask about the minimum wage is: who earns it? Surprisingly, most discussions about this seemingly straightforward policy parameter are quite limited.

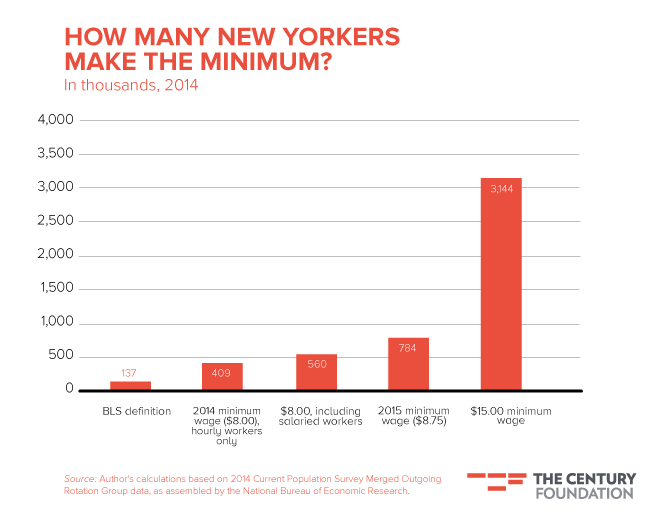

According to official data published by the Bureau of Labor Statistics (BLS), New York is home to 137,000 minimum wage workers. Yet this estimate is nowhere near the full story—for two reasons.

First, BLS includes only hourly workers in its minimum wage estimates. The justification is that the data source used to derive these estimates, the Current Population Survey (CPS), is based on self-reported earnings, and BLS worries that workers who do not report an hourly rate of pay may have difficulty accurately recalling earnings and hours worked.

Nevertheless, whatever this approach gains in accuracy, it loses in representativeness: more than two in five American workers are salaried or otherwise paid on a nonhourly basis. Omitting these workers is to ignore the full scope of minimum wage law: both federal and state minimum wage statutes apply to workers regardless of their frequency of pay (though there are some exemptions, including for executive, administrative, and professional employees making more than $455 a week). For workers paid other than hourly, determining the relevant wage standard requires just one extra step: dividing weekly earnings by weeks worked.

The second challenge with BLS data is that it is based on the federal minimum wage standard, which has been set at $7.25 since 2009. New York, like twenty-eight other states and D.C., has chosen to set its minimum above the federal standard, at $8.00 in 2014, $8.75 in 2015, and $9.00 in 2016. Applying a static federal benchmark in the face of evolving state policy generates misleading trends: states that proactively raise the minimum wage have their counts of minimum wage workers, as measured by the federal standard, artificially reduced—despite the fact that these workers are still earning the lowest possible legal rate of pay.

So how do the numbers change if we use a more comprehensive definition of minimum wage workers? Fortunately, monthly data from the Current Population Survey’s Outgoing Rotation Group (ORG) allow us to answer this question. The CPS, which is a joint effort of the Census Bureau and BLS, is the most important source of household-level information about the labor force in the United States. In this issue brief, we use a merged sample consisting of all twelve months of CPS ORG data for 2014, as compiled by the National Bureau of Economic Research (NBER). (Readers interested in learning more about the CPS or our methodology can consult the Appendix.)

By the standard of New York’s 2014 minimum ($8.00/hour), an additional 274,000 workers are added to the ranks of minimum wage earners, bringing the total to 409,000. Including nonhourly workers boosts the minimum wage workforce further still, to 560,000, or 7 percent of New York’s workforce. It’s a point that bears repeating: four times as many New Yorkers earn the minimum wage as official government statistics suggest. (To be precise, this means that in an average month in 2014, 560,000 of New York’s 8 million workers for whom earnings and hours data were available earned a rate of pay of $8.00 or less. Note that our analysis in this issue brief excludes self-employed workers, as well as those working in agriculture.)

