Executive Summary

Child poverty in the United States remains stubbornly high, with 12.2 million children living in poverty in 2013. Nearly 17 percent of children in the United States lived in poverty in 2013—a higher rate than for other age groups, and considerably higher than the child poverty rate in other advanced industrialized countries. The U.S. deep child poverty rate—children who live in families with incomes less than half of the poverty line—was 4.5 percent of all children in 2013, meaning nearly 1 in 20 children live in families that cannot even afford half of what is considered a minimally adequate living.

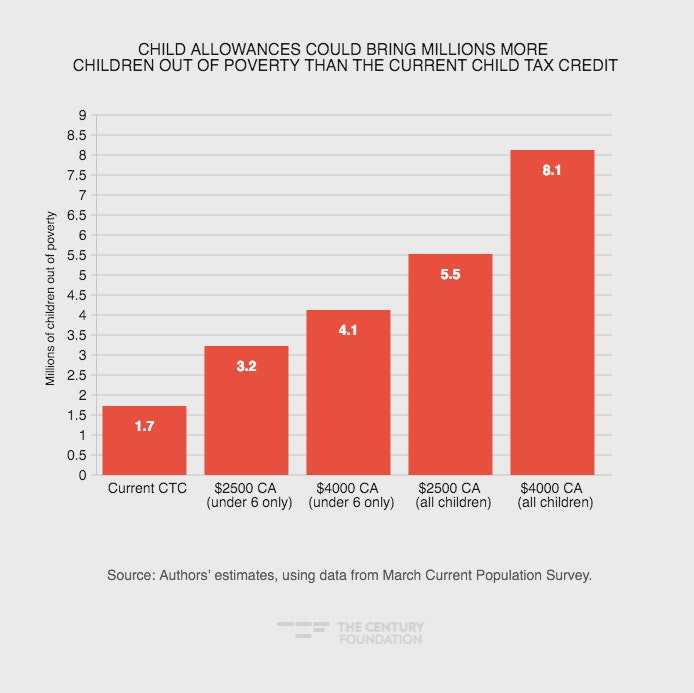

One key policy for reducing child poverty is the child tax credit (CTC)—which reduces the child poverty rate from 18.8 percent to 16.5 percent of American children. There is broad acceptance of the importance of the CTC, and key expansions to the CTC were made permanent at the end of 2015. At a moment when leaders ranging from President Barack Obama to Speaker Paul Ryan are talking about poverty, now is an opportune time to explore policy options that would build on this success. This report models two approaches to reduce child poverty in the United States even further—a universal child allowance and an expanded CTC.

A universal child allowance is a cash benefit that is provided to all families with children without regard to their income, earnings, or other qualifying conditions, and that could be subject to taxes for families with high incomes. The U.S. child tax credit, in contrast, is provided only to families that meet a threshold for earnings, phasing in as earnings increase and then phasing out as earnings rise higher. While most other advanced industrialized countries have some kind of universal support for children, the United States does not.

For each approach, we begin with a modest reform, and then model increasingly generous versions. In our simulations, we find that even the modest reforms generate important poverty reductions. Our results also make clear that the more we spend on these programs, the greater the reduction in poverty the United States can achieve.

Among our key findings:

- Providing a child allowance of $2,500 to all children under age 6 (leaving intact the CTC for children age 6 and above) would lift 3.2 million children out of poverty, reduce the child poverty rate to 14.5 percent, and reduce the deep child poverty rate to 3.7 percent. The cost of such an expansion would be approximately $17.7 billion.

- Investing in a universal child allowance that provides $2,500 per child for all families with children (age 0–17) would lift 5.5 million children out of poverty, cut the child poverty rate to 11.4 percent, and cut the deep poverty rate by 2.3 percentage points.

- A $2,500 universal child allowance would more than triple the antipoverty effect of the current CTC, with a much larger multiplier for child deep poverty. The marginal cost of this poverty reduction would be approximately $109.3 billion. A greater investment could yield even larger effects: for an investment of $200 billion a year, child poverty could be cut in half.

Our results point to an important difference between the two types of programs: a dollar invested in a universal child allowance would do more to reduce child poverty than a dollar spent on an expanded child tax credit, because a universal child allowance reaches the poorest families, including those who do not have sufficient earnings to qualify for the work-conditioned CTC. Put differently, child allowances that achieve equal reductions in poverty when compared to expansions of the CTC actually cost less to implement.

We hope our results are useful in illustrating a range of options for tackling child poverty. Policymakers will have to choose how much they are willing to spend tackling child poverty. Our results help make clear what that spending might achieve.

Introduction

The child poverty rate in the United States is stubbornly high, with more than 12 million American children—16.5 percent of all children—currently living in poverty. This poverty rate is higher than for other age groups, and also higher than the child poverty rate in other rich countries. Many Americans have become so accustomed to these statistics that they tend to take them for granted—and treat the situation as if it were somehow inevitable. But in fact, social policies can do a great deal to reduce child poverty. The high child poverty rate in the United States is not an inevitable outcome of demographics, the labor market, or other factors, but rather also reflects social policy choices.

We can see the role social policy plays—and does not play—in determining children’s economic well-being when we look at new statistics on poverty using the reformed poverty measure known as the supplemental poverty measure (SPM).1 One of the limitations of the official poverty measure in the United States is that it does not take into account the full range of government anti-poverty programs available to low-income families, particularly low-income families with children. The SPM, in contrast, brings in nearly all cash and near cash benefits, so that we can see what role these benefits are playing in reducing poverty. When we do so, we can see that social benefits are actually reducing poverty quite substantially—but also that there is much more that social policy could do.

