As families across the country prepare to carve turkey and watch football, new analysis from Groundwork Collaborative, The Century Foundation, and AFT finds that the price of a Thanksgiving dinner will be more expensive this year under President Trump, with a full meal up 9.8 percent compared to last year, more than triple the overall rate of inflation. Some staples will run families over 20 percent more than last year’s prices, including onions (56 percent), spiral hams (49 percent), cranberry sauce (22 percent), and creamed corn (21 percent).

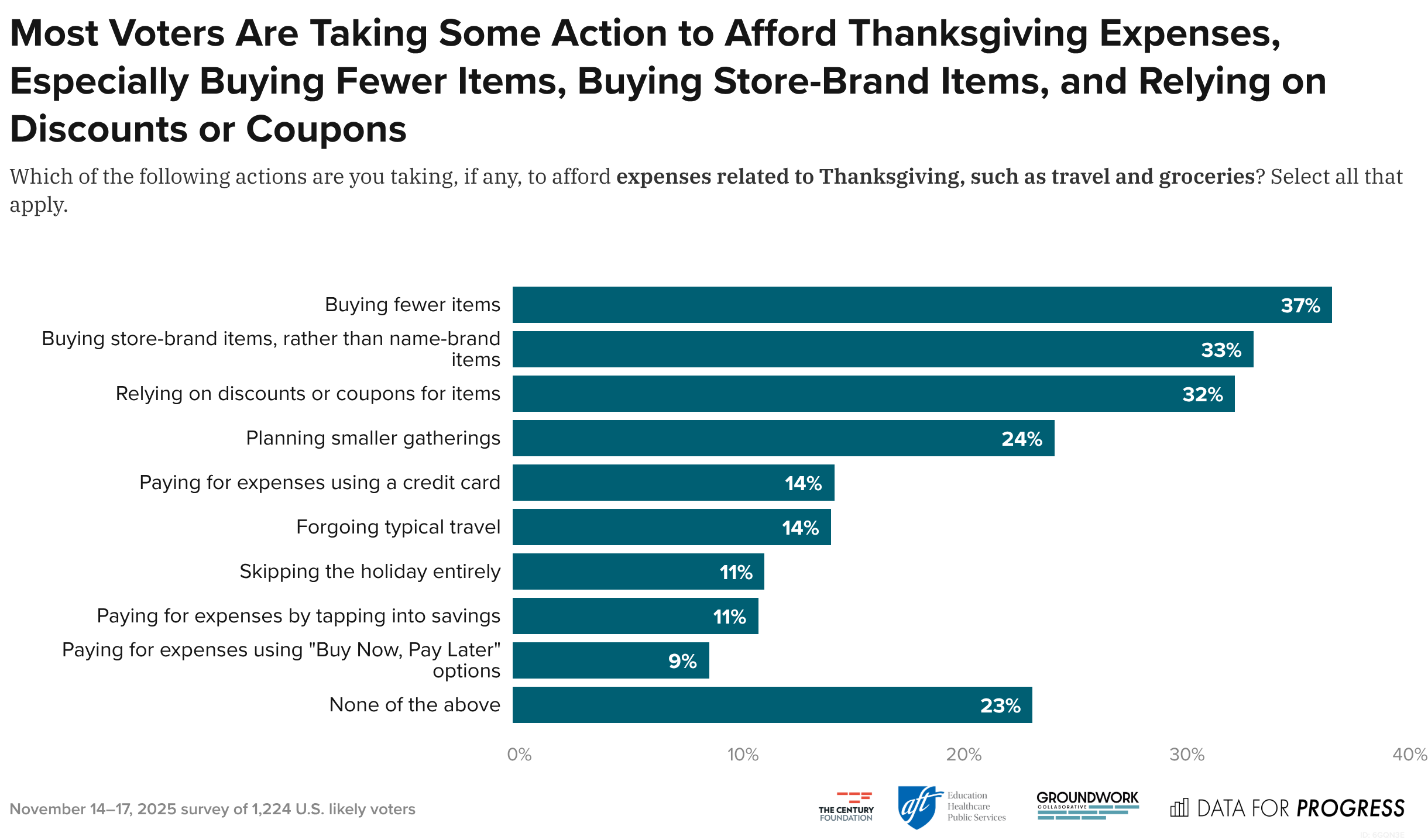

These price hikes come as new Data for Progress polling shows that nearly two-thirds of people are stressed about Thanksgiving prices, with 37 percent saying they plan to buy fewer items and one-quarter saying they are planning smaller gatherings to afford the holiday. Another 14 percent say they will forgo typical travel and more than one in ten say they will skip the holiday entirely.