We can also consider the range of workers likely to be impacted by increases in the minimum wage. In 2014, 784,000 New Yorkers earned $8.75 per hour or less, which is what New York’s minimum wage rose to in 2015. While this is an imperfect measure—because changes in the minimum wage can have effects on who earns it—it nonetheless gives us a sense of the magnitude of workers subject to the minimum wage in 2015.

Figure 2

If we take it a step further, to the proposed $15 minimum wage, we see that 3.1 million New Yorkers earned at or below this level in 2014—fully 39.2 percent of the workforce. Again, this is a rough estimate given the labor market dynamics associated with the minimum wage, as well as the fact that New York’s workforce will change between 2014 and 2021, when the proposed wage is expected to be phased-in. (It’s also worth noting that most estimates of the impact of minimum wage increases, including those by the Congressional Budget Office (CBO), assume that some portion of workers currently earning above a new minimum wage would also see their earnings rise, as firms seek to maintain well-established wage hierarchies. Thus, 3.1 million is a lower bound estimate of the number of impacted New Yorkers.)

Finding 2

Fewer Than One In Five Minimum Wage Earners In New York Work For National Fast-food Chains

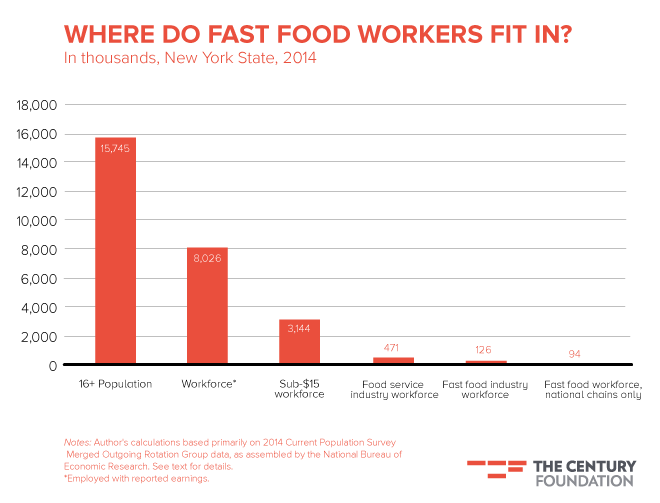

By these more comprehensive measures of earning the minimum wage, it is clear that New York is home to a considerable number of minimum wage workers. Of course, the proposed increase applies only to workers in limited-service “fast-food establishments” with thirty or more locations nationally. So the next question to consider is: where do fast-food workers fit in?

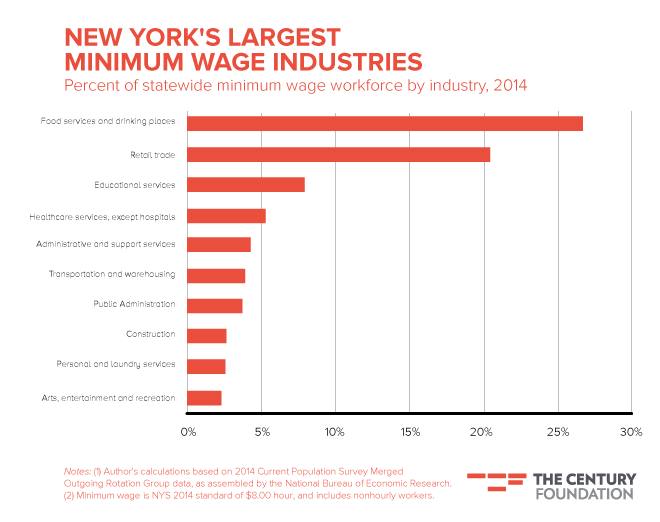

The figure below shows the share of New York’s minimum wage workforce—those earning $8.00 per hour or less in 2014—employed in each industry. Food services, the broad sector of which fast-food is a part, takes the top spot, accounting for 27 percent of minimum wage earners. It’s not hard to see why much of the attention given to the minimum wage in recent years has focused on this industry.