If we use a historical version of the SPM to compare child poverty today to poverty as it was in the 1960s, using a poverty line anchored in today’s standard of living, we find that child poverty has fallen by more than 35 percent—and virtually all of that reduction is due to social benefits.2 Contemporary SPM estimates from the Census Bureau also confirm the crucial role played by social policies such as tax credits for families with children. Estimates show that, without the Earned Income Tax Credit (EITC) and the child tax credit (CTC), another 6 percent of all children would be in poverty, for a total child poverty rate of 23 percent.3

But—even taking the current safety net into account—child poverty in the United States is still unacceptably high. And poverty among young children is particularly worrisome. Research shows not only that poverty is harmful to child development, 4 but also points to young children as being particularly vulnerable to its effects.5 At the same time, there is a growing body of evidence (discussed in detail below) documenting the benefits of additional income for low-income children’s health and development.

Since welfare reform in 1996, the United States has substantially expanded the work-based safety net, and that is an impressive achievement. The EITC and CTC are playing a very important anti-poverty role. Combined, they now lift more children out of poverty than any other federal measures. But, as many analysts have pointed out, one particularly vulnerable group of children has fallen through the cracks—children whose parents are not able to work on a regular basis.6 That leaves the United States with an incomplete safety net. While all Americans would endorse the concept of “work for those who can,” they should not forget the other side of that coin—“security for those who cannot.”7

A universal child allowance would reach those most vulnerable families, providing a minimal source of cash support—an income floor. A universal child allowance is complementary to a work-based safety net, because the benefit is not reduced as a family’s earnings increase. And, since it goes to all families with children, the benefit would not be stigmatized. Most countries like the United States already provide universal child benefits or child allowances, often augmenting these with additional cash benefits for the neediest families. But, in the United States, there has been remarkably little discussion of a universal child allowance.

The closest thing the United States has to a child allowance—the CTC—is not universal, and in fact misses the lowest-income families because their earnings are not high enough to meet the threshold, or because they cannot work to begin with. It also provides a relatively low level of benefits. And, it is provided just once a year, at tax time, making it hard for families to use it to support their children all year round.

A universal child allowance would not only provide more consistent support to low-income families, but it would also provide needed assistance to middle-class families. Middle-class incomes have barely increased in the past twenty years, while the costs of raising children have grown substantially. As expenditures by the highest income families on child enrichment items have increased, children in both low- and middle-income families have been left behind.8

Currently, the CTC provides a maximum of $1,000 a year per child to families with children. Although the CTC includes a meaningful refundable component, families in which parents do not work or who have very low earnings are excluded. Many such families do not receive the CTC, and they are disproportionately families with infants and toddlers (because those parents are more likely to be out of the labor force, since they find it particularly difficult to work and care for their young children and earn less on average than the parents of older children).9

During the Great Recession, the refundable component of the CTC was expanded, so that families could receive at least a partial benefit as long as they had earnings above $3,000 per year. These provisions were due to expire at the end of 2017, but have now been made permanent as part of the December 2015 tax legislation. Further reforms to the CTC are being proposed, as we discuss below.

But the United States could go further. A universal child allowance would ensure that all families with children receive public support, including the very poorest of poor families. It would establish the principle that all children are entitled to public support.

This report seeks ways to improve U.S. policy that could help reduce the unacceptably high child poverty rate. It begins by reviewing the evidence on the beneficial effects of higher incomes on child health and development, providing a short history of the political origins of support for child allowances and refundable child tax credits in the United States, and taking a brief look at policies in other countries.

The report then examines the effects on poverty and the fiscal costs of several alternative ways to provide more support to children. It provides a range of estimates, beginning with modest reforms, and then moving on to more generous ones. This exercise illustrates that different models produce varying child poverty impacts and have varying costs, including different levels of a child allowance and different options for expanding the CTC.

The Effects of Income on Child Health and Development

There is a growing body of evidence from rigorous studies showing that income transfers can improve child health and development. Studies using a natural experiment approach (which generally exploit natural variation that occurs when policies are implemented in specific time periods or different localities) have shown positive effects of the EITC on maternal health, mental health, biomarkers,10 birthweight,11 and child test scores.12 Researchers have also found beneficial effects of the Canadian child benefit program—a child allowance program—on child test scores and aggression, and maternal depression.13 One study suggests that an additional $1,000 in income would raise children’s test scores by 6 percent of a standard deviation.14 Another study’s results yield a similar estimate—a 7.3 percent of a standard deviation gain with an additional $1,000 in income.15 Reducing child poverty and improving income available to children is also likely to reduce costs in the long term by reducing crime, increasing productivity, and improving health.16

Income transfers may work in improving child health and development in part through allowing parents to buy more learning- and health-related items for their children.17 With the growth of income inequality, low-income parents increasingly lag behind other parents in their ability to purchase such items for their children. Additional financial resources enable parents to purchase these items; for example, a natural experiment study in the United Kingdom found that low-income parents benefiting from expanded income supports spent more on learning- and health-related items for their children, such as books and toys, and fresh fruit and vegetables.18

Income supports may also improve child health and development by relieving stress on parents and/or increasing their ability to focus on learning and other developmental activities. Researchers make the case that if parents are consumed with worrying about money, they have less ability than they otherwise would to attend to other issues.19 Evidence from primate studies graphically illustrates the harmful effects of income insecurity on parental and child functioning. In one experiment,20 researchers randomly assigned groups of mother monkeys and their infants to one of three different feeding environments—one in which mothers had to exert very little effort to find food, one in which mothers had to work very hard to find enough food, and one in which the mothers encountered both the rich and poor environments on a random basis. The mothers in the rich environment developed the calmest, most secure relationships with their infants and the infants displayed the most independence. Mothers in the poor environment were more prone to cut off interactions with their infants, and the infants displayed less independence and more signs of emotional disturbance. The mothers and infants assigned to the uncertain environment fared worst. These mothers were the most likely to arbitrarily cut off interactions, and the infants displayed the least independence and the most symptoms of emotional disturbance, including ten-to-twenty-minute episodes of hunching up in a fetal position.