Turkey with a Side of Sticker Shock

President Trump promised to lower prices for American families, but instead, he’s turned the season of “giving back” into the season of “getting by.”

New analysis finds that Thanksgiving staples will cost families 9.8 percent more this year, more than three times the rate of overall inflation. Ocean Spray jellied cranberry sauce will come in 22.3 percent more than last year, while the price of canned creamed corn from Seneca Foods, manufacturer of brands like Libby’s and Green Giant, is 21.1 percent higher. Other classic fixings like McCormick turkey gravy mix (7.4 percent), Idahoan Foods boxed mashed potatoes (4.6 percent), butternut squash (12.7 percent), and collard greens (12.3 percent) are all rising as well. Dessert is no relief either, with refrigerated pie crust climbing by nearly 13 percent, and pie fillings like honeycrisp apples and pecans up 8.2 percent and 11 percent, respectively.

Table 1

Families Are Pulling Back on Festivities

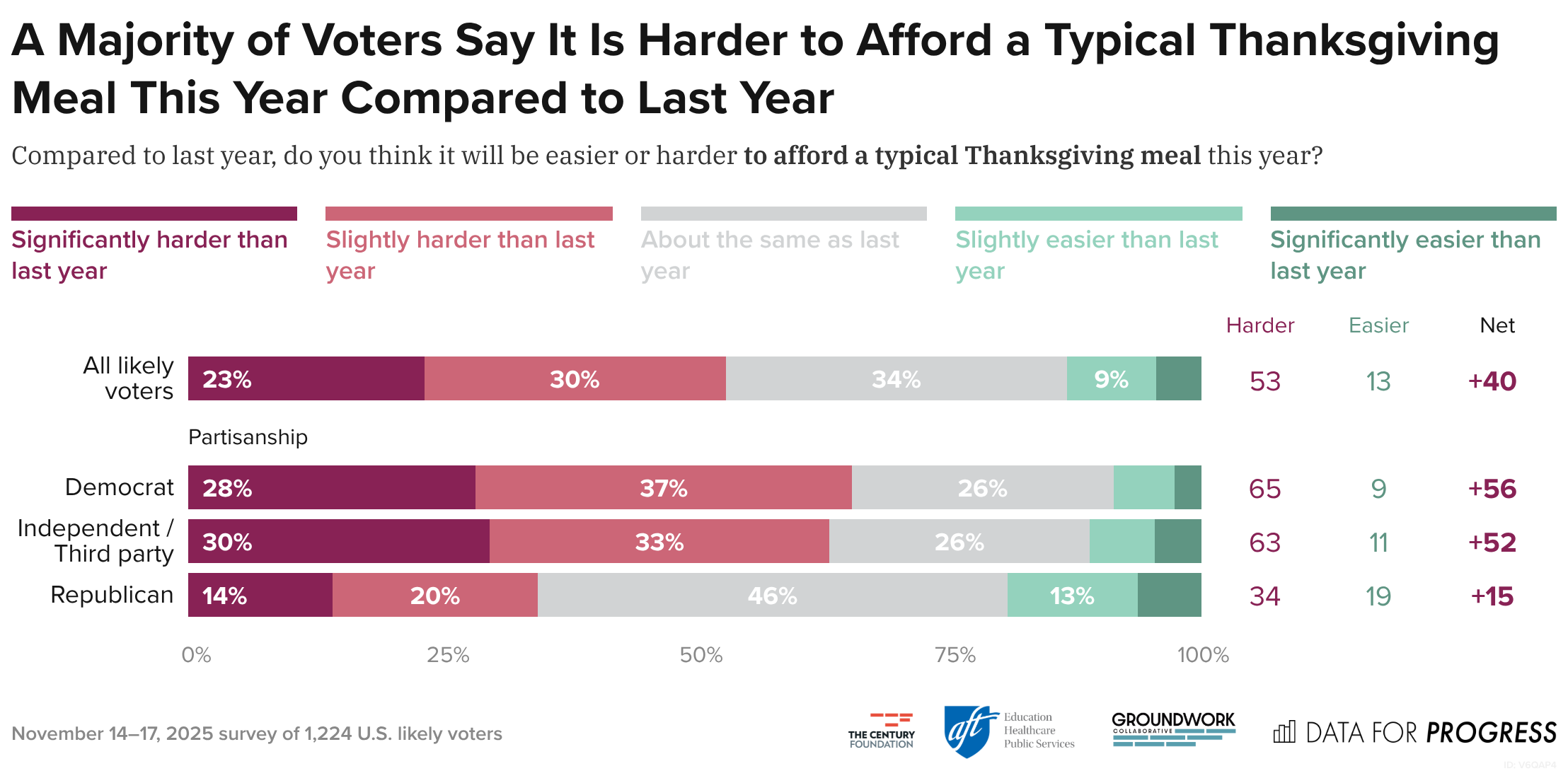

Americans are already feeling the pain of these soaring prices, with a majority saying that it’s harder to afford a typical Thanksgiving meal this year compared to last, according to new polling from Data for Progress. Moreover, two-thirds of voters feel stressed about affording holiday expenses, including one in five who say they feel very stressed.

Figure 1

These high holiday costs under Trump are forcing Americans to cut back on spending, with a majority of people saying they are taking some action to brace for high prices this Thanksgiving, such as buying fewer items, hosting smaller gatherings, taking on debt to cover holiday-related expenses, or cutting back on Thanksgiving travel.