Figure 3

However, it is also the case that roughly three-quarters of minimum wage workers work in a sector other than food services. These workers, who face the same challenges as food services workers, will miss the direct benefits of the Wage Board’s proposal. Leading the way is retail trade, which employs a fifth of minimum wage workers. The other largest such uncovered sectors include education (7.9 percent), health care (5.3 percent), and administrative support (4.3 percent). Notably, 3.8 percent of New York’s minimum wage earners work in public administration—that is, government.

The upshot is that if you were forced to pick one industry upon which to focus minimum wage reform, food services is the way to go. Nevertheless, this choice leaves out the vast majority of minimum wage workers. Indeed, the Wage Board’s proposal applies only to a more narrow niche still—workers employed by national fast-food chains.

Figure 4 below places the employees of national fast-food chains in the context of New York’s overall labor market. Of the approximately 8 million workers in New York’s active workforce, 471,000 work in food services. Based on additional data from BLS’s Quarterly Census of Employment and Wages (QCEW), we estimate about 27 percent of these food services workers work in fast-food, and, further, that 75 percent of fast food workers—about 94,000—are employed by national chains. Given that, according to the QCEW, average wages in the fast-food industry are about equal to the minimum wage for full-time work, we assume all 94,000 would be subject to the Wage Board’s $15 proposal. (For further details about this estimate, see the Appendix.)

Figure 4

Thus, while fast-food workers are the largest—and perhaps most visible—subset of minimum wage workers, they represent but a fraction of all workers who could be helped by sensible minimum wage reforms. As it stands, the 94,000 fast-food workers employed by national chains in New York account for less than a fifth of the state’s minimum wage workers, just 3 percent of its sub-$15 workforce, and a scant 1.2 percent of its overall workforce.