The History of Child Allowances and Child Tax Credits in the United States

Child allowances and tax credits have been supported by prominent American intellectuals and elected politicians, from both the left and the right. Senator Paul Douglas, an economics professor at the University of Chicago, is the most well-known early progressive advocate of child allowances. Senator Daniel Patrick Moynihan, both an intellectual and elected politician, was a more recent liberal advocate. Charles Murray is the most well-known current conservative intellectual advocate, but both George Gilder and David Stockman also supported child allowances.21 While there have been multiple recent proposals by researchers for a universal child allowance or young child allowance,22 child allowances have received relatively little attention in Congress. A proposal for a fully refundable child tax credit was introduced in the House Budget Committee by Representative Rosa DeLauro in 2003, but it has not advanced further since then. (A fully refundable tax credit is one in which, if the tax credit reduces a taxpayer’s amount owed to a negative number, this results in a refund check from the IRS for the full amount of that credit. As such, a fully refundable child tax credit, without a minimum earnings requirement, is the equivalent of a child allowance.)

While lacking a universal child allowance, the United States does have a child tax credit—one that was created with broad political support. The origins of the CTC date to 1991, when the bipartisan National Commission on Children recommended a $1,000 refundable tax credit for children.23

The CTC first appeared in the Republican U.S. House campaign manifesto of 1994, the “Contract with America,” as one way to “strengthen the family.”24 The Family Research Council advocated for a CTC to support families who chose to homeschool their children. 25 A CTC also appealed to libertarians who were in favor of families making their own decisions on how to invest in their children, and anti-tax conservatives who saw the potential for tax cuts to replace spending. In fact, the original draft of the CTC in the “Contract with America” was designed to be a credit against both income and payroll taxes—essentially a partially refundable CTC. And the Heritage Foundation, a conservative think tank, provided the original estimates of the costs of a $500 per child tax credit.

In 1996, President Bill Clinton included a $300-per-child tax credit in his budget, gradually rising to $500. With welfare reform on the line, a recently expanded EITC enacted, and his reelection looming, the administration’s proposal was nonrefundable. After the election, the Clinton administration and Republicans switched their positions on refundability in what would become the 1997 Balanced Budget Agreement. The Clinton administration worked to get some refundability, while Speaker Gingrich referred to refundability as “welfare.” In the end, the first CTC of $400 (rising to $500) was signed into law in 1997, with only a small refundable portion for families with more than two children, to supplement the EITC.

In 2001, President George W. Bush was elected and sought a major tax cut. In order to achieve some distributional balance, the proposed bill provided for the CTC to increase gradually to $1,000 per child and made the CTC partially refundable for families with any number of children for the first time, by allowing families a 15 percent credit for each dollar of earnings above $10,000. In the final negotiations, that eligibility threshold of $10,000 was indexed for inflation.

After the midterm elections, at the beginning of 2003, President Bush called for another tax cut—of $700 billion—that would accelerate the phase-in of his 2001 tax cuts, while also reducing dividend taxes. All of the personal tax cuts contained in the 2001 law that were to phase in over the decade would be accelerated so that that they would reach their maximum value immediately, with the only exceptions being the costly and controversial estate tax repeal and the refundable portions of the CTC and EITC. While it gained little notice at the time, Representative Rosa DeLauro (D-CT) offered an amendment in the House Budget Committee to make the CTC fully refundable—which lost on a party line vote. That vote was the first time that the U.S. Congress voted on the equivalent of a child allowance.

The refundable portion of the CTC was left out of the final 2003 bill, but its omission was widely noted, including in a front-page New York Times piece that appeared the day after the bill was signed.26 It would take a year, and a subsequent tax bill, for the refundable portion of the CTC to finally be increased to a maximum value of $1,000.

In August of 2005, Hurricane Katrina struck. Recognizing that, among other losses, families with reduced earnings could lose portions of their CTC and EITC in the following year, Congress created a “look back provision” allowing for families in the regions affected by Katrina—and subsequent Hurricanes Rita and Wilma—to opt to use their previous year’s earnings to calculate their CTC and EITC.

Democrats retook majorities in the House and Senate in the 2006 elections, and the incoming speaker, Nancy Pelosi (D-CA), dedicated the 110th Congress to children and families. She appointed two of her most trusted colleagues to shepherd this effort—Representatives DeLauro and George Miller (D-CA). In their search of policy options, they returned to expanding CTC eligibility to low-income families as one way—among others—to address the needs of children and families.

In January of 2008, with the economy softening, President Bush called for an economic stimulus package. Republicans fought against the inclusion of expansions of either food stamps (SNAP) or Unemployment Insurance. But GOP House leader John Boehner (R-OH) said his caucus could agree to a partially refundable child tax credit. A one-time refundable child tax credit of $300 per child for the first two children was created for all families with earnings above $3,000. It was the first time a stimulus package included a tax credit that was refundable—one that went to families most likely to spend it right away, injecting demand into the economy.

In September of 2008, House Ways and Means chairman Charlie Rangel (D-NY) lowered the CTC threshold from the previously enacted $10,000 indexed for inflation to $8,500 as part of the semi-annual extension of temporary tax provisions. In the subsequent TARP legislation, the Senate took the House tax bill and attached it to the subsequent TARP legislation, and the CTC threshold was lowered, albeit temporarily, to $8,500 unindexed.

After President Barack Obama’s election in 2008, the House and Senate passed different versions of CTC expansions in what would become the American Recovery and Reinvestment Act (ARRA). The House lowered the eligibility threshold to the first dollar of earnings. The Senate lowered the threshold to $8,500. In the final bill, the eligibility threshold was lowered to an unindexed $3,000 for two years. At the end of 2010, the ARRA CTC expansion was extended for another two years. And, at the end of 2012, it was extended for another five years, through 2017. In December of 2015, Congress passed the Protecting Americans from Tax Hikes (PATH) Act of 2015 making the $3,000 unindexed eligibility threshold permanent.