Figure 2

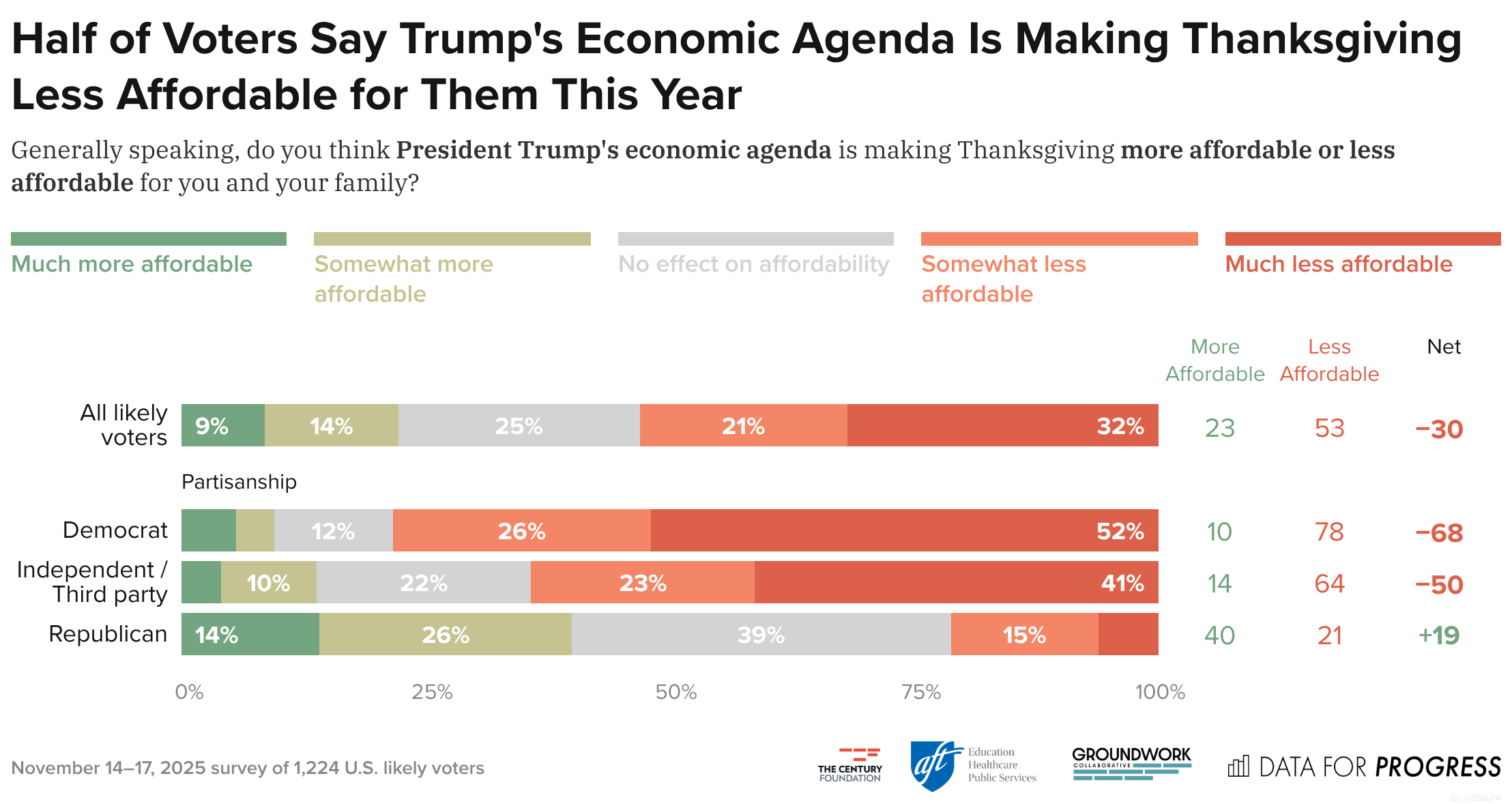

Indeed, more than half of voters believe that Trump’s economic agenda is to blame for higher prices this holiday season.

Figure 3

Trump’s Policies Are to Blame for Rising Thanksgiving Costs

With prices climbing and families increasingly concerned with paying the bills, it’s no surprise that President Trump has resorted to lying about the cost of Thanksgiving dinner. But the truth is that Trump’s policies are making Thanksgiving more expensive.

Typically, retailers use frozen turkeys as a loss leader, discounting them to get customers in the door to purchase the rest of their Thanksgiving meal, so it’s no surprise that frozen turkey prices are steady. However, wholesale prices for frozen turkeys have soared 75 percent over the past year, according to research from Purdue University, and fresh turkey prices are up 36 percent and likely to continue rising. Trump’s tariffs have driven up the cost of feed and avian flu has further thinned an already shrinking flock, now at its lowest level in four decades, squeezing American farmers and consumers alike.

The Trump administration has only exacerbated the shortage: sweeping cuts to research funding and mass firings across key agencies weakened the federal response to the avian flu outbreak, with USDA even accidentally dismissing and then scrambling to rehire the very officials working to contain it. Consequently, Americans picking up their Thanksgiving bird from the local butcher may see higher prices. Shoppers can’t escape rising poultry prices by switching to alternatives like pork and beef: spiral-cut ham prices are up nearly 50 percent this year, and beef roasts are up nearly 20 percent over the past year.

