Single parents are critical members of communities across the country, fundamental to their children’s well-being and the overall economy. In fact, 35 percent of parents in the United States are single parents.

Recent proposals to prioritize resources for communities with higher marriage and birth rates and raising taxes on single parents would harm millions of Americans, inefficiently and unfairly allocating resources to those that already have most.

Moreover, these proposed policies would disproportionately harm women, who are more likely than men to be single parents and who are more economically insecure to begin with. Those most at risk are the children impacted by these policies, which are based on outdated ideas about families and gender roles.

| Table 1: Single Parents by Gender |

| Total Single Parents |

13,861,083 |

| Percent of Single Parents that are Single Moms |

66.90% |

| Percent of Single Parents that are Single Dads |

33.10% |

| Source: Author Analysis of American Community Survey Data Retrieved via IPUMS |

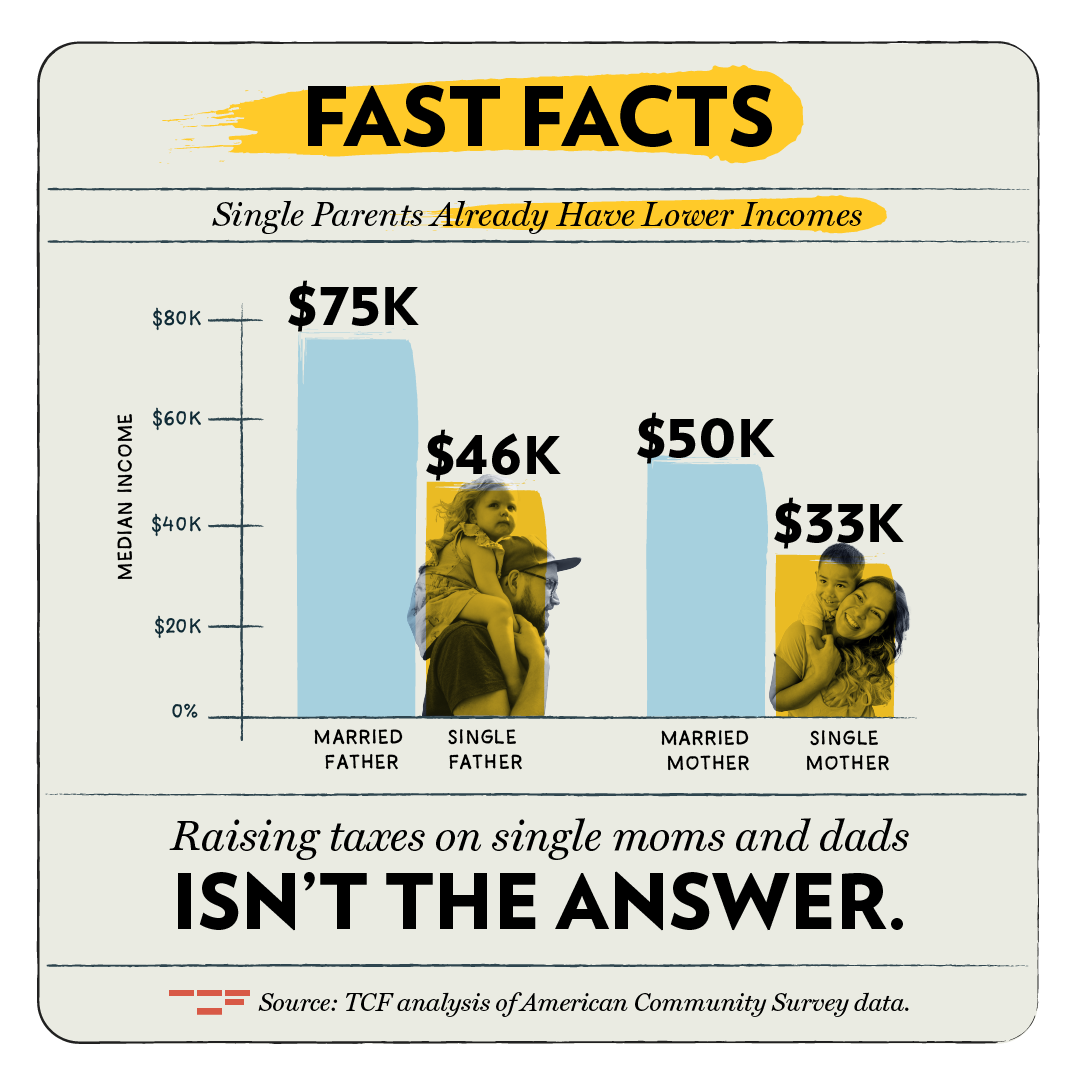

In the United States there are over 13 million single parents. Roughly two-thirds of single parents in the U.S. are single moms. Moms, regardless of marital status, have lower median incomes than fathers due to the well-documented gender wage gap.

The median income of married fathers is $29,000 higher than the median income of single fathers and more than twice the median income of single mothers. This is partly because married fathers experience a marriage bonus while mothers experience a motherhood penalty.

Tags: taxes, parenting, single parents

Single Parents Have Lower Incomes—Increasing their Taxes Isn’t the Answer

Single parents are critical members of communities across the country, fundamental to their children’s well-being and the overall economy. In fact, 35 percent of parents in the United States are single parents.

Recent proposals to prioritize resources for communities with higher marriage and birth rates and raising taxes on single parents would harm millions of Americans, inefficiently and unfairly allocating resources to those that already have most.

Moreover, these proposed policies would disproportionately harm women, who are more likely than men to be single parents and who are more economically insecure to begin with. Those most at risk are the children impacted by these policies, which are based on outdated ideas about families and gender roles.

In the United States there are over 13 million single parents. Roughly two-thirds of single parents in the U.S. are single moms. Moms, regardless of marital status, have lower median incomes than fathers due to the well-documented gender wage gap.

The median income of married fathers is $29,000 higher than the median income of single fathers and more than twice the median income of single mothers. This is partly because married fathers experience a marriage bonus while mothers experience a motherhood penalty.

Tags: taxes, parenting, single parents