Recent proposals have highlighted the possibility of a young child tax credit. Analysts at the Center for American Progress (CAP) have proposed a new universal young child tax credit of $1,500 for children under the age of 3, distributed monthly with no earnings or work requirement for eligibility.27 As we go to press, Representative DeLauro has just introduced the Young Child Tax Credit Act (YCTC), with the support of House Democratic Leader Nancy Pelosi and Representative Sandy Levin, the lead democrat on the House Ways and Means Committee. Like the CAP plan, the YCTC would act like a child allowance for the youngest children, those under the age of three, while leaving out only those families at the top of the earnings spectrum. Senator Michael Bennet (D-CO) has recently proposed an increased benefit—still conditioned on work—for families with young children. The Bennet plan would start eligibility for the CTC on the first dollar of earnings, and then triple the CTC for all eligible children under the age of 6, including—critically—those who are in families that earn too little to get the full credit.

In summary, since its enactment in 1996, the CTC has been made progressively more generous. However, it still does not reach families whose incomes are too low to meet the threshold, and in general, its level of support is low, particularly for young children.

What Other Countries Do

Universal child allowances or child benefits are a core element of the safety net in many countries, and they play an important role in reducing child poverty.28 Most relevant for the United States is the experience of its closest peers, the other Anglo-American countries, all of which offer a child allowance. Their programs differ,29 but all provide cash support to help families with the cost of raising children. Australia’s Family Tax Benefit program provides a general benefit of up to AU$460 a month, per child (gradually phased out for the highest income families), and a supplement of up to AU$300 a month, per child, that goes to single-income households. Canada’s National Child Benefit is similar, in that it provides a general benefit (up to CA$120.50 a month, per child, phased out for the highest income families), and a supplement that goes to the low-income families (up to CA$186 a month, per child). Ireland offers a universal Child Benefit, paid at the same rate (€130 a month, per child) for all families with children, and not taxable. The United Kingdom offers a universal Child Benefit (up to £82 a month, per child), taxable for high-income families (who may opt out rather than receive the benefit and pay taxes on it).

Simulations of Alternative Polices

The United States can do more to support families with children. But what would a more generous safety net for children deliver, and what could it cost?

What follows are the results of our simulations of ten policy scenarios, with comparisons of their antipoverty effects and costs to the current CTC. To provide a baseline scenario, we first looked at poverty and deep poverty (that is, children who live in families with incomes less than half of the poverty line) among children if the CTC did not exist, and then re-estimated the rates after including resources from the current CTC. We then compared the effects of various policy scenarios against the effects of the current CTC. These ten scenarios include five child allowance policies and five alternative CTC policies. (For an overview of the data and methods we used, see the Appendix.)

The five simulated child allowance policies, in order from least to most generous, are:

- Scenario 1: a universal child allowance of $2,500 per child for children under 6 (children age 6–16 continue to receive the CTC);

- Scenario 2: a universal child allowance of $4,000 per child for children under 6 (children age 6–16 continue to receive the CTC);

- Scenario 3: a universal child allowance of $2,500 for all children aged 0–17 (replacing the CTC for all children);

- Scenario 4: a universal child allowance of $4,000 for all children under 6 and $2,500 for children aged 6–17 (replacing the CTC for all children); and

- Scenario 5: a universal child allowance of $4,000 for all children aged 0–17 (replacing the CTC for all children).

The five alternative CTC policies are all more generous than the current CTC. In general, we began with the current CTC parameters and then made them progressively more generous, but with the important exception that all our alternatives began at the first dollar of earnings rather than at the current $3,000 earnings floor that excludes the most disadvantaged families. We also made 17-year-olds eligible for the CTC in these scenarios, in contrast to the current eligibility cap of 16 years of age. Whenever we increased the CTC, we did so for all eligible children. As such, in some scenarios we increased the phase-in rate by the same multiple as we increased the value of the credit. (The phase-in rate is the rate at which CTC payments increase as a family’s earned income increases; if the phase-in rate is 15 percent, a family gets 15 percent of every dollar in earnings above the threshold.) The current phase-in rate is 15 percent.

The five simulated CTC policy scenarios are:

- Scenario 6: a $2,500 CTC at the current phase-in rate (15 percent of every dollar of earnings);

- Scenario 7: a $4,000 CTC at the current phase-in rate (15 percent of every dollar of earnings);

- Scenario 8: a $2,500 CTC at a more generous phase-in rate (37.5 percent of every dollar of earnings);

- Scenario 9: a $4,000 CTC for children under 6 and a $2,500 CTC for children age 6–17 at a more generous phase-in rate (60 percent of every dollar if there is a child under 6 present, and 37.5 percent of every dollar if there are only children age 6–17 present); and

- Scenario 10: $4,000 CTC at a more generous phase-in rate (60 percent of every dollar of earnings).

Results of the Policy Scenarios

In order to understand the effects of our alternative scenarios on child poverty and deep child poverty, we begin by looking at the effect of the existing CTC. In this analysis, we simply zero out the current CTC and ask what the child poverty and deep poverty rates would be without including resources from the current CTC. (Here and elsewhere, we use the supplemental poverty measure, or SPM, to measure poverty).

Absent the current CTC, the child poverty rate would be 18.8 percent, and the deep child poverty rate would be 4.7 percent. After counting the current CTC, however, the child poverty rate is 2.3 percentage points lower, at 16.5 percent (lifting 1.7 million children out of poverty), while deep poverty is only slightly lower, by 0.2 percentage points, at 4.5 percent. The current CTC thus has a larger effect on overall child poverty than it does on deep child poverty, which makes sense, given that the current CTC does not reach the poorest and most disadvantaged families, given its contingency on families having at least $3,000 in earnings.