Moreover, canned fruits and vegetables across the board are up by 5 percent year-over-year, as Trump’s 50 percent tariff on steel drives up canning costs for the roughly 80 percent of canned goods that rely on imported steel. And, even domestic steel manufacturers are raising prices under the cover of tariffs, leaving no escape from higher prices in the canned food aisle. Tariffs on imported metals are raising prices on Thanksgiving leftovers as well—Reynold’s Wrap aluminum foil will run customers 40 percent more this year. Reynolds’ CEO told investors that the company’s input prices have risen sharply, prompting them to raise prices to cover the costs of tariffs on imports.

Fresh fruits and vegetables are up 2.5 percent as tariffs raise the costs of inputs like fertilizer and herbicides—increases which the National Corn Growers Association warned are “approaching disastrous levels.” In addition, the Trump administration’s attack on immigrant workers, in the words of the president’s own Department of Labor, is “threatening the stability of domestic food production and prices for U.S. consumers,” layering a labor shortage on top of an ongoing economic crisis for farmers.

For those settling in on the couch with a glass of wine or a beer, Trump’s tariffs are driving up the cost of imported beverages as well. Mary Taylor, an American importer of European wines, was hit with a $40,000 tariff charge on a single shipment. Even domestic vintners aren’t spared: rising cork and glass costs are forcing winemakers like Kory Burke of California’s Dresser Winery to raise prices by as much as 15 percent per bottle.

Trump and his economic advisors trumpeted an announcement from Walmart that their promotional Thanksgiving meal basket was less expensive than last year’s—but failed to disclose that Walmart reduced the number of items in the basket and substituted name brand products for cheaper store brand products. In fact, retailers like Walmart have been marketing to wealthier consumers, as lower-income consumers can’t keep pace with rising prices.