Finding 3

New York’s Minimum Wage Workforce Defies Stereotypes—but Is Disadvantaged

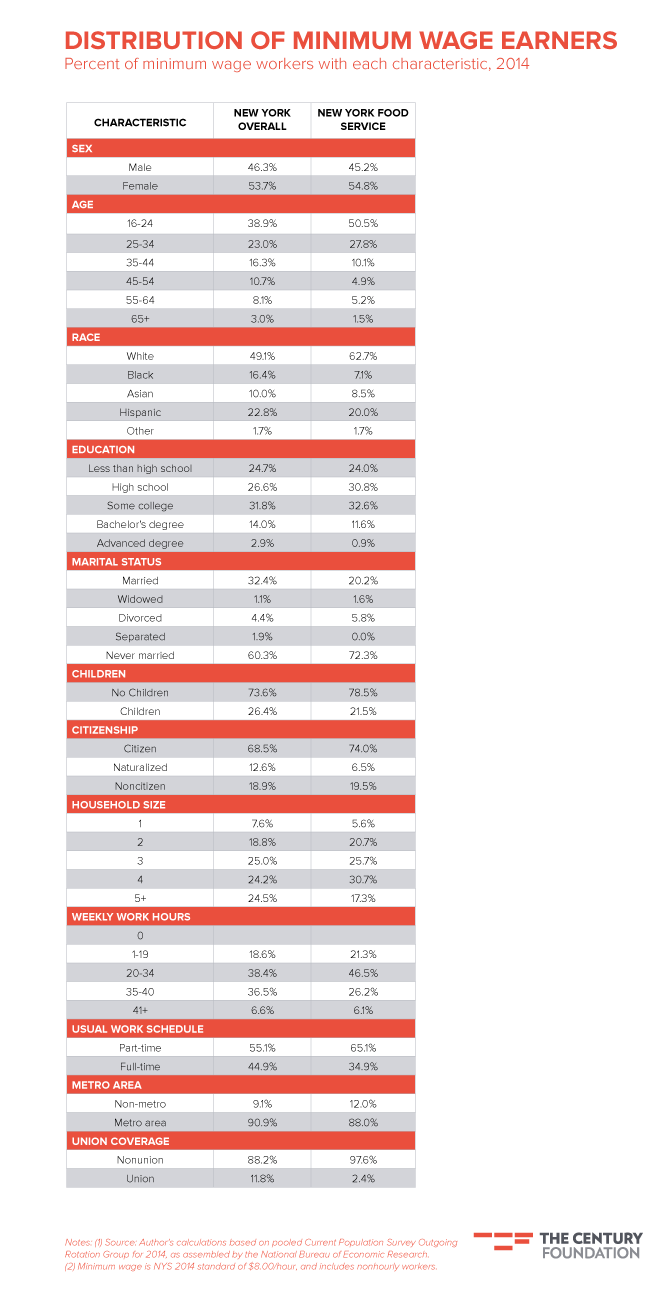

Beyond understanding the scope of minimum wage work in New York, it is also important to appreciate just who these workers are. In Figure 5, we summarize their key demographic traits, comparing New York’s overall minimum wage workforce with those in the food services industry (which we take as a proxy for the fast-food workers targeted by the Wage Board’s proposal).

To generalize, minimum wage workers in New York tend to be young, less-educated minorities. Sixty-two percent are thirty-four years old or younger. Half have a high school degree, or less, and more than four in five have not completed college. Twenty-three percent are Hispanic, and 16 percent are African American; both groups are overrepresented relative to their population shares. A third are immigrants. Women, at 54 percent of the minimum wage workforce, are also overrepresented.

Perhaps not surprisingly, these are exactly the groups that have traditionally faced labor market discrimination. Further underscoring the disadvantages these workers face, more than half work part-time—so that inadequate wages are often compounded by insufficient hours—compared to just 14 percent who earn more than the minimum wage. Only 12 percent are covered by unions. And nine in ten minimum wage workers live in cities, where living costs are high and competition for jobs can be fierce.

Figure 5

Notably, demographic patterns among minimum wage workers in the food services industry differ from the overall minimum wage population in several important ways. Food services minimum wage earners are considerably younger—nearly 80 percent are under thirty-five years old, compared with 62 percent among minimum wage earners overall—and they are a lot whiter, 63 percent versus 49 percent among all minimum wage workers. Three-quarters are native citizens. Just a fifth are married. Fully two-thirds work part-time, and only 2.4 percent are unionized.As much as these statistics confirm well-established stereotypes about minimum wage workers—patterns, which, in and of themselves, can be indicative of profound unfairness—they also help highlight trends that may run contrary to conventional wisdom. Although minimum wage workers do tend to be young, for example, about half of minimum wage workers fall into the prime-age category of twenty-five to fifty-four years. Half have at least some college experience. A third are married and more than a quarter have children. And as we’ve noted, three-quarters work outside of food services.

In other words, if the goal is to improve the welfare of families whose living standards are dependent on low-wage work, changes need to be applied beyond the food services industry. This is our first recommendation.

Finding 4

Failure To Account For Cost-of-living Is Unfair To Minimum Wage Workers

Under New York State Labor Law—specifically, Section 654—the standard a Wage Board must abide by in setting the minimum wage is that such a wage be “sufficient to provide adequate maintenance and to protect health,” while also taking into consideration “the value of the work or classification of work performed, and the wages paid in the state for work of like or comparable character.”

At the least, then, a reasonable threshold for the minimum wage in New York is one that allows a worker to provide for the health and basic needs of herself and her dependents. But calculating what constitutes such a living wage is by no means straightforward, implicating not only economics, but also value judgments and a nuanced appreciation of the idiosyncrasies of the market and policy environments in which it is to be implemented. Underscoring these complexities, the Wage Board considered “a range of measures and methodologies” from experts, including the Department of Labor’s Division of Research and Statistics, in formulating its $15 recommendation.

Rather than debate the merits of $15 as a definition of a livable wage—an exercise that would veer into speculative territory beyond the scope of this issue brief—our intent is to emphasize a principle any such valid measure ought to abide by: cost-of-living.

As New Yorkers know, New York tends to be an expensive place to live. The data confirm this intuitive impression. According to “regional price parities,” published by the Bureau of Economic Analysis (BEA), New York was the third most expensive place to live as of 2013, trailing only D.C. and Hawaii. On average, prices in New York are 15.3 percent higher than they are for the nation as a whole. This high cost-of-living is driven entirely by New York City, where prices are 22.3 percent higher than average (and second in the nation only to Honolulu). Ithaca and Kingston are also slightly more expensive than average, though the vast nonmetropolitan portion of New York is actually 5.5 percent cheaper than the United States norm.