What is the cost of current policy? Based on our estimates using data from the Current Population Survey Annual Social and Economic Supplement, the current cost of the CTC is $46.6 billion dollars (this is less than the estimates provided by official government scoring, which tend to hover around $55 billion).30 The difference is well known, and likely the result of the inability of commonly used tax calculators to precisely model actual tax filing realities and behavior. For internal consistency with the rest of our cost results, we treat our $46.6 billion cost estimate as the baseline when we alter policy parameters.

The antipoverty impact of the five alternative child allowance policies is significantly higher than that of the current CTC (see Tables 1 and 2; see also Figure 1). Scenario 1—providing a universal child allowance of $2,500 to all children under 6, leaving intact the CTC for children 6 and above—reduces child poverty to 14.5 percent from 16.5 percent, and reduces deep child poverty from 4.5 percent to 3.7 percent. Such a policy would lift 3.2 million children out of poverty (compared to the 1.7 million lifted out by the current CTC). The marginal cost of such an expansion would be approximately $17.7 billion.

| Table 1. Child Poverty and Program Costs Under Various Child Allowance and Child Tax Credit Policies | ||||

| Child Poverty Rate | Children in Poverty | Cost (Billions) | Marginal Cost (Billions) | |

| No current child tax credit | 18.8% | 13.9 | ||

| Current Child tax credit | 16.5% | 12.2 | $46.6 | $0 |

| Alternative Child Allowance Policies | ||||

| Scenario 1: $2500 child allowance, under age 6 | 14.5% | 10.7 | $80.3 | $33.7 |

| Scenario 2: $2500 child allowance, under age 6 | 13.2% | 9.8 | $109.7 | $63.1 |

| Scenario 3: $2500 child allowance, all children | 11.4% | 8.4 | $156.0 | $109.3 |

| Scenario 4: $4000 child allowance, under age 6/$2500 child allowance age 6 and over | 10.0% | 7.4 | $184.9 | $138.3 |

| Scenario 5: $4000 child allowance, all children | 7.8% | 5.8 | $249.6 | $202.9 |

| Alternative Child Tax Credit Policies | ||||

| Scenario 6: $2500 child tax credit, current phase-in | 15.3% | 11.3 | $105.9 | $59.3 |

| Scenario 7: $4000 child tax credit, current phase-in | 15.1% | 11.2 | $147.7 | $101.0 |

| Scenario 8: $2500 child tax credit, more generous phase-in | 13.9% | 10.3 | $122.2 | $75.6 |

| Scenario 9: $4000 child tax credit under age 6/ $2500 Child Tax Credit age 6 and over, more generous phase-in | 13.1% | 9.7 | $148.2 | $101.6 |

| Scenario 10: $4000 child tax credit, more generous phase-in | 12.1% | 9.0 | $197.0 | $150.0 |

| Notes: Simulations based on the March 2014 Current Population Survey Annual Social and Economic Supplement; child allowance values are taxed based on marginal tax rates derived from Census tax calculators. | ||||

| Table 2. Deep Child Poverty and Program Costs Under Various Child Allowance and Child Tax Credit Policies | ||||

| Deep Child Poverty Rate | Children in Deep Poverty | Cost (Billions) | Marginal Cost (Billions) | |

| No current child tax credit | 4.7% | 3.5 | ||

| Current Child tax credit | 4.5% | 3.4 | $46.6 | $0 |

| Alternative Child Allowance Policies | ||||

| Scenario 1: $2500 child allowance, under age 6 | 3.7% | 2.8 | $80.3 | $33.7 |

| Scenario 2: $2500 child allowance, under age 6 | 3.3% | 2.5 | $109.7 | $63.1 |

| Scenario 3: $2500 child allowance, all children | 2.4% | 1.8 | $156.0 | $109.3 |

| Scenario 4: $4000 child allowance, under age 6/$2500 child allowance age 6 and over | 2.1% | 1.6 | $184.9 | $138.3 |

| Scenario 5: $4000 child allowance, all children | 1.6% | 1.2 | $249.6 | $202.9 |

| Alternative Child Tax Credit Policies | ||||

| Scenario 6: $2500 child tax credit, current phase-in | 4.3% | 3.2 | $105.9 | $59.3 |

| Scenario 7: $4000 child tax credit, current phase-in | 4.3% | 3.2 | $147.7 | $101.0 |

| Scenario 8: $2500 child tax credit, more generous phase-in | 4.1% | 3.1 | $122.2 | $75.6 |

| Scenario 9: $4000 child tax credit under age 6/ $2500 Child Tax Credit age 6 and over, more generous phase-in | 3.9% | 2.9 | $148.2 | $101.6 |

| Scenario 10: $4000 child tax credit, more generous phase-in | 3.8% | 2.8 | $197.0 | $150.0 |

| Notes: Simulations based on the March 2014 Current Population Survey Annual Social and Economic Supplement; child allowance values are taxed based on marginal tax rates derived from Census tax calculators. | ||||

Scenario 2—again limiting the child allowance to children under age 6, but making it more generous at $4,000 per young child—would realize even greater reductions in child poverty and deep poverty. Child poverty would fall to 13.2 percent (lifting 4.1 million children out of poverty), while child deep poverty would fall to 3.3 percent. The marginal costs, of course, would be greater—in this case, about $47.2 billion. (The results reported here are for all children; we show results just for children under age 6 in Appendix Tables A1 and A2).

Scenario 3 shows the effects of extending a child allowance to all children age 0–17, and concomitantly eliminating the current CTC. The anti-poverty effects of such a policy change would be substantial, but would also come with significant costs, reflecting the maxim that “you get what you pay for.” If all children age 0–17 were eligible for a $2,500 per year child allowance, child poverty would drop from 18.8 percent to 11.4 percent (a 39 percent reduction, or 5.5 million children lifted out of poverty). For deep poverty, rates would be cut by 2.3 percentage points (a 49 percent reduction). A $2,500 universal child allowance would therefore more than triple the antipoverty effect of the current CTC, with a much larger multiplier for child deep poverty. The marginal cost of this poverty reduction would come to approximately $109.3 billion.