And, it’s not just Thanksgiving that has Americans struggling to put food on the table. Since Trump took office, grocery prices have risen more than 3 percent, and consumers are feeling the pinch. Albertsons Chief Executive Susan Morris said on a mid-October earnings call that shoppers are downsizing their purchases and turning to coupons to keep grocery prices in check.

In response to rising grocery prices, President Trump recently walked back his most reckless tariffs on foods like coffee and bananas, which come too late to provide shoppers relief this Thanksgiving. And Trump and congressional Republicans have exacerbated the impact of crushing grocery prices through disastrous cuts to the Supplemental Nutrition Assistance Program (SNAP) that will reduce or eliminate food assistance for more than 22 million families.

Conclusion

After headline-grabbing increases in Halloween candy prices weeks ago, consumers find themselves struggling with yet another holiday price hike. Consumer sentiment hit the second-lowest rating of all time in November as Americans’ assessment of their personal finances worsened by 17 percent.

In addition to more expensive food items, Thanksgiving travelers are bracing for a blow as the Trump administration scrapped a rule requiring airlines to offer cash compensation of up to $775 for delays and cancellations, mere days before the year’s busiest travel rush.

Trump campaigned on bringing down the price of groceries on day one. Yet in the biggest grocery week of the year, families across the country aren’t seeing any savings. Instead, their budgets are being carved up alongside the Thanksgiving turkey.

Tags: inflation, polling, donald trump, tariffs, thanksgiving

A Pricier Plate: Thanksgiving Costs Climb Nearly 10% This Year

As families across the country prepare to carve turkey and watch football, new analysis from Groundwork Collaborative, The Century Foundation, and AFT finds that the price of a Thanksgiving dinner will be more expensive this year under President Trump, with a full meal up 9.8 percent compared to last year, more than triple the overall rate of inflation. Some staples will run families over 20 percent more than last year’s prices, including onions (56 percent), spiral hams (49 percent), cranberry sauce (22 percent), and creamed corn (21 percent).

These price hikes come as new Data for Progress polling shows that nearly two-thirds of people are stressed about Thanksgiving prices, with 37 percent saying they plan to buy fewer items and one-quarter saying they are planning smaller gatherings to afford the holiday. Another 14 percent say they will forgo typical travel and more than one in ten say they will skip the holiday entirely.

Turkey with a Side of Sticker Shock

President Trump promised to lower prices for American families, but instead, he’s turned the season of “giving back” into the season of “getting by.”

New analysis finds that Thanksgiving staples will cost families 9.8 percent more this year, more than three times the rate of overall inflation.1 Ocean Spray jellied cranberry sauce will come in 22.3 percent more than last year, while the price of canned creamed corn from Seneca Foods, manufacturer of brands like Libby’s and Green Giant, is 21.1 percent higher. Other classic fixings like McCormick turkey gravy mix (7.4 percent), Idahoan Foods boxed mashed potatoes (4.6 percent), butternut squash (12.7 percent), and collard greens (12.3 percent) are all rising as well. Dessert is no relief either, with refrigerated pie crust climbing by nearly 13 percent, and pie fillings like honeycrisp apples and pecans up 8.2 percent and 11 percent, respectively.

Table 1

Families Are Pulling Back on Festivities

Americans are already feeling the pain of these soaring prices, with a majority saying that it’s harder to afford a typical Thanksgiving meal this year compared to last, according to new polling from Data for Progress. Moreover, two-thirds of voters feel stressed about affording holiday expenses, including one in five who say they feel very stressed.

Figure 1

These high holiday costs under Trump are forcing Americans to cut back on spending, with a majority of people saying they are taking some action to brace for high prices this Thanksgiving, such as buying fewer items, hosting smaller gatherings, taking on debt to cover holiday-related expenses, or cutting back on Thanksgiving travel.

Figure 2

Indeed, more than half of voters believe that Trump’s economic agenda is to blame for higher prices this holiday season.

Figure 3

Trump’s Policies Are to Blame for Rising Thanksgiving Costs

With prices climbing and families increasingly concerned with paying the bills, it’s no surprise that President Trump has resorted to lying about the cost of Thanksgiving dinner. But the truth is that Trump’s policies are making Thanksgiving more expensive.