A sensible self-sufficiency wage should respect these price differences. To their credit, the Wage Board incorporated cost-of-living differences in their $15 proposal—but they did so only partially. The new minimum phases in more rapidly in NYC. But after July 2021, all is again equalized, and fixed, at $15—which has little empirical justification. This leads to our second recommendation: New York’s minimum wage should respect the cost-of-living.

There’s also a second dimension to cost-of-living: time. Indeed, the temporal evolution of prices—more commonly known as inflation—is traditionally what gets most of the attention when it comes to purchasing power adjustments. As is the case with the federal minimum wage, neither New York’s existing minimum wage nor the Wage Board’s proposal is indexed for inflation. This is a mistake: the failure of the minimum wage to maintain consistent purchasing power over time is why legislative battles about raising it recur so regularly.

Recommendations for Strengthening Governor Cuomo’s Minimum Wage Proposal

Recommendation 1: New York’s Minimum Wage Increase Ought to Cover All Workers

In terms of coverage, the policy recommendation is clear: New York’s proposed minimum wage needs more of it. Beyond symbolism, there is little rationale for confining a minimum wage increase to employees of national fast-food chains alone.

There is nothing in New York State law that precludes Governor Cuomo from appointing a Wage Board to set the minimum wage for all workers at once. As Section 653 of the State’s Labor Law puts it, “The [Labor] commissioner shall have power on his own motion to cause an investigation to be made of the wages being paid to persons employed in any occupation or occupations to ascertain whether the minimum wages established in accordance with the provisions of this article are sufficient” [emphasis added].

If $9.00 is too low for fast-food workers, it is also too little for everyone else. Further, overselling the importance of a $15 fast-food minimum wage may lull would-be reformers and concerned citizens into a false sense of security, allowing the benefits for a visible minority to substitute for the good of all low-wage workers.

Recommendation 2: New York’s Minimum Wage Should Respect Cost-of-Living

Rather than simply take an extra year and a half to phase in the new minimum wage in upstate counties, the Wage Board ought to provide wage standards that permanently respect regional price differences—and which are able to adapt as place-based living costs vary in the future.

Section 655 of New York’s Labor Law explicitly allows a Wage Board to recommend a minimum wage “varying with localities if, in the judgment of the board, conditions make such variation appropriate.” That prices in New York City are about 29 percent higher than they are in the rest of the state is one clearly appropriate justification. If the minimum wage is defined as a livable wage, as it is under New York law, then, then it should be able to purchase the same standard of living, regardless of where it is earned.

If $15.00 is the right wage for NYC, the rest of the state would be on equal footing with about $11.50. Nor need the distinction be confined to NYC versus the rest of the state (though this is the simplest division); the minimum wage could be set at the county level, or by another reasonable geographic standard.

Similarly, with inflation running at about 2 percent annually (at least, that is the Fed’s goal), the minimum wage begins losing value the day it is enacted into law. By 2021, for example, when the Wage Board’s proposal is currently scheduled to be fully implemented, 2 percent annual inflation will have made $15.00 worth just $13.32—an 11 percent loss in purchasing power. This unfortunate situation could be easily avoided by setting the minimum wage to automatically adjust with changes in a relevant price index (the Consumer Price Index (CPI) and the Personal Consumption Expenditures(PCE) index are the two most common measures for inflation). A forward-thinking policy of this sort is exactly what the Wage Board ought to recommend.

Conclusion

In summary, New York’s Fast Food Wage Board can significantly improve its proposal by taking two simple steps—both of which are explicitly authorized by New York State law.

- New York’s new minimum wage should be continuously adjusted for cost-of-living differences.

- New York should pursue an across-the-board minimum wage increase that applies to all workers, regardless of industry.

New York’s 560,000 minimum wage workers cannot afford anything less.

Cover Photo Credit: The All-Nite Images, http://bit.ly/1HnKj7N