One could also envision a child allowance that varied by child age. For Scenario 4, we simulated the effect of an age-differentiated child allowance, at $4,000 per child under age 6 and $2,500 per child for children age 6–17 (again, eliminating the current CTC). In this scenario, with more generous allowances for children under 6, we see a steeper reduction in child poverty, to 10.0 percent (or 6.5 million children lifted out of poverty), and child deep poverty would be only 2.1 percent. Compared to the baseline, this child allowance policy would reduce child poverty by 47 percent, and child deep poverty by 55 percent. Such reductions would come at substantial cost—a marginal cost of $138.3 billion over current CTC costs.

In Scenario 5—our most generous—we simulated a $4,000-per-child universal child allowance, again eliminating the CTC. The results are striking. Poverty would drop from 18.8 percent at baseline to 7.8 percent, a reduction of more than half (59 percent, or 8.1 million children lifted out of poverty). Even compared to the situation under the current CTC, child poverty levels would be cut by more than half. Childhood deep poverty would also fall to a very low level (1.6 percent), a decline of 66 percent relative to levels with no CTC or child allowance. These poverty and deep poverty reductions are striking, but would also come with substantial costs, in this case a marginal cost of $202.9 billion dollars over current CTC costs.

Some stakeholders have argued for augmenting the current CTC, instead of introducing a universal child allowance. Modifying the CTC to make it incrementally more generous might be more politically feasible, given that the program already exists, and given that it is tied to work effort. Thus, our next set of scenarios consider the likely effects of alternative CTC policies relative to the current CTC.

In Scenario 6—which increases the maximum credit to $2,500, while keeping the current phase-in rate (of 15 percent) —we see a drop in child poverty from 16.5 percent (the rate under current CTC) to 15.3 percent (which would lift 2.6 million children out of poverty instead of the current 1.7 million). Note that this compares poorly to a $2,500 child allowance, which would reduce child poverty to 11.4 percent (lifting 5.5 million children out of poverty). This is because the benefit amount at lower income levels is smaller, given the phase-in rate under current CTC guidelines. However, reflecting this, the cost of this scenario is also lower than the cost of the $2,500 universal child allowance scenario.

In Scenario 7—in which we increase the maximum CTC to $4,000, again keeping the current phase-in rate—we see a modest reduction in deep poverty, but a more meaningful reduction in overall poverty. Deep child poverty would be 4.3 percent (versus 4.7 percent without any CTC), and the total child poverty rate would be 15.1 percent (versus 18.8 percent with no CTC, and 16.5 percent with the current CTC). This translates to 2.7 million children lifted out of poverty. The cost of this scenario is an incremental $101 billion.

In the last three scenarios, the alternative CTC policies are made more generous by increasing the phase-in rate. The effect of these changes is to give more money to lower-earning families sooner, making CTC expansions more progressive.

In Scenario 8—in which we expand the CTC to $2,500 per child, and make the phase-in rate more generous at 37.5 percent instead of 15 percent—poverty drops to 13.9 percent, instead of 15.3 percent under current phase-in (and this lifts 3.6 million children out of poverty). In Scenario 9—a mixed CTC of $4,000 and 60 percent phase-in for children under age 6, and $2,500 and 37.5 percent phase-in for children 6 and over—child poverty is reduced to 13.1 percent (or 4.2 million children lifted out of poverty) and deep child poverty to 3.9 percent. In Scenario 10—in which we expand the CTC to $4,000 per child, and make the phase-in rate more generous at 60 percent instead of 15 percent—poverty drops to 12.1 percent (or 4.9 million children lifted out of poverty). The implication is clear: increasing the phase-in rate so that lower-earning families realize a greater gain on dollars earned would do much to reduce child poverty rates over the current CTC system.

The costs of these latter three scenarios range from $75.6 billion to $150.4 billion. But notice that none of these CTC alternative policies reduce deep child poverty dramatically—as they are still contingent on work and are less generous at lower levels of earnings.

A comparison of the costs and poverty reduction effects of child allowances and expansions of CTC is telling. Expansions of the CTC, like child allowances, are expensive. But expansions of the CTC achieve less poverty reduction. Consider for example, the $4,000 child tax credit. It costs $100 billion, but with no change in the phase-in rate reduces poverty by only 1.4 percentage points, from 16.5 percent to 15.1 percent. A child allowance of only $2,500 per child costs virtually the same amount, but reduces poverty from 16.5 percent to 11.4 percent. (See Figure 2.)

Put differently, child allowances that achieve equal reductions in poverty when compared to expansions of the CTC actually cost less to implement. To see this, compare the $4,000 child allowance for children under age 6, which reduces the poverty rate to 13.2 percent, to the CTC expansion to $4,000 for children under age 6 and $2,500 for those over age 6, which reduces the poverty rate to 13.1 percent. The child allowance costs are about two-thirds those of the CTC expansion—$63 billion versus $102 billion. This raises the question: If universal child allowances are not more costly, what is the virtue of leaving out the poorest children?

Our results raise the question of why the CTC would be more costly than a child allowance for a given amount of poverty reduction. On the face of it, one might expect a universal child allowance to be more costly—because it goes to all families with children. However, the allowances going to higher-income families are taxed, so their cost is reduced. At the same time, the universal allowance reaches the poorest families, where its anti-poverty impact is the greatest. Because the CTC is conditioned on earnings, even if we drop the earnings threshold to the first dollar, it leaves out the poorest families, who have no earned income, but for whom the anti-poverty effects would be the greatest. Of course, the CTC could be extended downward, to reach all families with low earnings. Such a proposal would be an important improvement over current law, increasing the CTC by up to $450 per family. Increasing the phase-in rate could also have meaningful effect on poverty reduction. However, those families would still not receive the full benefit and those with no earnings would continue to get no credit, as they would under a child allowance system.