Typically, retailers use frozen turkeys as a loss leader, discounting them to get customers in the door to purchase the rest of their Thanksgiving meal, so it’s no surprise that frozen turkey prices are steady. However, wholesale prices for frozen turkeys have soared 75 percent over the past year, according to research from Purdue University, and fresh turkey prices are up 36 percent and likely to continue rising. Trump’s tariffs have driven up the cost of feed and avian flu has further thinned an already shrinking flock, now at its lowest level in four decades, squeezing American farmers and consumers alike.

The Trump administration has only exacerbated the shortage: sweeping cuts to research funding and mass firings across key agencies weakened the federal response to the avian flu outbreak, with USDA even accidentally dismissing and then scrambling to rehire the very officials working to contain it. Consequently, Americans picking up their Thanksgiving bird from the local butcher may see higher prices. Shoppers can’t escape rising poultry prices by switching to alternatives like pork and beef: spiral-cut ham prices are up nearly 50 percent this year, and beef roasts are up nearly 20 percent over the past year.

Moreover, canned fruits and vegetables across the board are up by 5 percent year-over-year, as Trump’s 50 percent tariff on steel drives up canning costs for the roughly 80 percent of canned goods that rely on imported steel. And, even domestic steel manufacturers are raising prices under the cover of tariffs, leaving no escape from higher prices in the canned food aisle. Tariffs on imported metals are raising prices on Thanksgiving leftovers as well—Reynold’s Wrap aluminum foil will run customers 40 percent more this year. Reynolds’ CEO told investors that the company’s input prices have risen sharply, prompting them to raise prices to cover the costs of tariffs on imports.

Fresh fruits and vegetables are up 2.5 percent as tariffs raise the costs of inputs like fertilizer and herbicides—increases which the National Corn Growers Association warned are “approaching disastrous levels.” In addition, the Trump administration’s attack on immigrant workers, in the words of the president’s own Department of Labor, is “threatening the stability of domestic food production and prices for U.S. consumers,” layering a labor shortage on top of an ongoing economic crisis for farmers.

For those settling in on the couch with a glass of wine or a beer, Trump’s tariffs are driving up the cost of imported beverages as well. Mary Taylor, an American importer of European wines, was hit with a $40,000 tariff charge on a single shipment. Even domestic vintners aren’t spared: rising cork and glass costs are forcing winemakers like Kory Burke of California’s Dresser Winery to raise prices by as much as 15 percent per bottle.

Trump and his economic advisors trumpeted an announcement from Walmart that their promotional Thanksgiving meal basket was less expensive than last year’s—but failed to disclose that Walmart reduced the number of items in the basket and substituted name brand products for cheaper store brand products. In fact, retailers like Walmart have been marketing to wealthier consumers, as lower-income consumers can’t keep pace with rising prices.

And, it’s not just Thanksgiving that has Americans struggling to put food on the table. Since Trump took office, grocery prices have risen more than 3 percent, and consumers are feeling the pinch. Albertsons Chief Executive Susan Morris said on a mid-October earnings call that shoppers are downsizing their purchases and turning to coupons to keep grocery prices in check.

In response to rising grocery prices, President Trump recently walked back his most reckless tariffs on foods like coffee and bananas, which come too late to provide shoppers relief this Thanksgiving. And Trump and congressional Republicans have exacerbated the impact of crushing grocery prices through disastrous cuts to the Supplemental Nutrition Assistance Program (SNAP) that will reduce or eliminate food assistance for more than 22 million families.

Conclusion

After headline-grabbing increases in Halloween candy prices weeks ago, consumers find themselves struggling with yet another holiday price hike. Consumer sentiment hit the second-lowest rating of all time in November as Americans’ assessment of their personal finances worsened by 17 percent.

In addition to more expensive food items, Thanksgiving travelers are bracing for a blow as the Trump administration scrapped a rule requiring airlines to offer cash compensation of up to $775 for delays and cancellations, mere days before the year’s busiest travel rush.

Trump campaigned on bringing down the price of groceries on day one. Yet in the biggest grocery week of the year, families across the country aren’t seeing any savings. Instead, their budgets are being carved up alongside the Thanksgiving turkey.

Notes

Tags: inflation, polling, donald trump, tariffs, thanksgiving