Conclusion

Our results confirm the maxim that “you get what you pay for.” The most generous of the child allowance scenarios we modeled succeeds in cutting poverty in half—a very good achievement—but at a cost of $200 billion. Less generous child allowances are less costly, but achieve less in poverty reduction.

Expansions of the child tax credit are also quite expensive and meaningfully reduce poverty, but less effectively than a universal child allowance would. Child allowances have received little serious political consideration in the United States, but the comparison between the child allowance and child tax credit raises the question of why the U.S. would take steps to increase the economic security of children, but exclude those in the poorest families.

One answer from those who want to exclude the poorest is that work incentives need to be preserved. But as Irwin Garfinkel and Sara McLanahan in Single Mothers and Their Children and David Ellwood in Poor Support demonstrate, it is possible to both reinforce the value of work and increase the economic security of the poorest children.31 Some of those who would leave out the poorest children believe their parents are irresponsible or lazy. Undoubtedly, some poor parents act irresponsibly. In extreme cases, when that happens, children are removed from their parents’ homes. But, based on solid empirical data, the United States and most other nations have concluded that families are better at raising children than institutions. Similarly, we have solid empirical data that indicates the overwhelming majority of the poorest families with children are poor because, for a variety of reasons, the parents cannot earn more. 32 They are poorly educated and/or have serious health problems. Many are single mothers who must both care for their child and earn a living on their own. Finally, one might reasonably ask whether it is appropriate to punish the child for the alleged sins of the parents. Placing a floor under the income of all families with children will give the poorest a more solid foundation upon which to build their families’ futures.

Others may be more sympathetic to the idea of a universal child allowance, but may worry that the United States cannot afford it. After all, isn’t it wasteful to transfer money not just to poor families, but to all families with children, even those who have ample private incomes? We appreciate this concern, and for this reason, we propose taxing back the universal child allowance from higher income families in all our scenarios. This helps reduce the cost somewhat.

We would also note that reducing child poverty today can yield sizable reductions in costs down the road, through increased incomes and productivity, improved health and lower health care costs, and lower crime rates.33 Our estimates do not take into account these long-run benefits, which could be very substantial.

The bottom line for us is that we believe spending money to reduce the unacceptably high poverty rate among children in the United States is a worthwhile investment. A $4,000-per-year child allowance would not eliminate child poverty in the United States, but it would be a big step in the right direction. The primary challenge before us should be not whether to implement a universal child allowance, but rather how to move toward doing so—to ensure that unacceptably high child poverty rates are not inevitable in this wealthy nation.

Credits and Acknowledgements

This report was published by the Bernard L. Schwartz Rediscovering Government Initiative, founded in 2011 with one broad mission: countering the anti-government ideology that has grown to dominate political discourse in the past three decades.

Jeff Madrick is director of the Bernard L. Schwartz Rediscovering Government Initiative at The Century Foundation, where he is a senior fellow. He is a regular contributor to The New York Review of Books, and a former economics columnist for The New York Times. In addition to his work at The Century Foundation, Madrick also edits Challenge Magazine, and is a visiting professor of humanities at The Cooper Union. He is the author of numerous best-selling books on economics, and was a 2009 winner of the PEN Galbraith Non-fiction Award. Madrick was educated at New York University and at Harvard University, where he was a Shorenstein Fellow.

The authors gratefully acknowledge support from the Annie E. Casey Foundation, JPB Foundation, and NICHD.

Notes

- “Supplemental Poverty Measure Overview,” U.S. Census Bureau, http://www.census.gov/hhes/povmeas/methodology/supplemental/overview.html.

- Christopher Wimer, Liana Fox, Irwin Garfinkel, Neeraj Kaushal, and Jane Waldfogel, “Progress on Poverty? New Estimates of Historical Trends Using an Anchored Supplemental Poverty Measure,” 2014, https://courseworks.columbia.edu/access/content/group/c5a1ef92-c03c-4d88-0018-ea43dd3cc5db/Articles/Anchored%20SPM%20December7.pdf.

- Kathleen Short, “The Supplemental Poverty Measure: 2013,” 2014, http://www.census.gov/content/dam/Census/library/publications/2014/demo/p60-251.pdf.

- Kerris Cooper and Kitty Stewart, “Does Money Affect Children’s Outcomes? A Systematic Review,” 2013, http://sticerd.lse.ac.uk/dps/case/cr/casereport80.pdf.

- Consequences of Growing Up Poor, ed. Greg Duncan and Jeanne Brooks-Gunn (New York: Russell Sage Foundation, 1999); Kimberly G. Noble, et al., “Family Income, Parental Education and Brain Structure in Children and Adolescents,” Nature Neuroscience, March 30, 2015, http://www.nature.com/neuro/journal/v18/n5/full/nn.3983.html; and Jack P. Shonkoff et al., “The Lifelong Effects of Early Childhood Adversity and Toxic Stress,” Pediatrics 129, no. 1 (January 2012), http://pediatrics.aappublications.org/content/early/2011/12/21/peds.2011-2663.

- See, for example, Robert Moffitt, “The Deserving Poor, the Family, and the U.S. Welfare System,” 2014, http://origin.library.constantcontact.com/download/get/file/1101040629095-1862/Moffitt+Address+5-2-2014+v4.pdf.

- Jane Waldfogel, Britain’s War on Poverty (New York: Russell Sage Foundation, 2010)

- Whither Opportunity? Rising Inequality, Schools, and Children’s Life Chances, ed. Greg Duncan and Richard Murnane (New York: Russell Sage Foundation, 2011).

- David Harris, “The Child Tax Credit: How the United States Underinvests in Its Youngest Children in Cash Assistance and How Changes to the Child Tax Credit Could Help,” Ph.D. dissertation, Columbia University School of Social Work, 2012, http://academiccommons.columbia.edu/catalog/ac%3A175200.

- William Evans and Craig Garthwaite , “Giving Mom a Break: The Impact of Higher EITC Payments on Maternal Health,” American Economic Journal: Economic Policy 6, no. 2 (2014): 258–90, http://www.kellogg.northwestern.edu/faculty/garthwaite/htm/Evans_Garthwaite_EITC.pdf.

-

Kate Strully, David Rehkopf, and Ziming Xuan, “Effects of Prenatal Poverty on Infant Health: State Earned Income Tax Credits and Birth Weight,” American Sociological Review 75, no. 4 (2010): 534–62, http://www.ncbi.nlm.nih.gov/pmc/articles/PMC3104729/.

- Gordon B. Dahl and Lance Lochner, “The Impact of Family Income on Child Achievement: Evidence from the Earned Income Tax Credit,” American Economic Review 105, no. 5 (2012): 1927–56, http://econweb.ucsd.edu/~gdahl/papers/children-and-EITC.pdf.

- Kevin Milligan and Mark Stabile, “Do Child Tax Benefits Affect the Wellbeing of Children? Evidence from Canadian Child Benefit Expansions,” American Economic Journal: Economic Policy 3, no. 3 (2011): 175–205, https://www.aeaweb.org/articles.php?doi=10.1257/pol.3.3.175.

- Dahl and Lochner, “The Impact of Family Income on Child Achievement.”

- Milligan and Stabile, “Do Child Tax Benefits Affect the Wellbeing of Children?”

- Harry J. Holzer, Diane Whitmore Schanzenbach, Greg J. Duncan, and Jens Ludwig, “The Economic Costs of Childhood Poverty in the United States,” Journal of Children and Poverty 14, no. 1 (2008): 41–61, http://home.uchicago.edu/ludwigj/papers/HolzerEtAlChildhoodPoverty.pdf.

- Kaushal, Neeraj, Katherine Magnuson, and Jane Waldfogel (2011). “How Is Family Income Related to Investments in Children’s Learning?” in Whither Opportunity?; Sabino Kornrich and Frank Furstenberg, “Investing in Children: Changes in Parental Spending on Children: 1972 to 2007,” Demography 50, no. 1 (2013): 1–23.

- Paul Gregg, Jane Waldfogel, and Elizabeth Washbrook, “Family Expenditures Post-Welfare Reform in the UK: Are Low-Income Families with Children Starting to Catch Up?” Labour Economics 13, no. 6 (2006): 721–46.

- Sendhil Mullainathan and Eldar Shafir, Scarcity: Why Having Too Little Means So Much (New York: Macmillan, 2013).

- Leonard Rosenblum and Gayle S. Paully, “The Effects of Varying Environmental Demands on Maternal and Infant Behavior,” Child Development 55 (1984): 305–14, http://www.ncbi.nlm.nih.gov/pubmed/6705632.

- Charles Murray, In Our Hands: A Plan to Replace the Welfare State (Washington, D.C.: American Enterprise Institute Press, 2006).

- Proposals include those in Greg Duncan, Katherine Magnuson, and Elizabeth Votruba-Drzal, “Boosting Family Income to Promote Child Development,” Future of Children 24, no. 1 (2014): 99–120, http://futureofchildren.org/futureofchildren/publications/docs/24_01_05.pdf; Jane Waldfogel, “The Role of Family Policies in Anti-Poverty Policy,” in Changing Poverty, Changing Policies, ed. Maria Cancian and Sheldon Danziger (New York: Russell Sage Foundation, 2009); Jane Waldfogel, “The Safety Net for Families with Children,” in Legacies of the War on Poverty, ed. Martha Bailey and Sheldon Danziger (New York: Russell Sage Foundation, 2013); and Harris, “The Child Tax Credit.”

- Beyond Rhetoric: A New American Agenda for Children and Families (Washington, D.C.: National Commission on Children, 1991), http://files.eric.ed.gov/fulltext/ED336201.pdf.

- Newt Gingrich, “Contract with America,” 1995.

- Harris, “The Child Tax Credit.”

- David Firestone, “Tax Law Omits $400 Child Credit for Millions,” New York Times, May 29, 2003, A1.

- Rachel West, Melissa Boteach, and Rebecca Vallas, “Harnessing the Child Tax Credit as a Tool to Invest in the Next Generation,” Center for American Progress, 2015, https://cdn.americanprogress.org/wp-content/uploads/2015/08/11114756/ChildAllowance-report.pdf. Our analyses (not shown) suggest that a variant of this proposed policy would reduce child poverty to 15.7 percent from 16.5 percent, and cost an additional $15.1 billion above the cost of the current CTC and ACTC. Poverty among children under 3 years of age would drop from 18.7 percent to 16.0 percent.

- Megan Curran, “Catching Up on the Cost of Raising Children: Creating a Child Allowance in the United States,” MPP thesis, University College Dublin, 2014; Waldfogel, Britain’s War on Poverty.

- Curran, “Catching Up on the Cost of Raising Children.”

- Internal Revenue Service, “Individual Income Tax Returns 2013,” Statistics of Income—2013, Publication 1304 (Rev. 08-2015).

- Irwin Garfinkel and Sara McLanahan, Single Mothers and Their Children: A New American Dilemma (Washington, D.C.: Urban Institute Press, 1986); David Ellwood, Poor Support (New York: Basic Books, 1988).

- Irwin Garfinkel and Robert Haveman, Earnings Capacity, Poverty, and Inequality (New York: Academic Press, 1977); Moffitt, “The Deserving Poor, the Family, and the U.S. Welfare System.”

- Holzer, Schanzenbach, Duncan, and Ludwig, “The Economic Costs of Childhood Poverty in the United States.”